Benefits of Stock Financing for the Logistics Industry

Challenges of Stock Financing for the Logistics Industry

Examples of Companies Using Stock Financing in the Logistics Industry

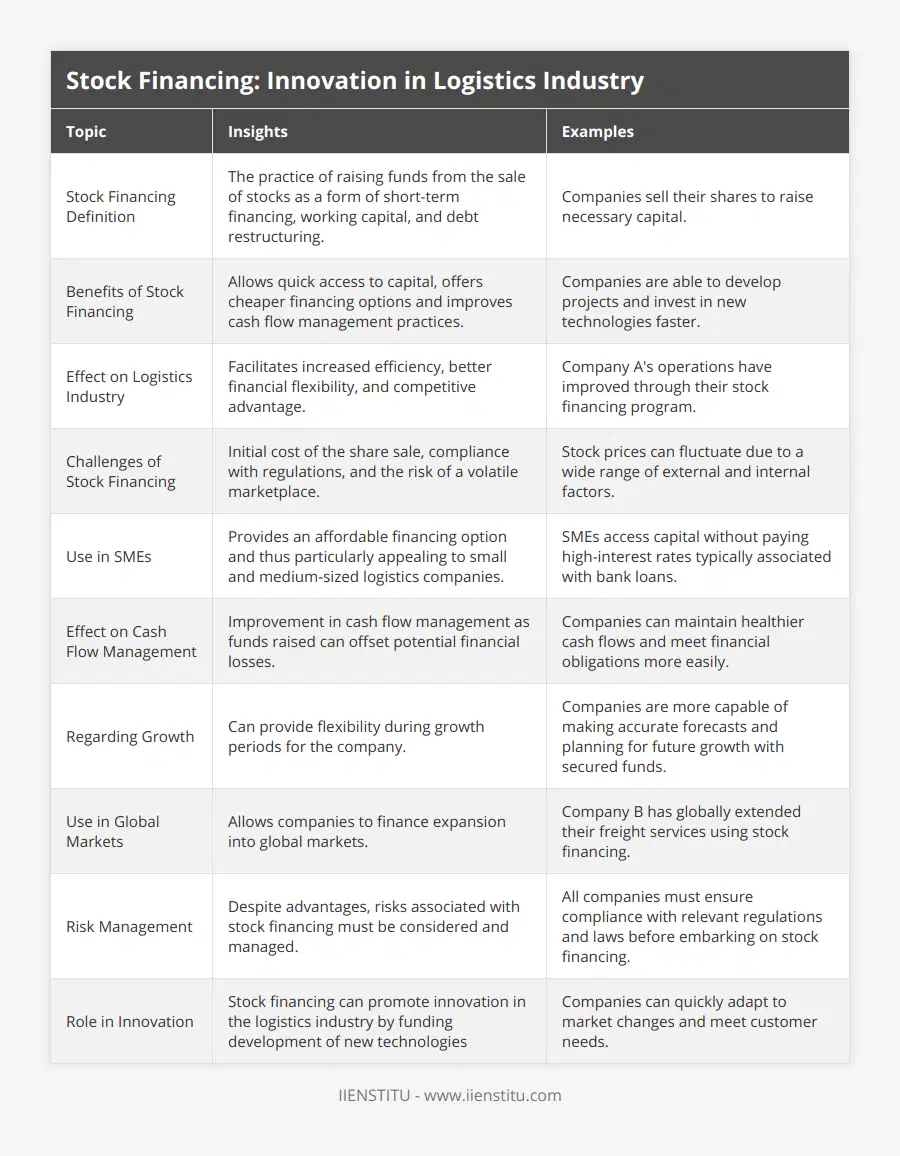

The logistics industry is a fast-paced, constantly evolving field that requires effective financial management to stay competitive. As such, impeccable cash flow management is critical to long-term success. With increasing competition and rising customer expectations, companies are beginning to recognize the need to explore innovative financing options, particularly stock financing.

So, what is stock financing? Stock financing is the practice of raising funds from the sale of stocks. By selling their stores, companies can access the capital necessary for short-term financing, working capital, and debt restructuring. This approach increases their chances of survival during turbulent times. In addition, it can provide added flexibility during periods of growth for a company.

Benefits of Stock Financing for the Logistics Industry

The logistics industry is highly competitive, and companies increasingly turn to new innovation and financing options to stay ahead. Leveraging stock financing can provide several benefits for a logistics business, such as increased efficiency, cheaper financing options, and better cash flow management.

Firstly, stock financing allows companies to access capital quickly without taking on time-consuming loan applications or burdensome debt repayments. As a result, companies can access the funds necessary to develop projects and invest in new technologies faster. This, in turn, helps businesses to become more efficient and agile, allowing them to respond to market changes and customer needs more quickly.

Secondly, stock financing offers a more affordable option than other financing sources, such as loans. As a result, companies can access the capital they need without paying the high-interest rates typically associated with bank loans. This makes it appealing to small and medium-sized logistics companies who may need more money for a large loan or a track record of profitability to back it.

Finally, stock financing can improve cash flow management practices for a business, as the funds raised through stock sales can offset potential financial losses. This approach can help companies to maintain a healthy cash flow and, therefore, more easily meet their financial obligations. A better understanding of their financial position can help businesses conduct more accurate forecasting and plan for future growth.

Challenges of Stock Financing for the Logistics Industry

Navigating the Science of Batch Order Picking in Supply Chain Operations

Maximizing Inbound Logistics: Benefits, Challenges & Strategies

Diving Deep into the Concept of Vendor Rating and Evaluation

Although stock financing offers many advantages for the logistics industry, there are also risks associated with it. One of the primary challenges of stock financing is the initial cost of the share sale. Companies can incur expenses related to the sale process. They must ensure that any shares sold comply with relevant regulations and laws. Additionally, the risk of a volatile marketplace must also be considered, as stock prices can be influenced by a wide range of external and internal factors.

Examples of Companies Using Stock Financing in the Logistics Industry

Despite the inherent risks of stock financing, several logistics companies are incorporating it into their financial strategies. For example, Company A has implemented a stock financing program to raise capital and increase efficiency in its core operations. Likewise, Company B has successfully used stock financing to finance the growth of its freight services in global markets.

In summary, stock financing is an innovative and cost-effective way to finance the logistics industry. Companies can access funds quickly without the prohibitive costs associated with other types of financing. They can increase efficiency through improved cash flow management. However, risks are associated with this approach, and businesses should conduct thorough research before making any stock financing decisions.

Adapting to new technology is key to streamlining the logistics industry and achieving stock financing success.

Frequently Asked Questions

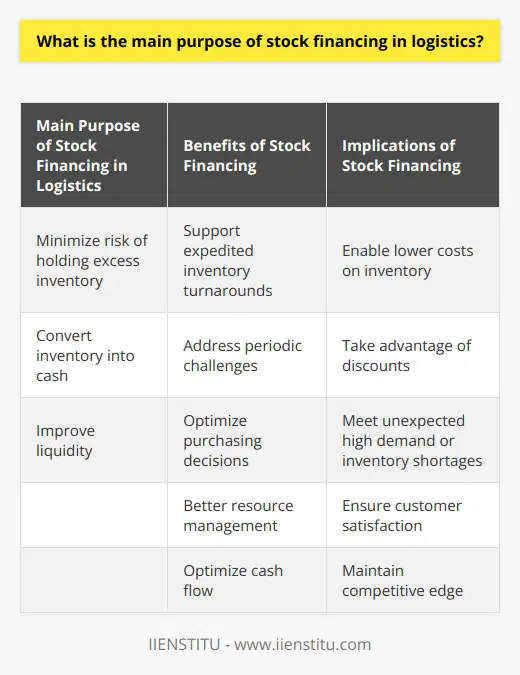

What is the main purpose of stock financing in logistics?

The primary purpose of stock financing in logistics is to provide a financial solution that allows firms to minimize the risk of holding excess inventory and rapidly convert it into cash. It is a form of inventory financing which helps shippers and carriers understand and manage inventory expenses. Through stock financing, companies can reduce the risks of owning excess stock and convert unused inventory into liquid funds.

Stock financing in logistics is commonly used for expedited inventory turnarounds and other periodic challenges. For instance, smaller organizations selling goods to the retail market may experience higher purchase order volumes for seasonal goods. These increasing order volumes require additional inventory that could become unnecessary over time. In such cases, inventory financing is used to purchase these items in the short term and then sell them as soon as necessary.

Stock financing also allows companies to secure lower costs on inventory and fulfill customer orders on time. By carefully analyzing marketplace activity and stock levels, logistics companies can reduce the costs of keeping significant inventory levels. By replenishing stock promptly, companies can benefit from discounts and other cost-saving opportunities. Additionally, the flexible nature of stock financing allows companies to speed up deliveries and fulfill orders even during unexpected high demand or inventory shortages.

In conclusion, stock financing in logistics enables companies to reduce the risks associated with excess inventory and rapidly convert it into liquid funds. It provides a financial solution to fulfill purchase orders on time, secure lower costs on merchandise, and reduce the risks associated with holding excess inventory. Stock financing is valuable for shippers, carriers, and retailers, helping them understand and manage inventory costs.

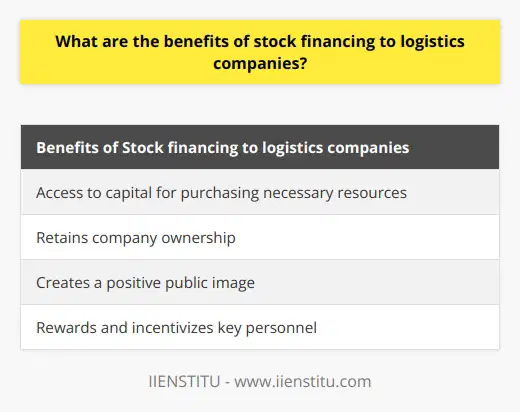

What are the benefits of stock financing to logistics companies?

Logistics companies are essential to many businesses and the global economy. Access to sufficient capital resources is a critical factor for their success. Stock financing is viable for logistics companies to raise capital without taking on additional debt or giving up company ownership. By utilizing stock financing, logistics companies can take advantage of its numerous benefits.

One key advantage of stock financing is the improved ability to finance the purchase of equipment and vehicles necessary to move and manage inventory. Stock financing enables logistics companies to acquire the resources needed without taking on additional debt or pledging their current assets, as is often required when using traditional financing options. The resulting increased flexibility allows for a more efficient allocation of resources and improved purchase negotiation power.

Accessing capital without giving up company ownership is another crucial advantage of stock financing for logistics companies. Companies that utilize stock financing can raise the money they need without giving up voting rights or relinquishing any control over the company. This allows companies to retain business ownership while accessing the necessary capital to expand or improve their operations.

The power of stock financing to create a solid public image is another benefit to logistics companies. A booming stock offering can become a public relations tool emphasizing the company's value proposition and its products and services to investors. When investors are confident in the company and its offerings, it can increase the value of the company's shares, leading to further investment opportunities and an improved financial position.

Finally, stock financing can also reward and incentivize key personnel within a logistics company. Through stock-based compensation plans, companies can motivate and retain valuable employees by offering them a share in the company's future success. This also further aligns the interests of employees and the company, ensuring that everyone is working towards the same goal of success.

In conclusion, stock financing is a viable option for logistics companies that can access the capital needed to purchase the necessary resources, retain ownership, create a solid public image, and reward valued employees. In addition, logistics companies can build a foundation for future growth and success by taking advantage of the many benefits of stock financing.

How can stock financing be used to encourage innovation in the logistics industry?

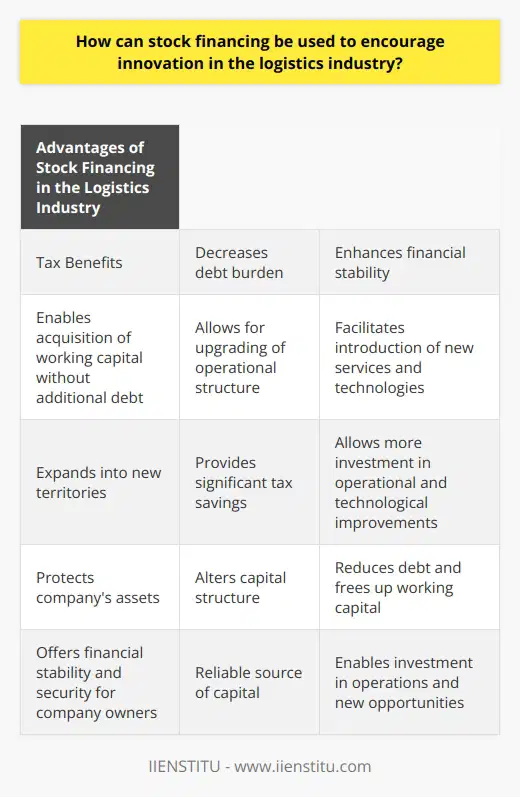

In recent years, the logistics industry has seen significant advances in introducing innovative processes and services to develop efficient supply chain management systems. This has been attributed to improvements in technology, as well as the emergence of various financing options. One of the most exciting and promising options is stock financing, which enables the logistics industry to acquire working capital without taking on additional debt.

Stock financing is the provisioning of capital, in the form of stock, to businesses to enable them to increase their operations and innovate. By offering business owners the opportunity to sell partial ownership of the company to investors, they can raise the necessary funds to upgrade their operational structure and vehicles, introduce new services and technologies, or even expand into new territories. Furthermore, stock financing can also provide liquidity for companies that wish to take advantage of investment opportunities but need more capital.

One of the main advantages of stock financing for logistics companies is that it offers tax benefits. As the funds are not a loan and the owners have no personal liability, the company is spared from paying principal and interest on the funds, which can result in significant tax savings. In addition, since the proceeds from the share sale are not subject to income tax, it allows the company to invest more of the funds into operational and technological improvements.

Another benefit of stock financing is that it can help to protect the company’s assets. By selling stocks, the company can alter its capital structure, reducing the debt on its books and freeing up working capital. This can also provide additional security to the company’s owners.

In conclusion, stock financing can be an effective method of encouraging innovation in the logistics industry. Furthermore, stock financing can be a reliable source of capital for companies in this sector by providing business owners with the resources to invest in their operations and take advantage of new opportunities.

What are the key factors driving innovation in the logistics industry?

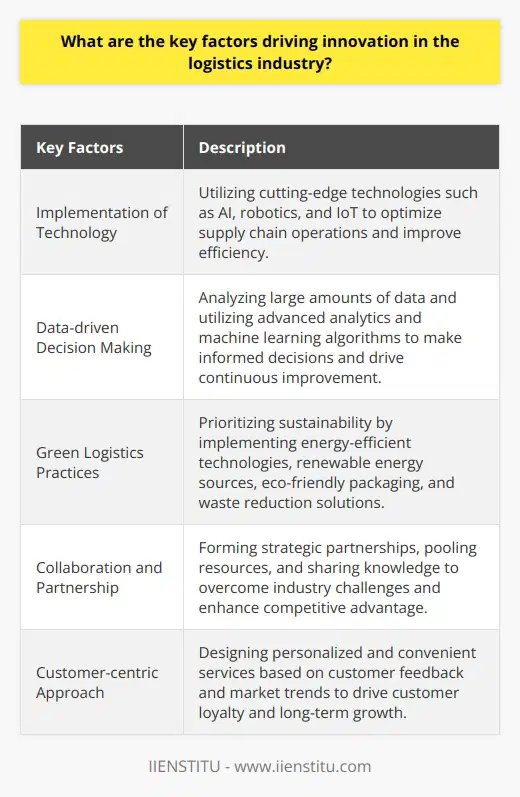

Implementation of Technology

One of the key factors driving innovation in the logistics industry is the implementation of cutting-edge technologies. As the world shifts towards digitalization and automation, the logistics sector is rapidly adapting. Companies are leveraging solutions such as artificial intelligence, robotics, and the Internet of Things (IoT) to optimize supply chain operations and improve overall efficiency.

Data-driven Decision Making

Another critical factor is data-driven decision making. Competitiveness in the logistics industry is increasingly driven by the ability to analyze large amounts of data and derive valuable insights. Businesses utilize advanced analytics and machine learning algorithms to discover patterns and trends in performance, enabling them to make informed decisions and drive continuous improvement.

Green Logistics Practices

The growing focus on sustainability and environmental concerns has contributed significantly to innovation in logistics. Companies now prioritize green logistics practices, incorporating energy-efficient technologies and renewable energy sources to reduce their carbon footprint. Moreover, they implement eco-friendly packaging and materials handling solutions to minimize waste and maximize resource utilization.

Collaboration and Partnership

In addition to technology and data, the logistics industry relies on effective collaboration and partnership strategies to drive innovation. Companies are increasingly forming strategic partnerships, pooling resources, and sharing knowledge to overcome industry challenges and enhance their competitive advantage. Collaboration between businesses, government agencies, and educational institutions allows for the exchange of best practices and the development of innovative solutions.

Customer-centric Approach

Finally, a customer-centric approach is crucial for spurring innovation in logistics. The industry is constantly evolving to meet the changing needs and expectations of customers. By listening to their feedback and studying market trends, logistics firms can design more personalized and convenient services, building customer loyalty and driving long-term growth.

In conclusion, the implementation of technology, data-driven decision making, green logistics practices, collaboration and partnership, and a customer-centric approach are the key factors propelling innovation in the logistics industry. As companies continue to adapt and evolve in response to emerging challenges, they must prioritize these factors to stay ahead of the competition and drive sustainable growth in the dynamic logistics landscape.

How can businesses adapt to the emerging technology trends in logistics to remain competitive?

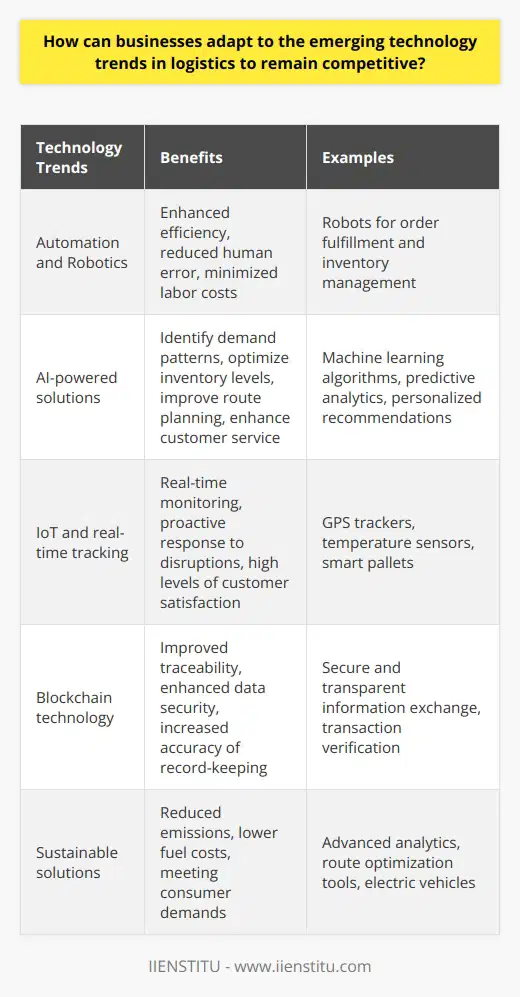

Embracing Automation and Robotics

Businesses can adapt to emerging technological trends in logistics by implementing automation and robotics into their operations. Automation enhances efficiency by streamlining processes, reducing human error, and minimizing labor costs. Incorporating robotics in warehouses and distribution centers can expedite order fulfillment and inventory management, ultimately boosting competitiveness.

Investing in AI-Powered Solutions

Another strategy involves investing in artificial intelligence (AI)-powered solutions, such as machine learning algorithms and predictive analytics. These tools can assist businesses in identifying patterns in demand, optimizing inventory, and improving route planning. Furthermore, AI can enhance customer service by providing personalized recommendations and timely delivery updates, setting companies apart from their competitors.

Exploring IoT and Real-Time Tracking

The Internet of Things (IoT) has revolutionized logistics by enabling real-time tracking and monitoring of shipments. Businesses can remain competitive by adopting IoT devices such as GPS trackers, temperature sensors, and smart pallets. These devices provide real-time data on shipment location, status, and condition, allowing businesses to proactively respond to potential disruptions and maintain high levels of customer satisfaction.

Integrating Blockchain Technology

Blockchain technology offers a secure, transparent, and efficient means of information exchange and transaction verification in logistics. By integrating blockchain into supply chain operations, businesses can improve traceability, enhance data security, and increase the accuracy of record-keeping. As a result, these companies can build trust, reduce costs related to fraud, and create a more efficient and competitive logistics operation.

Developing Sustainable Solutions

Finally, businesses can adapt to emerging technology trends in logistics by focusing on sustainability. Implementing advanced analytics, route optimization tools, and electric vehicles can help reduce emissions and lower fuel costs. Furthermore, embracing sustainable practices is not only environmentally responsible but also increasingly demanded by consumers – making it a critical factor in maintaining a competitive advantage.

What approaches can be employed to overcome the challenges currently faced in the logistics industry due to technological disruptions?

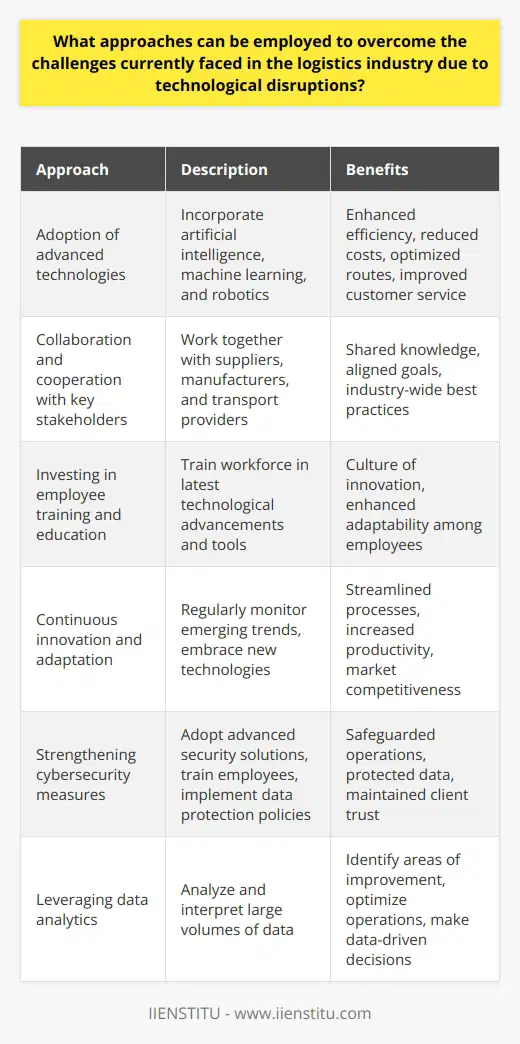

Adopting Advanced Technologies

One approach to overcome the challenges faced in the logistics industry due to technological disruptions is the adoption of advanced technologies such as artificial intelligence (AI), machine learning, and robotics. These technologies can enhance the efficiency and effectiveness of logistics operations and help in reducing costs, optimizing routes, and improving overall customer service standards.

Collaboration and Cooperation

Collaborating with technology providers and other key stakeholders is crucial for addressing the challenges arising from technological disruptions. By cooperating with various parties such as suppliers, manufacturers, and transport providers, logistics companies can share knowledge, align their goals, and develop industry-wide best practices to leverage technological advancements for mutual benefit.

Investment in Training and Education

Investing in employee training and education is another approach to tackle the challenges stemming from technological disruptions in the logistics industry. Companies should train their workforce in the latest technological advancements and tools, which will foster a culture of innovation and enhance adaptability among employees.

Continuous Innovation and Adaptation

Given the rapid pace of technological advancements and disruptions, logistics companies must focus on continuously innovating and adapting their processes and operations. They should regularly monitor emerging trends and adopt new technologies that can streamline their processes, boost productivity, and improve their overall competitiveness in the market.

Strengthening Cybersecurity Measures

As technological disruptions increase, the vulnerability of logistics operations to cybersecurity threats also rises. To overcome this challenge, companies should strengthen their cybersecurity measures by adopting advanced security solutions, training employees to recognize threats, and implementing robust data protection policies.

Leveraging Data Analytics

Lastly, leveraging data analytics can provide logistics companies with valuable insights and opportunities for overcoming industry challenges caused by technological disruptions. By effectively analyzing and interpreting large volumes of data, companies can identify areas of improvement, optimize their operations, and make data-driven decisions that boost efficiency and address client needs.

By adopting these approaches, logistics companies can position themselves to stay agile, competitive, and relevant in a rapidly changing industry landscape. Such strategies will enable them to overcome the challenges posed by technological disruptions, ultimately providing better services to their clients and enhancing their overall business performance.

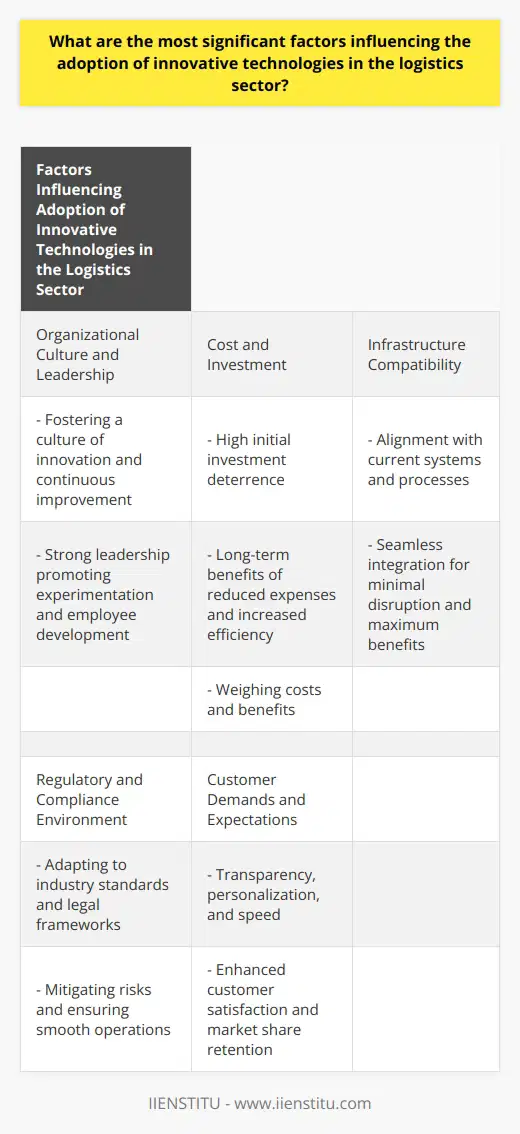

What are the most significant factors influencing the adoption of innovative technologies in the logistics sector?

Factors Influencing Innovation Adoption

The logistics sector faces continuous challenges in adapting to the rapidly evolving technological landscape. Several significant factors influence the adoption of innovative technologies, shaping the overall transformation in the industry.

Organizational Culture and Leadership

Crucial to the adoption of innovative technologies is a supportive organizational culture and strong leadership. Companies with a culture that fosters innovation and continuous improvement are more likely to embrace technological advancements. Leaders should actively promote experimentation and invest in employee development, encouraging a mindset that embraces change.

Cost and Investment

Cost is a significant determinant in the adoption of innovative technologies, with high initial investment acting as a barrier for many companies. However, considering the long-term benefits of reduced expenses, increased efficiency, and scalability, these investments often result in positive returns. Weighing the costs and benefits of adopting new technologies is essential for decision-makers in the logistics sector.

Infrastructure and Compatibility

The existing infrastructure and compatibility with new technologies play a vital role in the integration process. Companies must evaluate whether the new technologies align with their existing systems and processes. Seamless integration of innovative technologies ensures minimal disruption to the business while maximizing the benefits.

Regulatory and Compliance Requirements

The logistics sector operates within a complex environment of regulations and compliance requirements. Adapting to new technologies should be in line with industry standards and legal frameworks to mitigate risks and ensure smooth operations. The extent to which these constraints influence the adoption of innovative technologies depends on the specific technology and its application within the sector.

Customer Demands and Expectations

Customer demands and expectations are evolving rapidly, with an increased need for transparency, personalization, and speed. Consequently, the adoption of innovative technologies enables logistics companies to meet these demands, enhancing customer satisfaction and retaining market share. Companies that fail to adapt to changing customer expectations risk losing their competitive edge.

In conclusion, several factors, including organizational culture, cost, infrastructure compatibility, regulatory requirements, and customer demands, significantly influence the adoption of innovative technologies in the logistics sector. By understanding these factors and adapting to the changing landscape, logistics companies can harness the potential of technological advancements and maintain a competitive advantage in the industry.

How is the integration of artificial intelligence and machine learning transforming the logistics industry?

**AI and Machine Learning in Logistics**

The integration of artificial intelligence (AI) and machine learning is transforming the logistics industry in several ways. One prominent example is the improvement of supply chain efficiency. By analyzing historical data and tracking real-time information, these technologies enable companies to adjust their inventory levels, optimize routes, and plan delivery schedules more accurately.

**Optimizing Operational Processes**

Moreover, AI-powered tools can streamline various operational processes in logistics. For instance, machine learning algorithms facilitate demand forecasting by analyzing patterns, thereby reducing the risk of stockouts or overstocking. Additionally, AI-driven automation can enhance the accuracy and speed of order fulfillment through smart robotics and warehouse management systems.

**Intelligent Transportation Systems**

AI-based systems also revolutionize transportation in the logistics industry. Self-driving vehicles, enabled by AI algorithms, can reduce operational costs and increase safety, particularly during long-haul journeys. Furthermore, computer vision technologies can help in predicting maintenance requirements and preventing vehicle breakdowns, thus minimizing delays and disruptions in the supply chain.

**Advanced Data Analytics**

Machine learning plays a crucial role in leveraging data analytics to make informed business decisions. Advanced analytical tools can process vast amounts of data to identify trends and uncover new opportunities, such as underutilized routes or cost-effective shipping alternatives. This information allows companies to strategize and adjust their services to meet customer expectations better.

**Enhanced Customer Experience**

Finally, AI and machine learning can significantly improve customer experiences in the logistics industry. Chatbots and virtual assistants, powered by natural language processing, can provide instant support and handle customers' inquiries efficiently. AI-driven systems can also enable more accurate delivery tracking and proactive communication, ensuring timely deliveries and increased customer satisfaction.

In conclusion, the integration of artificial intelligence and machine learning is revolutionizing the logistics industry through increased efficiency, process automation, intelligent transportation systems, advanced data analytics, and improved customer experience. These advancements promise to reshape the industry and provide new opportunities for growth and innovation.

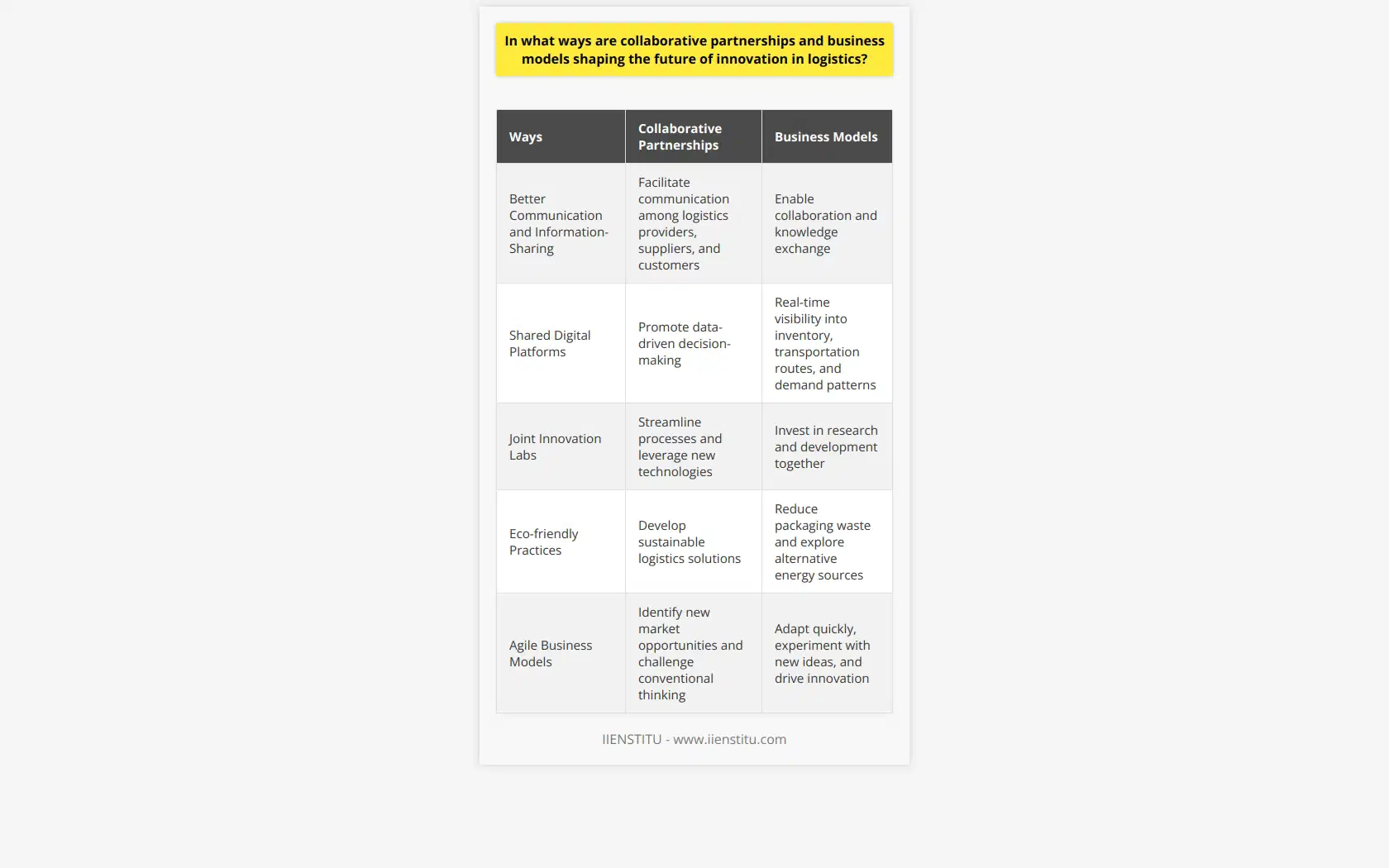

In what ways are collaborative partnerships and business models shaping the future of innovation in logistics?

Collaborative Partnerships in Logistics

One way collaborative partnerships are shaping the future of innovation in logistics is through fostering better communication and information-sharing. By creating a network of cooperative connections between logistics providers, suppliers, and customers, new levels of efficiency are being achieved. Companies can now exchange their knowledge, experiences, and resources more effectively, enabling them to create innovative solutions to solve common problems.

Shared Digital Platforms

These partnerships also benefit from shared digital platforms that promote data-driven decision-making. Through real-time visibility into inventory levels, transportation routes, and demand patterns, all stakeholders can access the same information and contribute to the optimization of supply chain operations. This aligned data management encourages companies to find new ways of reducing costs, improving customer service, and increasing their overall competitiveness.

Joint Innovation Labs

Another way collaborative partnerships are driving innovation in logistics is through the establishment of joint innovation labs. These collaborative centers focus on finding new ways to streamline processes, automate tasks, and leverage new technologies such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain. By joining forces to invest in research and development, logistics providers and business partners can co-create and share knowledge to boost the industry's capacity for breakthrough innovation.

Eco-friendly Practices

The adoption of eco-friendly practices is on the rise, driven by rising consumer demand and regulatory pressure. Through collaboration, businesses can pool resources and knowledge to devise sustainable logistics solutions. Examples include reducing packaging waste, promoting reusable materials, and exploring alternative energy sources in transportation. These shared efforts support innovation and contribute to building a more environmentally responsible future for the logistics sector.

Agile Business Models

Finally, the future of innovation in logistics is being shaped by the adoption of agile business models, which rely on cross-functional teams and flexible strategies. By working together to identify new market opportunities, logistics providers and their partners can tap into breakthrough concepts that challenge conventional thinking. Flexible project structures, iterative methodologies, and robust feedback channels enable these collaborators to adapt quickly, experiment with new ideas, and drive innovation at a rapid pace.

In conclusion, the future of innovation in logistics relies heavily on collaborative partnerships and agile business models. These interconnected relationships foster better communication, information-sharing, shared digital platforms, and joint investments in research and development. The result is an industry that is constantly adapting to new challenges and creating more efficient, customer-centric, and environmentally responsible solutions.

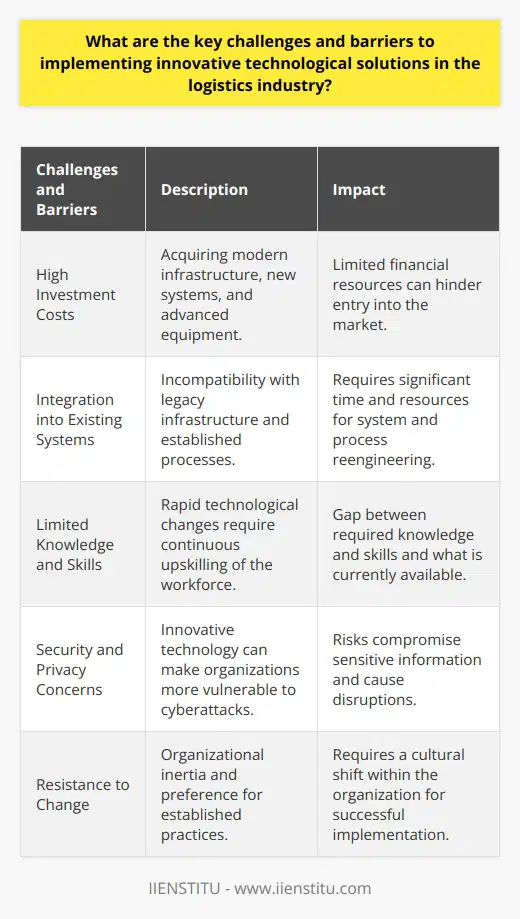

What are the key challenges and barriers to implementing innovative technological solutions in the logistics industry?

Challenges in Implementing Technology in Logistics

High Investment Costs

One of the primary challenges in implementing innovative technological solutions in the logistics industry is the high investment costs required. Acquiring modern infrastructure, new systems, and advanced equipment entails significant financial investment by logistics firms, which can act as a considerable barrier to entry.

Integration into Existing Systems

Another challenge faced by logistics companies is integrating new technological solutions into their existing systems. Legacy infrastructure and processes may not be compatible with the latest technology, requiring significant time and resources spent on system and process reengineering to implement these innovations effectively.

Limited Knowledge and Skills

The rapid pace of technological change in the logistics industry necessitates continuous upskilling of the workforce. However, limited knowledge and skills within the industry pose a significant barrier to adoption and implementation of innovative technology. Organizations may struggle to train their employees, learn new technologies, and adapt to shifts in industry practices, hindering the adoption of cutting-edge solutions.

Security and Privacy Concerns

The increasing volume and complexity of data being generated across the logistics industry has raised security and privacy concerns. Implementing new technology can make organizations more vulnerable to cyberattacks, potentially jeopardizing sensitive information and causing significant disruptions. Consequently, reluctance to adopt innovative solutions may stem from the perceived risk associated with the potential loss of data security and privacy.

Resistance to Change

Lastly, resistance to change often poses a challenge in implementing innovative technological solutions in logistics. Organizational inertia and a preference for established practices may lead to reluctance in adopting new technology. The adaptation of innovation requires not only technological change but also cultural change, with employees needing to adjust their mindset and ways of working for successful implementation.

In conclusion, logistics firms face numerous challenges when implementing innovative technological solutions, such as high investment costs, integration into existing systems, limited knowledge and skills, security and privacy concerns, and resistance to change. Overcoming these barriers requires a proactive approach, adequate resources, and a commitment to continuous improvement.

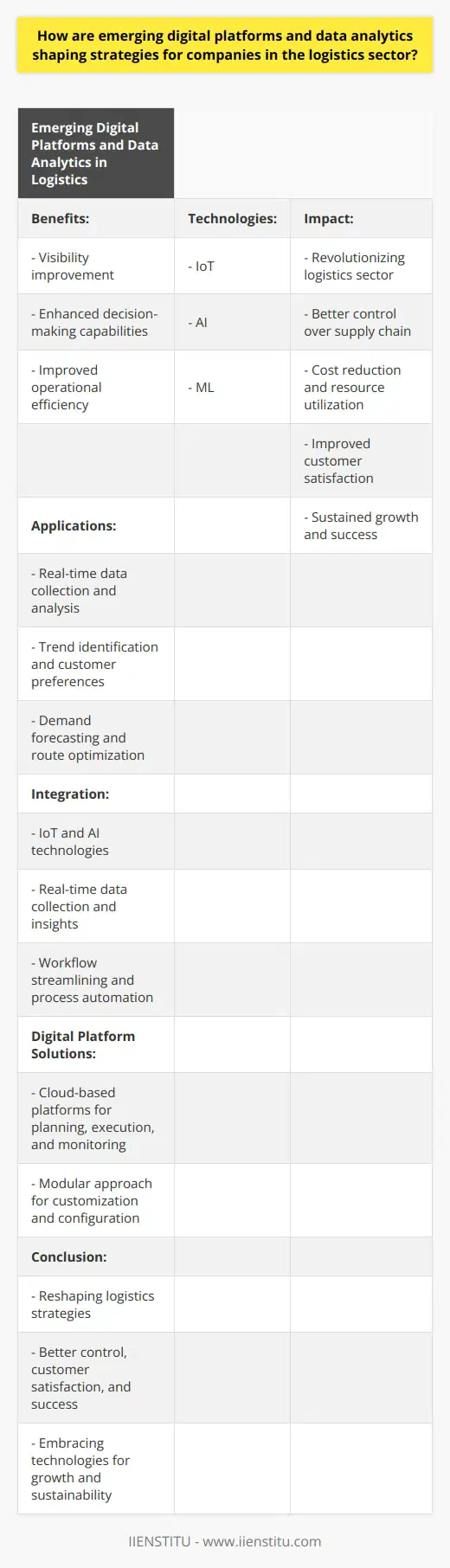

How are emerging digital platforms and data analytics shaping strategies for companies in the logistics sector?

Emerging Digital Platforms Impact on Logistics

Emerging digital platforms are playing a significant role in transforming the logistics sector. To cater to ever-changing customer demands for real-time information, companies are leveraging these platforms to gain enhanced visibility, decision-making capabilities, and operational efficiency. Additionally, the latest developments in technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML) further contribute to shaping logistics strategies.

Role of Data Analytics in Logistics Strategy

Data analytics has become an essential component of modern logistics. Real-time data collection, monitoring and analysis enable companies to identify trends, understand customer preferences, and optimize supply chain operations. By utilizing advanced analytics techniques, logistics companies can forecast demand accurately, devise efficient routing plans, and manage inventory levels more effectively. Consequently, this facilitates cost reduction, better resource utilization, and improved customer satisfaction.

Integration of IoT and AI

The integration of IoT and AI technologies is another crucial aspect shaping the logistics strategies. IoT devices collect and transmit real-time data from different stages of the supply chain, providing companies with resolute insights into their operations. Simultaneously, AI-powered algorithms utilize this data to predict outcomes, streamline workflows, and automate various processes such as warehouse management, transportation, and last-mile delivery. This integration results in enhanced performance and productivity by enabling companies to take proactive measures, prevent bottlenecks, and optimize the overall system.

Adoption of Digital Platform Solutions

The shift towards adopting digital platform solutions has had tremendous implications for the logistics sector. Companies are increasingly leveraging cloud-based platforms that integrate planning, execution, and monitoring processes, thereby providing holistic support and enabling stakeholders to make informed decisions. Moreover, these digital platforms often employ a modular approach, allowing companies to customize and configure their logistics solutions according to their unique requirements. This adaptability and scalability provide a competitive edge and lead to greater success in the logistics sector.

In conclusion, emerging digital platforms and data analytics are essential contributors to the development of efficient and agile logistics strategies. By harnessing the power of these technologies, companies can gain better control over their supply chain operations, enhance customer satisfaction, and ultimately position themselves for sustainable success in the rapidly evolving logistics landscape.

How can governments and policymakers support and promote innovation in the logistics industry to enhance efficiency and sustainability?

Role of Governments and Policymakers

Governments and policymakers play a crucial role in supporting and promoting innovation in the logistics industry to enhance efficiency and sustainability. Their involvement can help develop the necessary infrastructure, regulations, and incentives that foster a conducive environment for businesses and entrepreneurs to innovate and improve logistics processes.

Investment in Infrastructure

One essential way governments can promote innovation in logistics is by investing in infrastructure projects such as road networks, rail systems, and port facilities. By prioritizing and supporting the development of efficient transportation systems, policymakers can attract investments from logistics companies which, in turn, promotes the growth of the industry and boosts its capacity to innovate.

Favorable Regulations

Another aspect of promoting innovation lies in the setting of favorable regulations that encourage research, development, and technology adoption in the logistics sector. Governments can endorse policies that stimulate competition within the industry, thereby incentivizing companies to continuously strive to optimize their logistics processes and reduce costs. Additionally, setting regulatory standards that promote sustainability, such as reducing emissions and waste, can push logistics companies to adopt greener technologies and practices.

Financial Incentives

Governments can also provide financial incentives to foster innovation in the logistics industry. This could include tax incentives, grants, and subsidies aimed at supporting research and development projects, improving energy efficiency, or adopting eco-friendly technologies. Financial incentives can encourage businesses to invest in innovative solutions that can improve their operations, enhance efficiency, and contribute to environmental sustainability.

Collaboration and Partnerships

Lastly, fostering collaboration and partnerships between government agencies, private sector organizations, and academic institutions can contribute to innovation in the logistics industry. Establishing channels that promote information exchange, knowledge sharing, and joint research projects can help businesses and entrepreneurs access new ideas, funding, and technologies.

In conclusion, by investing in infrastructure, implementing supportive regulations, providing financial incentives, and promoting collaboration and partnerships, governments and policymakers can create an environment where innovation flourishes in the logistics industry. This will ultimately lead to improved efficiency and sustainability, benefiting the economy, the industry, and the environment.

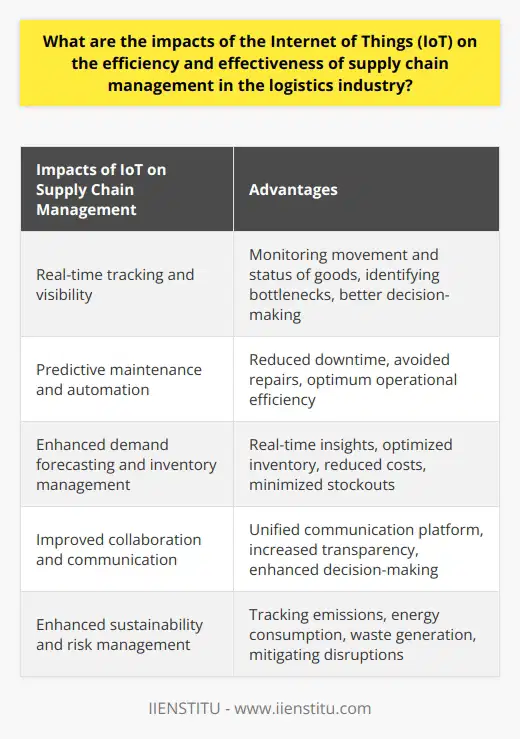

What are the impacts of the Internet of Things (IoT) on the efficiency and effectiveness of supply chain management in the logistics industry?

Impacts on Efficiency and Effectiveness

Real-Time Tracking and Visibility

The IoT significantly improves the efficiency and effectiveness of supply chain management by enabling real-time tracking and visibility across the entire logistics network. By using IoT sensors and data analytics, companies can monitor the movement and status of goods in transit, identify bottlenecks and improve decision-making processes for better resource allocation and utilization.

Predictive Maintenance and Automation

IoT devices, when combined with data analytics and machine learning algorithms, allow companies to predict and automate maintenance activities for transportation and warehousing equipment. This predictive maintenance approach can reduce equipment downtime and spare part inventories by identifying potential failures before they occur, avoiding costly repairs, and ensuring optimum operational efficiency.

Demand Forecasting and Inventory Management

IoT technology plays a vital role in enhancing the accuracy of demand forecasting and inventory management in the logistics industry. IoT devices can collect and analyze data on customer preferences, buying habits, and market trends to generate real-time insights for better demand planning. This, in turn, allows companies to optimize inventory levels, reduce carrying costs, and minimize stockouts, enhancing the overall efficiency and effectiveness of supply chain operations.

Improved Collaboration and Communication

The IoT facilitates seamless information exchange between different stakeholders in the supply chain by providing a unified communication platform. This increased transparency across the supply chain ensures that relevant information reaches the right parties at the right time, improving collaboration, decision-making, and overall operational efficiency.

Enhanced Sustainability and Risk Management

By incorporating IoT solutions into supply chain operations, companies can better manage environmental and social risks associated with their activities. IoT devices can track and report on emissions, energy consumption, and waste generation, promoting sustainable practices while ensuring compliance with regulatory requirements. Additionally, the real-time monitoring capabilities of IoT technology can help companies mitigate supply chain disruptions caused by adverse weather conditions, geopolitical tensions, and other external factors.

In conclusion, the Internet of Things significantly impacts the efficiency and effectiveness of supply chain management in the logistics industry by providing real-time tracking, predictive maintenance, accurate demand forecasting, improved collaboration and communication, and enhanced sustainability and risk management. As IoT technology continues to evolve, it promises to further revolutionize the logistics industry and redefine traditional supply chain practices.

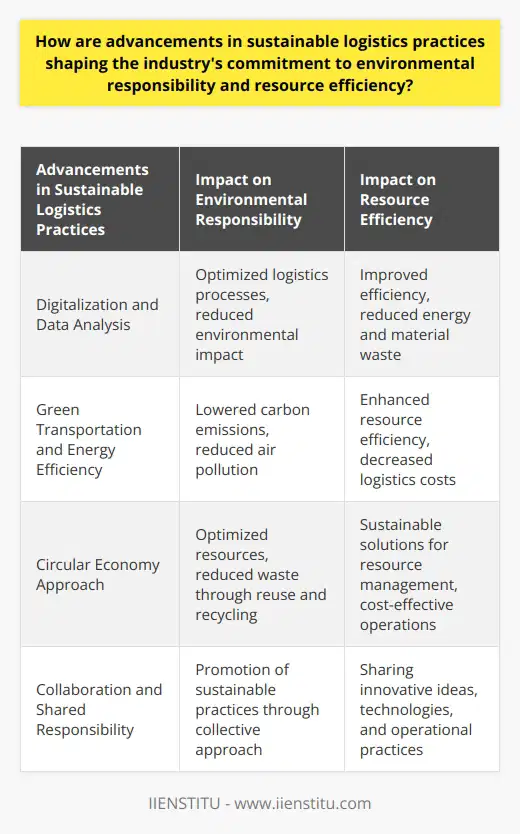

How are advancements in sustainable logistics practices shaping the industry's commitment to environmental responsibility and resource efficiency?

Emerging Technologies in Sustainable Logistics

Advancements in sustainable logistics practices significantly impact the industry's commitment to environmental responsibility and resource efficiency. Considering the global rise in environmental awareness and the need for economically sustainable business models, adopting these practices is vital. Innovative solutions, driven by technological and operational advancements, enable companies to maintain a more environmentally-friendly and efficient supply chain.

Digitalization and Data Analysis for Efficiency

Digitalization and data analysis have greatly contributed to the optimization of logistics processes, leading to reduced environmental impact. Real-time tracking, data-driven decision-making, and streamlined communication enable companies to boost their efficiency, curbing energy and material waste. Additionally, data analysis is essential for transportation modes optimization, resulting in reduced greenhouse gas emissions, fuel consumption, and overall logistics costs.

Green Transportation and Energy Efficiency

New transportation options, such as electric or hydrogen-powered vehicles, are vital in minimizing the environmental impact of logistics operations. Embracing these technologies results in lower carbon emissions and air pollution levels, providing a greener alternative to traditional fuel-based vehicles. Moreover, optimizing transportation routes and introducing more energy-efficient warehouse systems through advanced technologies further enhances resource efficiency within the industry.

Circular Economy and Recycling Initiatives

A circular economy approach, encompassing both resource optimization and waste reduction, reinforces the industry's dedication to environmental responsibility. By integrating reuse and recycling initiatives into their practices, logistics companies can create more sustainable solutions for resource management. These initiatives help minimize the environmental impact on natural resources, keeping waste at a minimum and ensuring cost-effective operations.

Collaboration and Shared Responsibility

Lastly, fostering collaboration and shared responsibility among industry stakeholders is essential in promoting sustainable logistics practices. By working together, companies can share innovative ideas, technology, and operational practices that drive greater efficiency while minimizing environmental impact. Collaborative efforts also stimulate a collective approach to adopting more sustainable practices, thereby strengthening the industry's commitment to environmental responsibility and resource efficiency.

In conclusion, technological advancements and innovative solutions play a crucial role in propelling the logistics industry towards sustainable practices. Embracing digitalization, adopting green transportation, fostering a circular economy mindset, and promoting collaboration contribute to a more environmentally responsible and resource-efficient sector. Ultimately, these advancements shape the industry's commitment to preserving the planet and promoting sustainable business models.

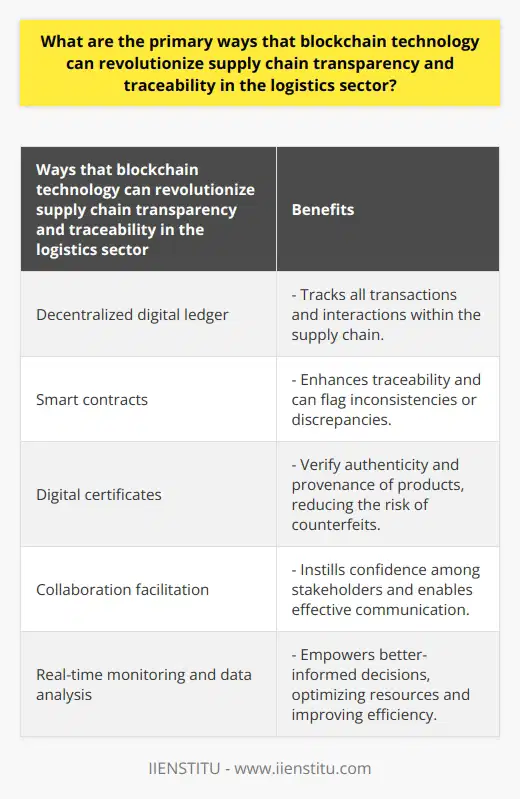

What are the primary ways that blockchain technology can revolutionize supply chain transparency and traceability in the logistics sector?

**Blockchain's Impact on Supply Chain Transparency**

Among the primary ways blockchain technology can revolutionize supply chain transparency and traceability in the logistics sector is by providing a decentralized digital ledger. This ledger establishes a comprehensive record of all transactions and interactions within the supply chain. Businesses can track crucial information such as product origin, vessel, and destination as the product moves across various stages.

**Enhancing Traceability with Smart Contracts**

Blockchain technology can also implement smart contracts, which are self-executing, programmable code with agreed-upon rules and conditions. These contracts can monitor and enforce the flow of goods, flagging inconsistencies or discrepancies that may signal fraud or theft. The use of smart contracts serves to optimize the flow of goods within the supply chain, improving overall efficiency.

**Verifying Authenticity through Digital Certificates**

Further, blockchain technology can issue digital certificates to authenticate products and confirm their provenance. These certificates are cryptographically secure, making them resistant to tampering or alteration. The ability to verify a product's origin and authenticity with high confidence reduces the risk of counterfeit or misrepresented items entering the supply chain.

**Supporting Collaboration among Stakeholders**

Another primary way blockchain can revolutionize supply chain transparency is by fostering collaboration among various stakeholders. By providing a shared, trustworthy, and tamper-proof record, blockchain facilitates confidence among businesses, suppliers, customers, and regulators. Trust in the supply chain is vital for building relationships, reducing information asymmetries, and enabling effective communication among all parties involved.

**Real-Time Monitoring and Data Analysis**

Blockchain technology enables real-time monitoring and data analysis, giving businesses an accurate, up-to-date overview of their supply chain operations. Access to such information empowers companies to make better-informed decisions about their supply chain strategies, optimize resources, identify potential bottlenecks, and improve overall efficiency.

In conclusion, blockchain technology holds the potential to revolutionize supply chain transparency and traceability in the logistics sector. Through its decentralized ledger, smart contracts, digital certificates, and collaborative capabilities, blockchain can optimize operations, mitigate risks, and foster trust among all stakeholders in the supply chain.

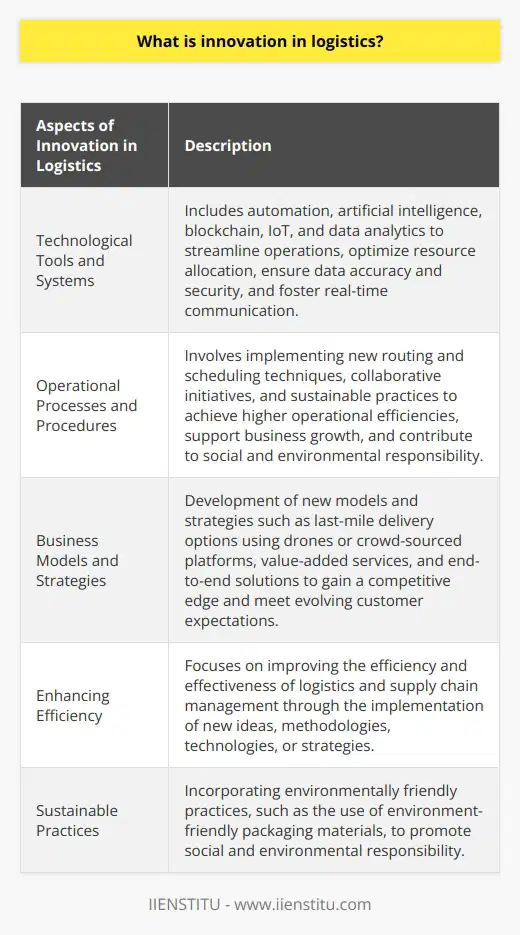

What is innovation in logistics?

Defining Innovation in Logistics

Innovation in logistics refers to the process of implementing new ideas, methodologies, technologies, or strategies to improve the efficiency and effectiveness of logistics and supply chain management. These advancements should significantly enhance the movement, storage, and handling of products, services, and information throughout the entire supply chain, from the point of origin to the point of consumption.

Technological Innovations

One aspect of innovation in logistics is the adoption of advanced technological tools and systems. These may include automation, artificial intelligence, blockchain, the Internet of Things (IoT), and data analytics. By leveraging these digital technologies, logistics companies can streamline operations, optimize resource allocation, ensure data accuracy and security, and foster real-time communication between supply chain partners.

Operational Improvements

Another facet of innovation in logistics is the enhancement of operational processes and procedures. This may involve the implementation of new routing and scheduling techniques, collaborative initiatives such as sharing distribution networks, or the introduction of sustainable practices like the use of environment-friendly packaging materials. These strategic innovations can not only help logistics firms achieve higher operational efficiencies but also support overall business growth and contribute to social and environmental responsibility.

Business Model Evolution

Innovation in logistics can also extend to the development of new business models and strategies that cater to emerging market trends and changing customer demands. Some examples include the introduction of last-mile delivery options, including the use of drones and crowd-sourced platforms, or offering value-added services such as real-time tracking, flexible pricing, or end-to-end solutions. By adopting these innovative business practices, logistics companies can gain a competitive edge and meet evolving customer expectations.

In conclusion, innovation in logistics goes beyond merely incorporating advanced technologies or systems. It encompasses a broad range of strategic initiatives and processes aimed at enhancing operational efficiency, adopting sustainable practices, and developing customer-centric solutions. Fostering innovation in logistics is crucial to remain competitive in a fast-paced and ever-evolving global market.

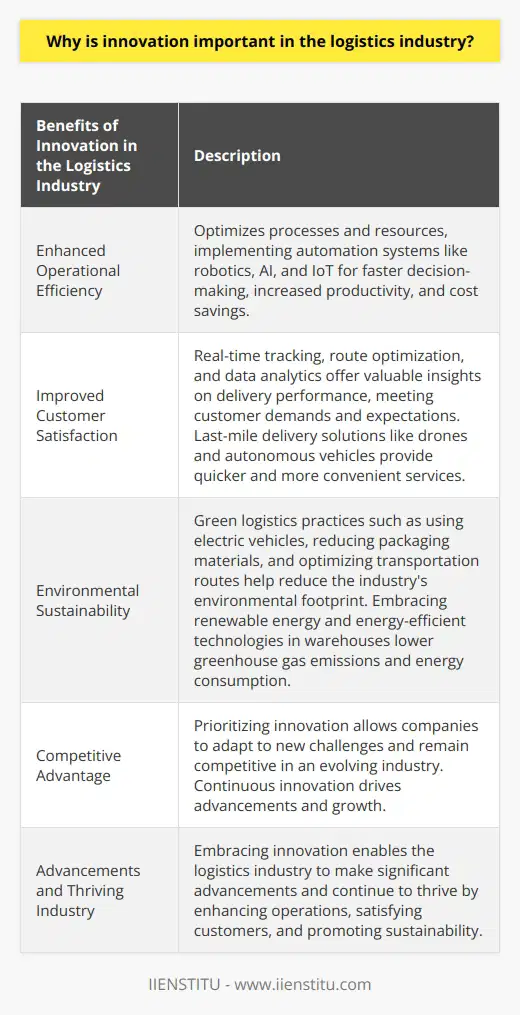

Why is innovation important in the logistics industry?

Significance of Innovation in Logistics

Innovation in the logistics industry is essential for several reasons, such as increased operational efficiency, improved customer satisfaction, and environmental sustainability. By implementing innovative technologies and processes, logistics companies can enhance their service offerings, reduce costs, and maintain a competitive edge in the market.

Enhancement of Operational Efficiency

The adoption of automation systems in areas such as warehouse management, inventory control, and transportation can greatly improve operational efficiency. Innovative technologies like robotics, artificial intelligence (AI), and the Internet of Things (IoT) enable faster and more accurate decision-making, leading to increased productivity and reduced operational errors. This, in turn, helps companies to streamline their processes and optimize their resources.

Improved Customer Satisfaction

Another reason why innovation plays a vital role in the logistics industry is the need for improved customer satisfaction. Technologies like real-time tracking, route optimization, and data analytics can provide valuable insights on delivery performance, ultimately enabling companies to meet customers' increasing demands and expectations. Furthermore, innovative last-mile delivery solutions, such as drones and autonomous vehicles, offer quicker and more convenient ways to deliver goods to consumers, significantly enhancing the overall customer experience.

Achieving Environmental Sustainability

Lastly, innovation in logistics can play a crucial role in promoting environmental sustainability. Green logistics practices, such as using electric vehicles, reducing packaging materials, and optimizing transportation routes, can help reduce the industry's environmental footprint. Additionally, adopting renewable energy sources and implementing energy-efficient technologies in warehouses contribute to lower greenhouse gas emissions and energy consumption, fostering a more sustainable supply chain.

In conclusion, innovation is critical for the logistics industry as it enables companies to improve operational efficiency, enhance customer satisfaction, and achieve environmental sustainability. As the industry continues to evolve, it is crucial for companies to remain agile and adapt to new challenges by continuously embracing the power of innovation.

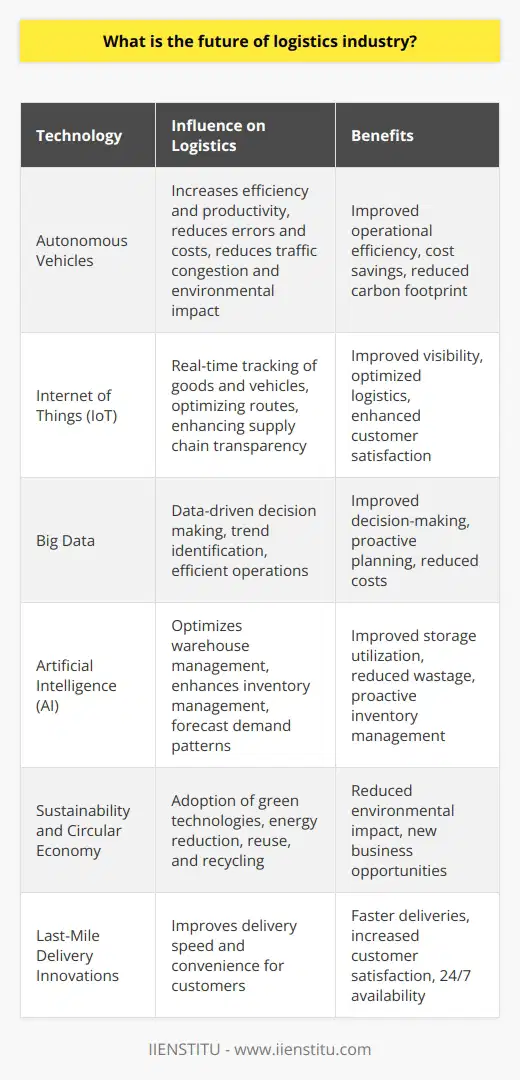

What is the future of logistics industry?

Emerging Technologies in Logistics

The future of the logistics industry is heavily influenced by emerging technologies, which are continuously transforming this sector. One of the most promising technologies is autonomous vehicles. These vehicles are expected to increase efficiency and productivity while reducing human errors and operational costs. Additionally, autonomous vehicles will likely reduce traffic congestion, fuel consumption, and environmental impact.

IoT and Big Data Impact

The Internet of Things (IoT) and Big Data are also playing crucial roles in shaping the future of logistics. IoT technology enables real-time tracking of goods and vehicles, optimizing routes and enhancing supply chain transparency. This is particularly vital for industries such as pharmaceuticals and perishables, where strict temperature and time-sensitive controls are necessary. Big Data, on the other hand, supports the logistics industry in making data-driven decisions and identifying trends, ensuring smarter and more efficient operations.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies are rapidly advancing, bringing vast implications for the logistics industry. AI-powered automation systems can improve warehouse management by optimizing storage space, rapidly locating available products, and streamlining order processing. Furthermore, AI-based algorithms can be utilized to forecast demand patterns, enhancing inventory management, and minimizing product wastage.

Sustainability and Circular Economy

Sustainability and the circular economy are becoming increasingly important topics in the logistics sector. Ecological concerns and regulations are driving companies to adopt environmentally friendly practices, such as implementing green technologies for transportation, reducing energy consumption, and prioritizing the reuse and recycling of materials. This shift towards a circular economy will not only benefit the planet but also create new business opportunities in areas like remanufacturing, leasing, and recycling.

Last-Mile Delivery Innovations

Last-mile delivery is a critical component in the logistics industry as it directly impacts customer satisfaction. Innovations in this aspect are expected to transform the way goods are delivered, making the process quicker and more convenient for customers. Examples of these innovations include drone and robot deliveries, which could enable faster, more efficient deliveries, and even 24/7 availability in certain areas.

In conclusion, the future of the logistics industry appears to be bright and fueled by various technological advancements, ecological concerns, and innovative solutions addressing last-mile delivery challenges. These trends will promote efficiency, transparency, and sustainability and ultimately contribute to a more robust and customer-centric industry.

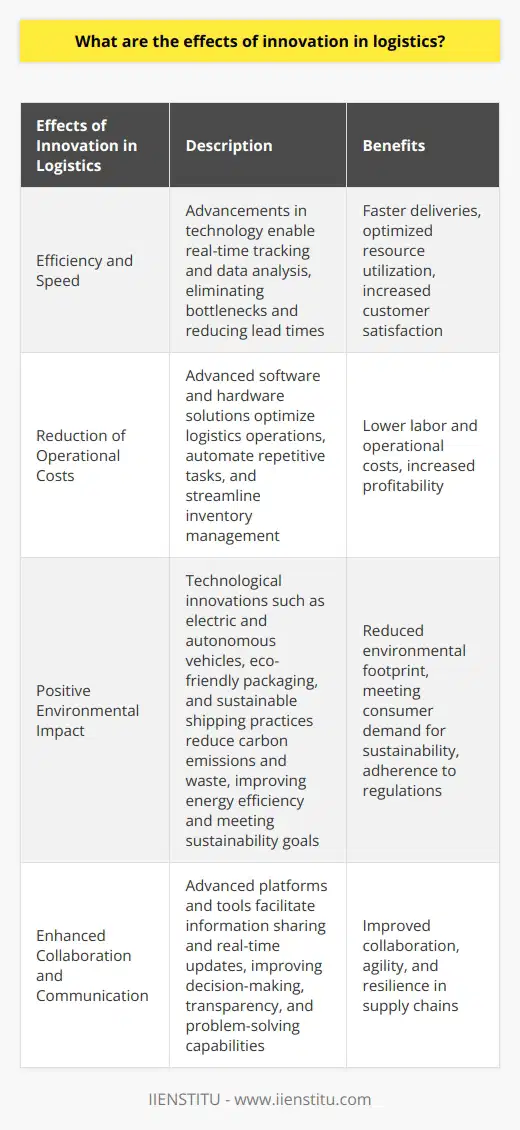

What are the effects of innovation in logistics?

Impact on Efficiency and Speed

One significant effect of innovation in logistics is increased efficiency and speed in the supply chain. Technological advancements, such as automation, Internet of Things (IoT), and artificial intelligence, facilitate real-time tracking and data analysis. The availability of precise information about every element of the supply chain, such as order status and inventory levels, eliminates bottlenecks and reduces lead times. Consequently, these improvements enable faster deliveries, better resource utilization, and higher customer satisfaction.

Reduced Operational Costs

Another effect of innovation in logistics is the reduction of operational costs. Advanced software and hardware solutions provide companies with the tools to optimize their logistics operations. For example, warehouse management systems streamline inventory management while routing and scheduling software ensure timely and cost-efficient deliveries. Moreover, the adoption of technologies like robotic process automation can significantly reduce labor costs by automating repetitive, time-consuming tasks. This reduction in operational costs directly translates to increased profitability for businesses.

Environmental Impact

Technological advancements in logistics also have a considerable impact on the environment. Innovations such as electric and autonomous vehicles, for instance, contribute to reduced carbon emissions, decreased road congestion, and improved energy efficiency. Furthermore, eco-friendly packaging materials and sustainable shipping practices minimize waste and lessen the industry's environmental footprint. As a result, companies can meet growing consumer demand for sustainable products and services while adhering to strict government regulations and global emissions targets.

Enhanced Collaboration and Communication

Innovation in logistics also fosters enhanced collaboration and communication within the industry. Advanced platforms and tools, such as cloud-based systems, facilitate information sharing and real-time updates among different stakeholders, including manufacturers, retailers, and end customers. These communication channels enable better decision-making, increased transparency, and improved problem-solving capabilities. Consequently, enhanced collaboration and communication contribute to smoother, more agile, and resilient supply chains.

In summary, innovation in logistics brings numerous effects to the industry, including improved efficiency and speed, reduced operational costs, minimized environmental impact, and enhanced collaboration and communication. These advancements have far-reaching implications for the global economy, as they pave the way for more sustainable, reliable, and streamlined supply chain management. By embracing technological innovations in logistics, businesses can position themselves at the forefront of industry trends and gain a competitive advantage in a rapidly evolving marketplace.

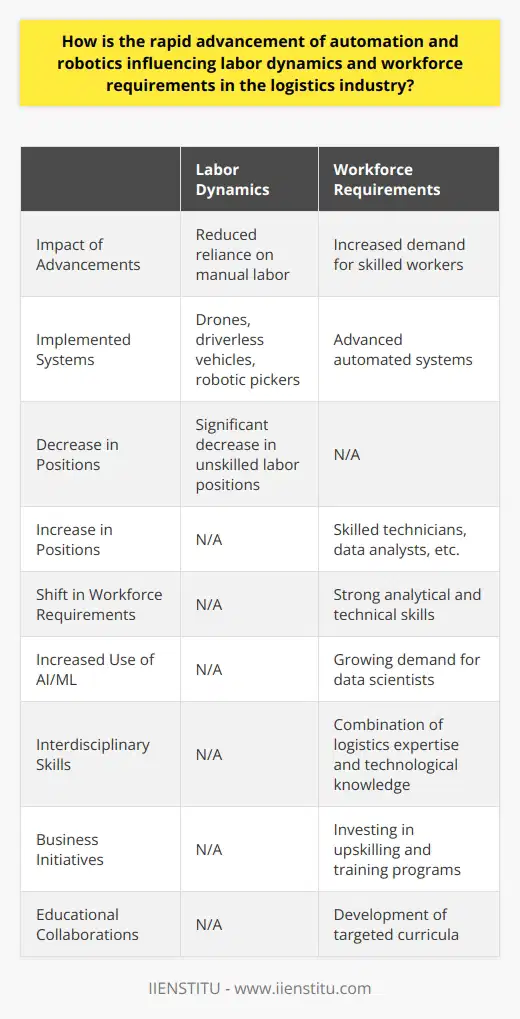

How is the rapid advancement of automation and robotics influencing labor dynamics and workforce requirements in the logistics industry?

Influence on Labor Dynamics

The rapid advancement of automation and robotics is reshaping labor dynamics in the logistics industry by reducing the reliance on manual labor and boosting the demand for skilled workers. Companies are increasingly deploying automated systems, such as drones, driverless vehicles, and robotic pickers, to perform tasks previously completed by human workers. This shift has led to a significant reduction in the number of unskilled labor positions, while the need for skilled technicians, data analysts, and other professionals with relevant expertise has increased.

Workforce Requirements

Alongside changes in labor dynamics comes a shift in workforce requirements, with an emphasis on employees possessing strong analytical and technical skills. In the age of automation, logistics professionals must be equipped to operate, maintain, and troubleshoot advanced systems, necessitating a high level of proficiency. Additionally, with the increased use of artificial intelligence and machine learning in the industry, there is a growing need for data scientists who can analyze complex datasets and derive valuable insights. Workers with interdisciplinary skills, capable of using both logistics expertise and technological knowledge, are also highly sought after.

Upskilling and Training Programs

To manage these evolving workforce requirements, businesses in the logistics industry are actively investing in upskilling and training programs. These efforts aim to provide existing employees the opportunity to acquire the skills necessary for thriving in an increasingly automated environment. By offering comprehensive retraining initiatives, companies can minimize workforce displacement, foster employee loyalty, and attract tech-savvy talent. Furthermore, collaborations between educational institutions and logistics companies have led to the development of targeted curricula that addresses the skill gap in the industry and prepares future professionals for success.

Adapting to Change

In conclusion, automation and robotics advancements have significantly influenced labor dynamics and workforce requirements in the logistics industry. Businesses must adapt to these changes through upskilling initiatives and by nurturing a competent workforce with strong technical and analytical skills. As the trend toward automation continues to escalate, embracing these strategies will be crucial for maintaining a competitive edge and ensuring long-term success in the growing logistics sector.

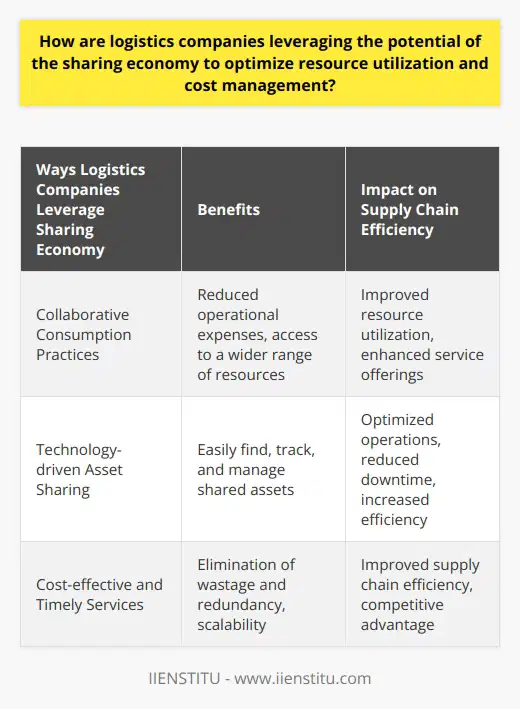

How are logistics companies leveraging the potential of the sharing economy to optimize resource utilization and cost management?

Sharing Economy Impact on Logistics

Logistics companies are increasingly exploring the sharing economy to optimize resources and manage costs more effectively. They achieve this by implementing collaborative consumption practices within their business models, harnessing technology to facilitate asset sharing, and ultimately improving their supply chain efficiency.

Collaborative Consumption Practices

Implementing collaborative practices allows logistics companies to access a wide range of resources without the need for significant capital investments. By collaborating with other businesses on shared warehousing, transport, and labor, these companies can expand their services while reducing operational expenses.

Harnessing Technology for Asset Sharing

The use of advanced technology platforms is essential in connecting logistics companies with available resources in the sharing economy. These digital platforms enable businesses to find, track, and manage shared assets more easily, improving both resource utilization and cost management.

Improved Supply Chain Efficiency

By leveraging the sharing economy, logistics companies can increase their supply chain efficiency, ultimately benefiting their customers with cost-effective, reliable, and timely services. Shared resources lead to better asset utilization and enable companies to scale their operations in response to market demands without increasing costs.

In conclusion, the sharing economy provides logistics companies with opportunities to optimize their resource utilization and cost management through collaborative consumption practices and the use of technology platforms. These approaches ultimately lead to improved supply chain efficiency, enabling logistics businesses to meet the ever-changing demands of their customers while maintaining a competitive edge in the market.