You know, back when I first started working in human resources, I remember a time when our company was in the midst of launching a massive project. We were short-staffed, deadlines were looming, and the pressure was immense. That's when my manager brought in a team of contingent workers to help us out. I'll admit, I was a bit skeptical at first. But looking back, integrating that contingent workforce was one of the best decisions we made. It not only saved us time and money but also infused fresh perspectives into our work.

Introduction

Benefits of Integrating a Contingent Workforce

HR Management Challenges

IRS’s “20-Factor Test”

Conclusion

Embracing the Contingent Workforce

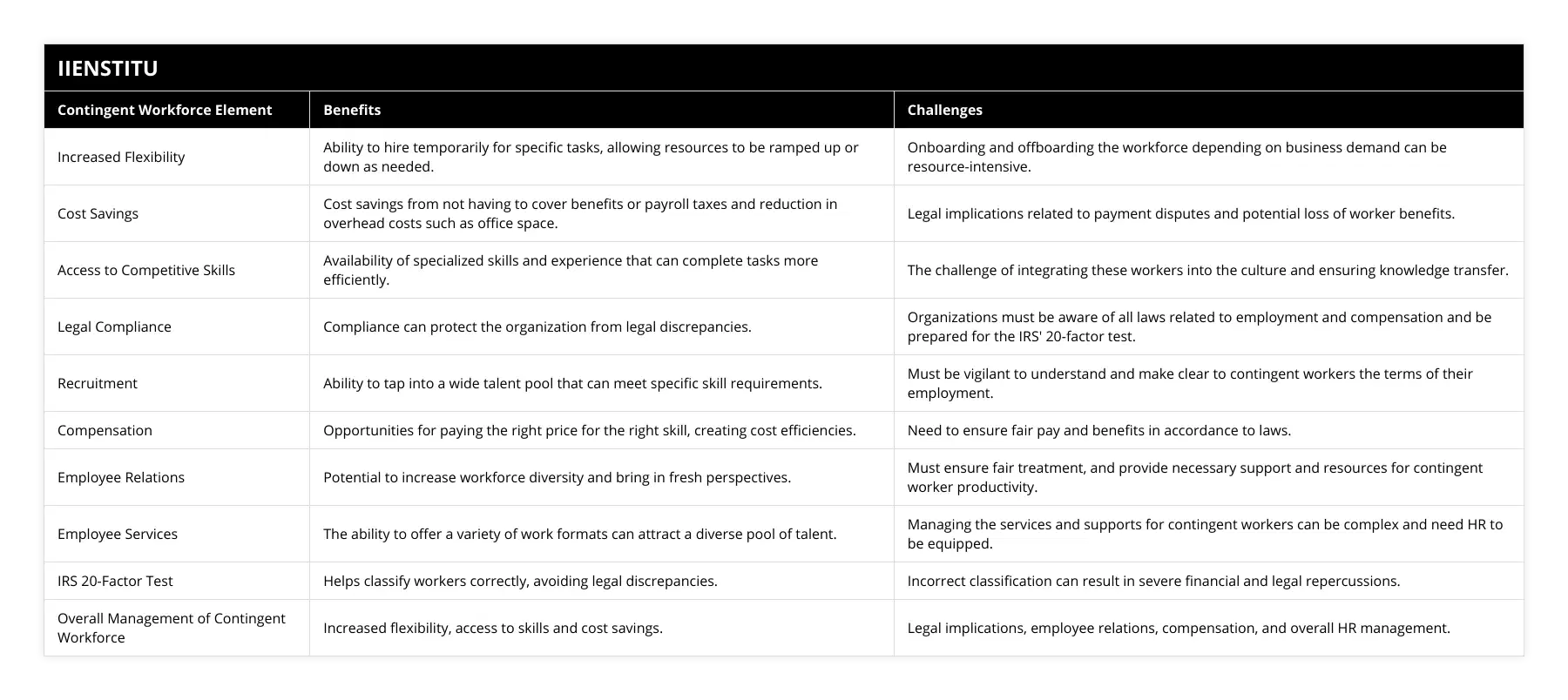

In today's ever-evolving business landscape, organizations are constantly seeking ways to stay agile and competitive. One strategy that's been gaining traction is the integration of contingent workers—these are non-company employees who are brought on board for specific tasks or projects, often for a set period. They might be freelancers, consultants, or temporary staff.

The Winds of Change in HR Management

The rise of the gig economy has reshaped how we think about employment. As companies navigate through economic uncertainties and fluctuating market demands, the traditional nine-to-five, permanent employment model is no longer the only game in town. Strategic human resource management now often involves a blend of full-time staff and contingent workers to create a more flexible and responsive workforce.

Benefits That Can't Be Ignored

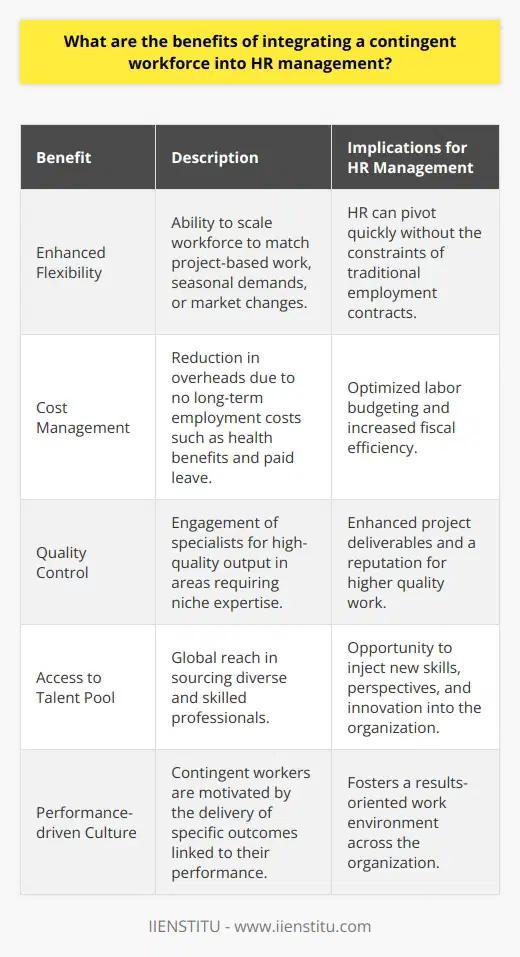

So, what makes the integration of a contingent workforce so appealing? Well, there are several compelling reasons:

1- Increased Flexibility: Contingent workers allow organizations to ramp up or down their workforce based on current needs. For instance, if there's a seasonal spike in demand or a special project, companies can bring in extra hands without long-term commitments.

2- Cost Savings: Let's face it, hiring full-time employees comes with a host of expenses—benefits, payroll taxes, office space, equipment—the list goes on. With contingent workers, many of these costs are reduced or eliminated. This doesn't mean skimping on fair compensation but optimizing resources where possible.

3- Access to Specialized Skills: Sometimes, a project requires niche expertise that your current team might not possess. Contingent workers can fill these gaps, bringing in new knowledge and innovative approaches that can boost overall performance.

4- Global Reach: In our interconnected world, contingent workers can be sourced from anywhere. This global talent pool provides diverse perspectives and can help companies tap into new markets.

I recall a time when we needed a specialist in data analytics for a short-term project. Instead of going through the lengthy hiring process, we brought in an expert on a contract basis. Not only did we complete the project ahead of schedule, but our team also learned invaluable skills from him.

Navigating the HR Management Challenges

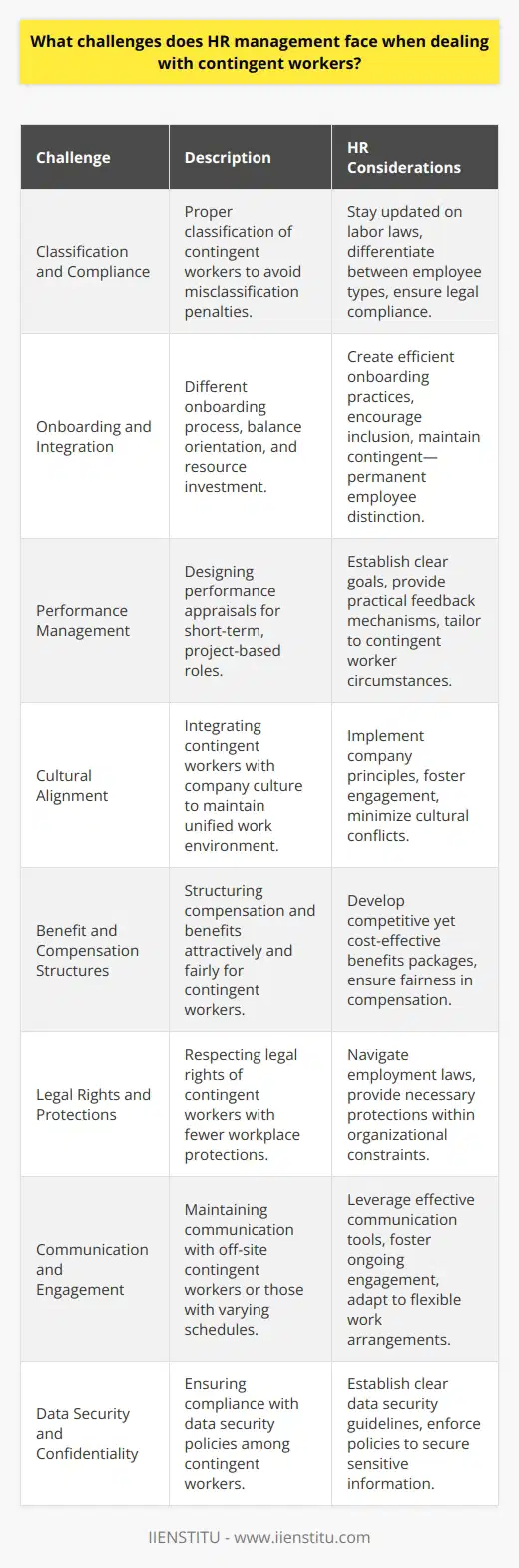

Of course, integrating a contingent workforce isn't all sunshine and rainbows. There are significant challenges that HR management needs to address to ensure a smooth operation.

Legal Landmines and Compliance

One of the biggest hurdles is navigating the complex web of legal requirements. Misclassification of workers can lead to hefty fines and legal disputes. The lines between an employee and an independent contractor can sometimes blur, so it's crucial to get it right.

Employment Laws: Different countries, and even states, have varying definitions and regulations regarding contingent workers. HR human resources departments need to be up-to-date on these laws to avoid violations.

Contracts and Agreements: Clear, concise contracts that outline the scope of work, duration, compensation, and expectations are essential. This not only protects the company but also ensures that the worker understands their role.

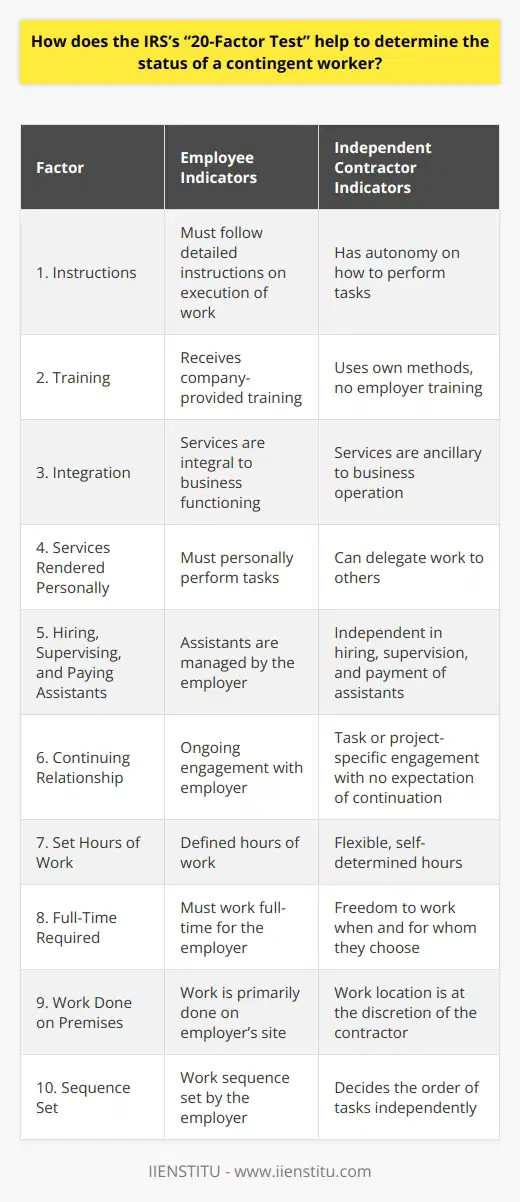

The IRS's "20-Factor Test": In the United States, the Internal Revenue Service uses this test to determine whether a worker is an employee or an independent contractor. Factors include the level of control, financial investment, opportunity for profit and loss, and the nature of the relationship, among others.

I once worked with a company that nearly faced penalties because they hadn't properly classified their contingent workers. It was a wake-up call about the importance of understanding and adhering to legal requirements.

Compensation and Benefits

While contingent workers aren't employees in the traditional sense, fair compensation is non-negotiable. Companies must ensure they're paying market rates and considering any additional costs, such as equipment or software licenses required for the job.

A flexible workforce is essential for successful HR management in the modern world.

No Benefits Doesn't Mean No Support: While they might not receive the same benefits as full-time staff, offering perks like flexible hours, remote work options, or access to training can make a difference.

Transparent Communication: Being upfront about compensation and any available benefits helps build trust and fosters a positive working relationship.

Bridging the Gap with Full-Time Staff

Integrating contingent workers into existing teams can sometimes lead to friction. Full-time employees might feel threatened or undervalued.

Fostering Inclusivity: Encourage collaboration and treat contingent workers as part of the team during their tenure. This can be as simple as including them in meetings or company events.

Clear Roles and Responsibilities: Define the roles of contingent workers and how they fit into the project's overall objectives. This clarity helps prevent overlap and confusion.

Providing Support and Resources: Just like any team member, contingent workers need access to the right tools and information to succeed. Whether it's onboarding sessions or regular check-ins, support is key.

The Importance of Strategic HR Management

Incorporating contingent workers effectively requires a shift towards strategic HR management. This means aligning HR practices with the organization's long-term goals.

Developing a Contingent Workforce Strategy

1- Assessing Organizational Needs: Identify areas where contingent workers could fill gaps or enhance capabilities.

2- Establishing Policies and Procedures: Create guidelines for hiring, managing, and offboarding contingent workers to ensure consistency.

3- Leveraging HRM Management Systems: Utilize human resource management systems to track contracts, performance, and compliance.

Training and Development Opportunities

Contrary to popular belief, investing in the development of contingent workers can benefit the organization.

Skill Enhancement: Offering training can lead to better project outcomes.

Building a Talent Pool: Skilled contingent workers might be interested in future projects or even full-time positions.

I remember a contractor who initially joined us for a three-month assignment. Through ongoing development opportunities and positive engagement, she eventually became a valuable full-time team member.

Understanding the IRS's "20-Factor Test"

The IRS's "20-Factor Test" is a crucial tool for organizations in the United States to determine a worker's status. Misclassification can result in severe penalties, so understanding these factors is essential.

Key Factors to Consider

Behavioral Control: Does the company control or have the right to control what the worker does and how the worker does their job?

Financial Control: Are the business aspects of the worker's job controlled by the payer? (e.g., how the worker is paid, whether expenses are reimbursed)

Type of Relationship: Are there written contracts or employee-type benefits? Will the relationship continue, and is the work performed a key aspect of the business?

Applying the Test in Practice

Organizations should evaluate their relationships with workers using these factors. It's not about passing all 20 factors but considering the overall relationship's nature.

Documentation: Keep detailed records of agreements and communications.

Consult Legal Expertise: When in doubt, seek legal counsel to ensure compliance.

Conclusion: Harnessing the Power of a Flexible Workforce

In the hustle and bustle of today's business world, companies need to stay nimble. Integrating a contingent workforce offers numerous benefits—from cost savings to tapping into specialized skills. But it's not without its challenges. Human resource services play a pivotal role in navigating these complexities, ensuring that both the organization and the workers thrive.

By approaching the integration with a strategic mindset, understanding the legal landscape, and fostering a supportive environment, companies can unlock new levels of productivity and innovation. After all, at the heart of every successful business are the people—whether they're full-time staff or contingent workers, it's about bringing together the right talent to achieve shared goals.

References

1- Dessler, G. (2015). Human Resource Management. Pearson Education.

2- Kalleberg, A. L. (2000). Nonstandard Employment Relations: Part-time, Temporary, and Contract Work. Annual Review of Sociology, 26, 341–365.

3- Lepak, D. P., & Snell, S. A. (1999). The Human Resource Architecture: Toward a Theory of Human Capital Allocation and Development. Academy of Management Review, 24(1), 31–48.

4- Belcourt, M. (2006). Outsourcing—The Benefits and the Risks. Human Resource Management Review, 16(2), 269–279.

5- Mertz, E. (2017). The Dynamics of Employee Relations. Oxford University Press.

Final Thoughts: Managing a contingent workforce isn't just a trend; it's a strategic move that, when done right, can propel an organization forward. Whether you're an HR professional drafting a reassignment request letter tips and information or a manager looking into managed HR solutions, embracing flexibility can make all the difference.

Well, that's just my two cents on the matter!

Frequently Asked Questions

What are the benefits of integrating a contingent workforce into HR management?

Integrating a contingent workforce into HR management is critical in the modern business environment. This type of workforce is made up of temporary, short-term, and seasonal employees who are employed on an as-needed basis. With the ever-changing demands of the workplace, HR departments need to be able to quickly and effectively integrate contingent workers into their existing workforce. Therefore, this article will discuss the benefits of incorporating a contingent workforce into HR management.

The first benefit of integrating a contingent workforce into HR management is increased flexibility. Contingent workers can be employed on an as-needed basis, allowing employers to adjust their workforce size based on changing demands. This can help employers respond quickly to changing market conditions allowing them to add staff swiftly during peak demand. This flexibility can help employers save money by avoiding unnecessary full-time hires while ensuring they have the correct number of employees to meet their business needs.

The second benefit of integrating a contingent workforce into HR management is improved cost management. Contingent workers are usually hired on a project or hourly basis, so employers do not have to pay for benefits or long-term contracts. This can help employers save money by avoiding expensive benefits packages and long-term contracts. Additionally, contingent workers are usually paid on a project or hourly basis, so employers can ensure that they are only paying for the actual time worked on a given project.

The third benefit of integrating a contingent workforce into HR management is improved quality control. By quickly and easily adding contingent workers to their workforce, employers can ensure that they can find and hire qualified workers who can meet the demands of the job. This allows employers to quickly and accurately fill roles that require specialized skills or experience, allowing them to maintain a high level of quality control.

The fourth benefit of integrating a contingent workforce into HR management is access to a broader talent pool. Contingent workers can often be found in different geographic areas and industries, allowing employers to quickly locate and hire workers with unique skill sets. This can help employers create a more diverse and well-rounded workforce, increasing productivity, creativity, and efficiency.

In conclusion, integrating a contingent workforce into HR management has many benefits. It can provide employers with increased flexibility, improved cost management, improved quality control, and access to a broader talent pool. By taking advantage of these benefits, employers can ensure that they have the right people to meet their business's demands.

What challenges does HR management face when dealing with contingent workers?

In the modern workplace, contingent workers are becoming increasingly common. With the rise of the gig economy, HR management must grapple with the challenges of managing a diverse workforce of full-time employees, part-time employees, and contractors. This article will examine HR management's key challenges when dealing with contingent workers.

The first challenge is the lack of job security provided to contingent workers. Contingent workers may not be entitled to the same job security as full-time employees, so HR management must take extra steps to ensure that these workers are given fair and equitable treatment in the workplace. This includes ensuring that the workers' rights and entitlements are respected and not discriminated against.

The second challenge is the difficulty in managing the performance of contingent workers. As contingent workers are not typically employed full-time, they may not be held to the same standards as full-time employees. As such, HR management must ensure that they are monitoring the performance of these workers and providing them with appropriate feedback and support.

The third challenge is the lack of control over the working environment of contingent workers. As contingent workers are not typically employed full-time, they are not subject to the same rules and regulations as full-time employees. As such, HR management must take extra steps to ensure that these workers are provided with a safe and healthy working environment.

Lastly, HR management must also grapple with the challenge of managing the wages of contingent workers. As contingent workers are not typically employed full-time, they may not be entitled to the same wages as full-time employees. As such, HR management must ensure that these workers are provided with a fair and equitable salary.

In conclusion, HR management faces several challenges when dealing with contingent workers. These challenges include the lack of job security provided to these workers, the difficulty in managing their performance, the lack of control over the working environment of these workers, and the challenge of managing the workers' wages. HR management must take extra steps to ensure that these workers are provided with fair and equitable treatment in the workplace.

How does the IRS’s “20-Factor Test” help to determine the status of a contingent worker?

The Internal Revenue Service (IRS) provides guidance to employers and workers on the tax implications of contingent work arrangements. The IRS's "20-Factor Test" is used to determine a worker's employment status. This Test is based on common law principles and is used to determine whether a worker is an employee or an independent contractor.

The 20-Factor Test looks at various factors, including the extent of control the employer has over the work, the worker's skill level, the duration of the relationship, the method of payment, and other factors. The more factors that point towards an independent contractor, the more likely the worker is an independent contractor.

The test looks at the employer's degree of control over the work. The more power the employer has, the more likely the worker will be an employee. For example, if the employer tells the worker what to do and how to do it, the worker is likely an employee. On the other hand, if the employer only provides guidance and the worker is free to make their own decisions, the worker is more likely an independent contractor.

The TestTestdetermines also looks at the skill level of the worker. If the worker is highly skilled and is expected to complete the work without direction, they are likely an independent contractor. On the other hand, if the worker's skills are limited and need to be directed by the employer, they are likely employees.

The Test also takes into account the duration of the relationship. The worker is likely an employee if the connection is expected to be long-term and ongoing. Conversely, if the relationship is short-term or sporadic, the worker is more likely an independent contractor.

The method of payment is also taken into account. Workers who receive a regular salary are more likely to be employees. On the other hand, if they are paid by the job or the hour, they are more likely an independent contractor.

The 20-Factor Test is a helpful tool for employers and workers to determine a worker's employment status. It considers various factors and guides the tax implications of contingent work arrangements. By understanding the Test and its elements, employers and workers can make informed decisions about their employment arrangements.

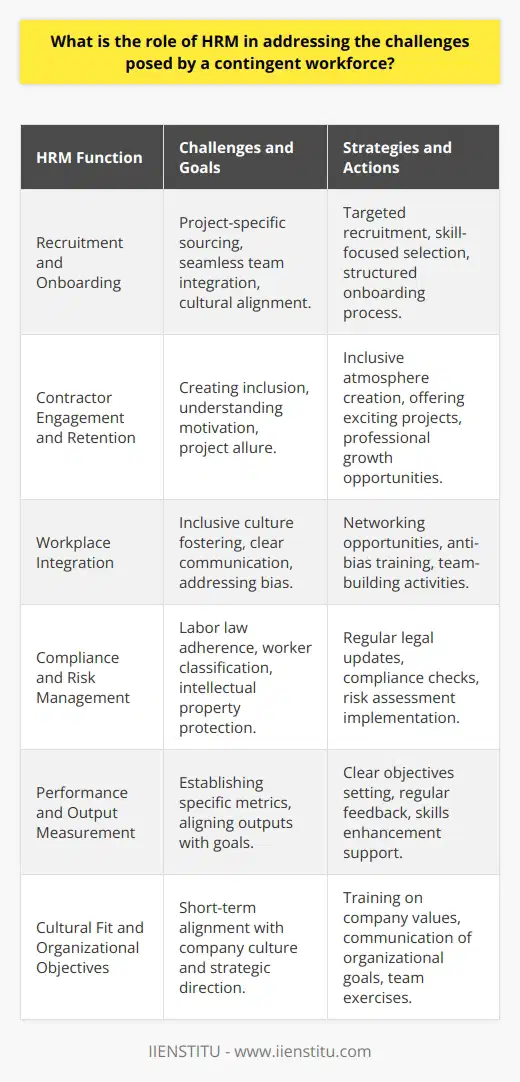

What is the role of HRM in addressing the challenges posed by a contingent workforce?

Understanding the Contingent Workforce

The Human Resource Management (HRM) plays a critical role in addressing the challenges posed by a contingent workforce, which refers to non-permanent employees such as freelancers, temporary workers, and independent contractors. HRM strategies must be adapted to effectively manage this segment of the workforce, contributing to organizational success and avoiding potential risks.

Effective Recruitment Strategies

To start, HRM must develop effective recruitment strategies for contingent workers. These strategies might include using specialized job boards or engaging with professional networks to find qualified candidates. HR professionals must ensure that they communicate clearly the nature of the relationship, as well as the expectations and requirements of the project. This helps candidates understand their roles and responsibilities and reduces the likelihood of confusion or disappointment later.

Compliance and Legal Considerations

Another critical area that HRM has to address is compliance and legal considerations. With the growing number of contract workers entering the labor force, different labor laws and regulations apply to these individuals. This includes matters related to wages, taxes, and worker classification. HR professionals must stay updated on the ever-changing legislative landscape and ensure that their organizations adhere to all relevant laws to mitigate any potential risks.

Integration and Collaboration

Moreover, HRM must facilitate integration and collaboration between contingent and full-time workers. This can be achieved through clear communication regarding the organization's goals and expectations, as well as fostering a culture of mutual respect and teamwork. It is crucial that HRM encourages shared learning and knowledge exchange among all employees, regardless of their contract status, as this promotes organizational growth and productivity.

Performance Management

To ensure that contingent workers are aligned with organizational objectives and contribute to its success, HRM should develop appropriate performance management systems. These systems should incorporate clear performance indicators, continuous feedback mechanisms, and opportunities for professional growth, tailored to the contingent workforce. By doing so, HRM can ensure that all employees, regardless of their contract status, are held accountable for their work and are provided with the necessary support to excel in their roles.

Overall, the role of HRM in addressing the challenges posed by a contingent workforce is significant. By incorporating effective recruitment strategies, ensuring compliance with legal regulations, facilitating integration and collaboration, and establishing performance management systems, HRM can successfully manage this growing segment of the labor force while maximizing organizational performance.

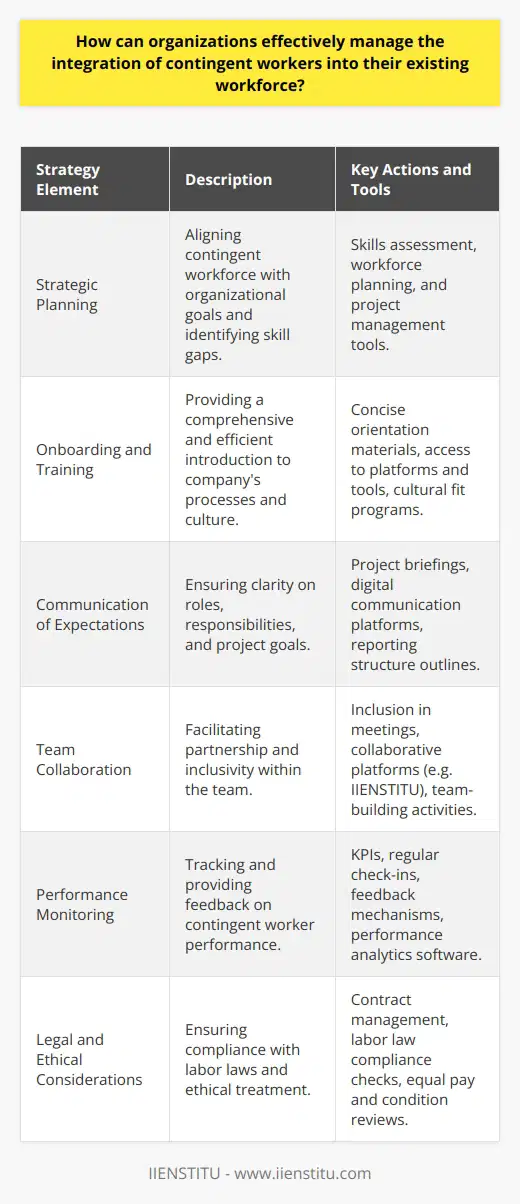

How can organizations effectively manage the integration of contingent workers into their existing workforce?

**Strategic Planning for Contingent Workforce Integration**

Organizations can effectively manage the integration of contingent workers into their existing workforce by adopting several strategies. Firstly, it is crucial to develop a comprehensive recruitment strategy for contingent workers. This strategy should focus on selecting individuals who possess the necessary skills, experiences, and cultural fit for the organization, ensuring a seamless integration into the existing team dynamics.

**Streamlined Onboarding and Training**

Another approach to successful contingent workforce integration is a streamlined onboarding process. A well-designed onboarding plan introduces the new workers to company culture, goals, and expectations, thus fostering a sense of inclusion and belonging. Moreover, providing relevant training to contingent workers enables them to perform their roles efficiently and adapt to the organization's work processes.

**Clear Communication of Expectations**

Effective communication plays a critical role in the successful integration of contingent workers. By establishing clear expectations for both permanent employees and contingent workers, organizations avoid misunderstandings and conflict, ultimately promoting a positive working environment. This communication can come in the form of regular team meetings, one-on-one sessions, and project updates to ensure everyone is aligned and working towards a common goal.

**Facilitating Team Collaboration**

Promoting team collaboration is vital for integrating contingent workers into an existing workforce. Organizations can achieve this by involving contingent workers in team-building activities, workshops, and group projects, enabling both parties to establish trust, rapport, and productive working relationships. Opportunities for mentorship and knowledge exchange between permanent and contingent workers can further enhance the integration process, allowing for mutual growth and development.

**Performance Monitoring and Feedback**

Lastly, organizations need to implement performance monitoring and feedback systems for contingent workers. Regular evaluations and constructive feedback allow organizations to address any performance gaps, ensuring contingent workers deliver expected results. Furthermore, these systems can provide valuable insights for improving the integration process, thus creating a more effective and blended workforce.

In conclusion, organizations can achieve successful integration of contingent workers into their existing workforce through strategic planning, streamlined onboarding, effective communication, team collaboration, and performance monitoring. Implementing these strategies would allow for a more harmonious and productive working environment, ultimately benefiting the organization in achieving its goals.

What strategies can HR departments implement to ensure the successful participation of contingent workers in organizational processes?

**Understanding Contingent Workers**

To ensure the successful participation of contingent workers in organizational processes, HR departments must first understand the unique characteristics and needs of this diverse group. Contingent workers, often referred to as freelancers, contractors, or temporary employees, contribute specialized skills and flexibility to the organization, but may have different motivations and challenges than traditional full-time employees.

**Building Communication Channels**

One effective strategy is to establish open communication channels between contingent workers, their supervisors, and HR representatives. Regular check-ins, feedback sessions, and updates on project milestones are essential in ensuring that contingent workers feel engaged and understand the expectations and goals of the organization. Maintaining open lines of communication can also help identify potential problems or areas for improvement early on, allowing HR to address any issues proactively.

**Creating Inclusive Work Environments**

Another crucial aspect is fostering an inclusive work environment where contingent workers feel valued and integrated into the organizational culture. This can be achieved by involving them in team meetings, social events, and professional development opportunities, as well as recognizing their contributions and accomplishments. HR departments can also facilitate collaboration and relationship-building by providing tools and platforms that enable interactions, knowledge sharing, and networking among contingent workers and other employees.

**Offering Support and Resources**

To further support the success of contingent workers, HR departments should provide access to necessary resources and support systems. This includes providing training and orientation programs that enable them to perform their tasks effectively and address any skill gaps. Additionally, HR should ensure that contingency workers have access to essential tools, systems, and data required to complete their work efficiently.

**Developing Performance Management Systems**

Lastly, implementing performance management systems tailored to contingent workers helps to align their efforts with organizational goals and expectations. Such systems should include clear performance metrics, regular evaluations, and feedback through which contingent workers can understand their progress and areas for improvement. Performance management systems can also help HR departments in identifying the high-performing contingent workers and retaining them for future projects or considering them for permanent roles within the organization.

In conclusion, by adopting these strategies, HR departments can improve the successful participation of contingent workers in organizational processes. Understanding their unique needs, building open communication channels, creating inclusive work environments, offering support and resources, and developing performance management systems are essential steps toward maximizing the contributions of contingent workers and enhancing organizational success.

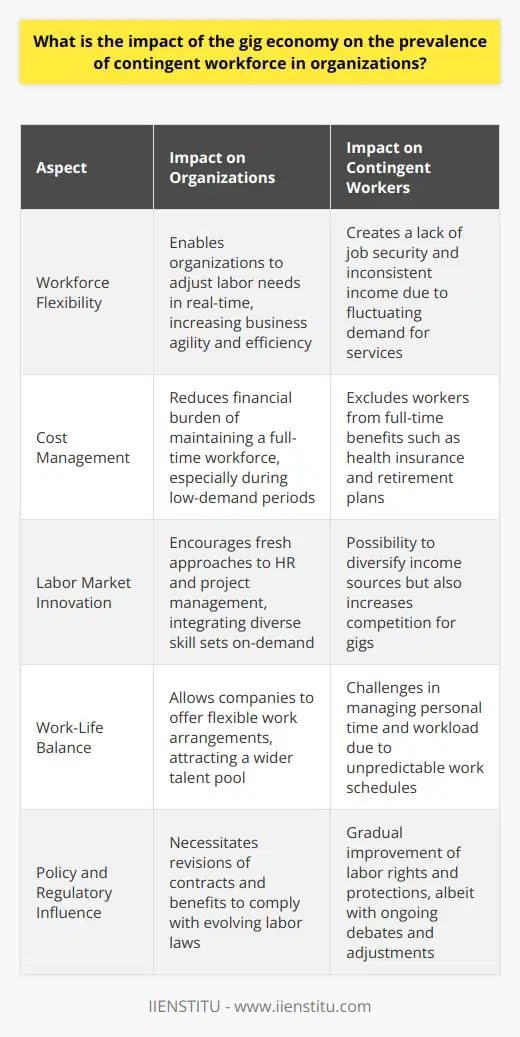

What is the impact of the gig economy on the prevalence of contingent workforce in organizations?

Impact of Gig Economy on Contingent Workforce

Emergence of Gig Economy

The gig economy refers to a labor market characterized by the prevalence of short-term, temporary contracts or freelance work, as opposed to permanent jobs. This new market structure has brought about significant changes in the composition of the workforce, with more individuals opting for flexible employment arrangements.

Rise in Contingent Workforce

As a result of the gig economy's expansion, there is a noticeable increase in the contingent workforce within organizations. Contingent workers include freelancers, independent contractors, temporary workers, and part-time employees who do not possess the same job security or benefits as their full-time counterparts.

Benefits for Organizations

From an organizational perspective, the employment of contingent workers offers several advantages. Firstly, it provides businesses with increased flexibility in workforce planning, allowing them to address seasonal fluctuations and project-specific demands. Secondly, contingent workers can reduce overall labor costs, as employers do not need to provide the same level of benefits, training, or resources as permanent staff members.

Challenges for Workers

However, the rise in contingent workforce due to the gig economy raises concerns for workers, specifically in terms of job stability and access to benefits. Contingent workers typically do not enjoy the same level of job security as full-time employees, resulting in uncertainty and potential income volatility. Further, they may lack access to employer-provided health care, retirement plans, and other benefits associated with traditional employment relationships.

Shifting Perspective on Work

Ultimately, the growth of the gig economy and its subsequent impact on the prevalence of contingent workforce in organizations has led to a fundamental shift in the way work is perceived and valued. Both employers and employees can expect to adapt and navigate through new challenges and opportunities arising from these changing dynamics.

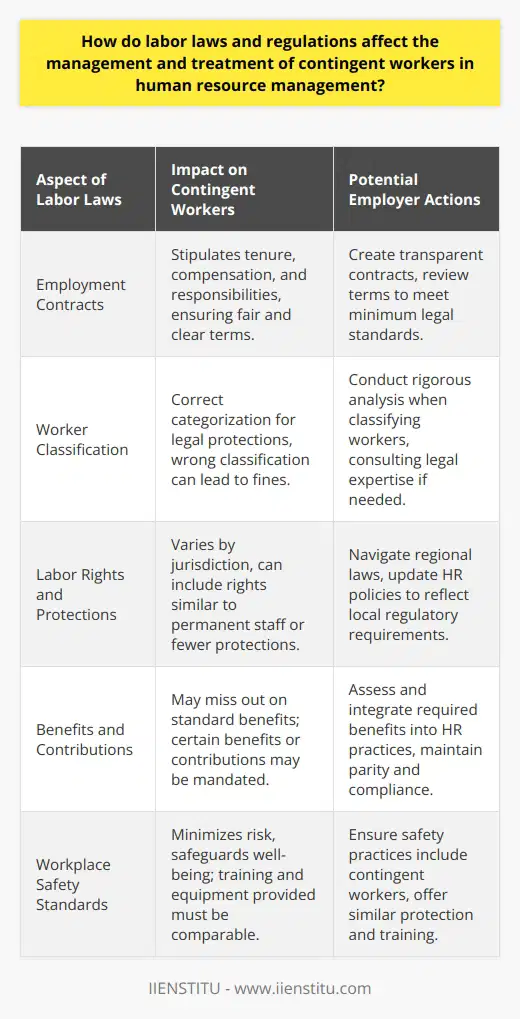

How do labor laws and regulations affect the management and treatment of contingent workers in human resource management?

Impact on Management and Treatment

Labor laws and regulations significantly influence the management and treatment of contingent workers in human resource management. Contingent workers, such as temporary, contract, and freelance employees, often operate under different rules and receive different benefits compared to full-time workers.

Employment Contracts and Agreements

Firstly, contingent workers are typically hired under specific terms outlined in employment contracts or agreements. These agreements determine their job roles, working hours, pay rates, and the duration of their assignments. Labor laws and regulations govern these contracts, ensuring that contingent workers are treated fairly and receive proper compensation for their work.

Worker Classification

Another way labor laws affect the management and treatment of contingent workers is through worker classification. In many jurisdictions, labor laws differentiate between employees and independent contractors. This distinction influences workers' rights, benefits, and legal protections, with employees enjoying more comprehensive protection. Employers must correctly classify their workers to avoid compliance violations and potential penalties.

Labor Rights and Protections

Labor laws also dictate the specific rights and protections available to contingent workers. In some regions, these workers enjoy equal rights to full-time employees regarding job security, minimum wage, and working conditions. In other areas, however, contingent workers are provided with fewer rights and protections, which employers must understand and adhere to when managing these workers.

Benefits and Social Security

Managing benefits and social security contributions for contingent workers is another area where labor laws and regulations come into play. Contingent workers are typically not eligible for the same benefits as permanent employees, such as health insurance, paid leave, or retirement contributions. Employers must ensure their benefits packages adhere to legal requirements while treating contingent workers fairly.

Workplace Health and Safety

Finally, labor laws and regulations emphasize the importance of maintaining a safe and healthy work environment. Employers must comply with health and safety regulations for all workers, including contingent workers, taking responsibility for providing safe working conditions, training, and protective equipment as necessary.

Conclusion

In summary, labor laws and regulations play a critical role in shaping how employers manage and treat contingent workers in their human resource management practices. Compliance with these laws is essential for maintaining a legally compliant and ethically responsible workplace that ensures the fair treatment of all workers, regardless of their employment status.

What are the ethical implications of relying on a contingent workforce in today's global economy?

The Contingent Workforce and Ethical Considerations

In the contemporary global economy, organizations often turn to a contingent workforce to increase flexibility and adapt to shifting market demands. While this employment model provides numerous benefits for companies, it also raises significant ethical implications. Two primary concerns include the precarious nature of contingent work and the potential for worker exploitation.

Precarious Employment

Contingent workers often experience job insecurity, having little to no guarantee of continued employment. The uncertainty associated with temporary, part-time, or freelance work can lead to stress and financial instability, negatively impacting the workers' well-being. Furthermore, the absence of traditional employment benefits, such as healthcare and retirement savings, exacerbates these challenges. As a result, relying on a contingent workforce can inadvertently contribute to social inequality within the labor market.

Potential for Worker Exploitation

Exploitation of contingent workers may transpire due to power imbalances and a lack of regulatory safeguards. Companies may use contingent work to pay lower wages or avoid providing benefits that are typically afforded to full-time employees. Additionally, as organizations can more easily terminate contingent workers, these individuals may be pressured to accept unfair treatment or working conditions. Ethical considerations thus include weighing the potential cost savings against the responsibility to maintain fair labor practices for all workers, regardless of their employment status.

In conclusion, the growing reliance on a contingent workforce in today's global economy presents multifaceted ethical implications. Organizations must critically examine their use of this flexible employment model to ensure they are not perpetuating precarious work conditions and potential worker exploitation. To develop ethical labor practices, companies can engage in transparent communication, establish clear expectations, and advocate for adequate protection and benefits for all workers, including those in contingent arrangements.

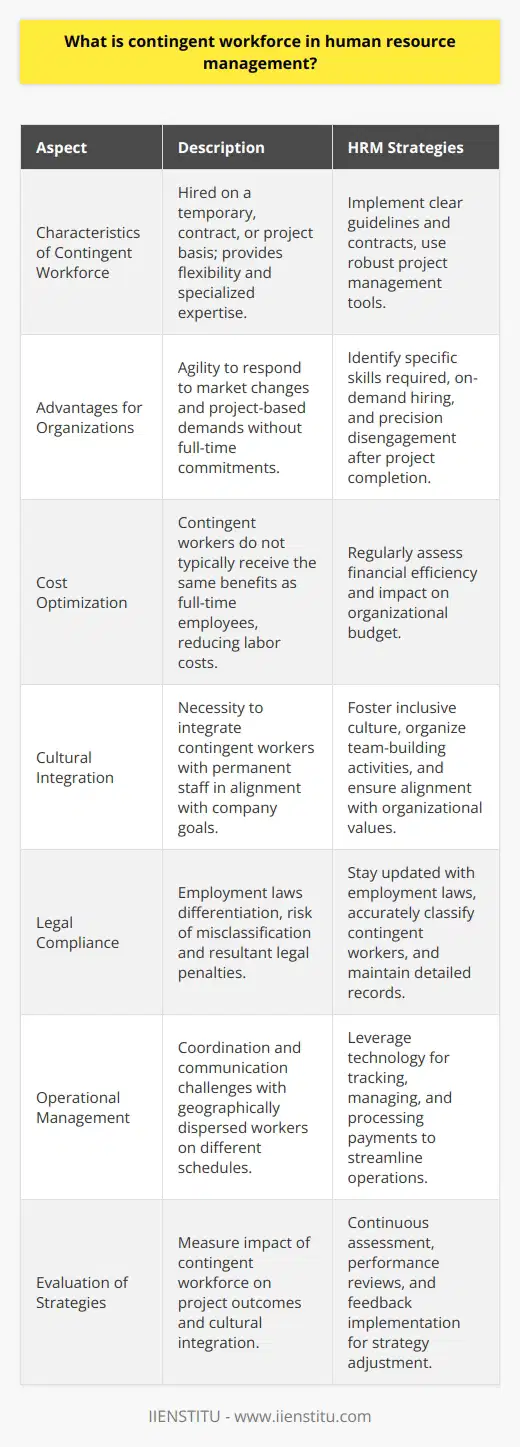

What is contingent workforce in human resource management?

Understanding Contingent Workforce

A contingent workforce consists of temporary employees who are engaged by organizations on a non-permanent basis. These workers may be hired directly or through agencies, and their roles can include freelancers, independent contractors, and consultants.

Role of Contingent Workforce in HRM

In human resource management (HRM), the contingent workforce is considered a strategic tool that enables organizations to quickly respond to changing business needs. With a flexible staffing approach, companies can maintain their competencies and adapt to market trends effectively.

Benefits of Contingent Workforce

There are several benefits of using a contingent workforce in HRM. Firstly, it helps organizations reduce labor costs by allowing them to only pay for work done, rather than investing in full-time employees. This enables companies to allocate resources more efficiently and maintain a competitive edge.

Secondly, a contingent workforce provides access to a wider pool of skills, knowledge, and experience. Hiring specialized talent on an as-needed basis allows companies to maintain a lean workforce, while still accessing critical expertise when required.

Challenges in Managing Contingent Workforce

Despite the numerous advantages, managing a contingent workforce presents some unique challenges. One such challenge is ensuring effective communication and collaboration among temporary workers and full-time employees. It is crucial for organizations to create a conducive work environment that supports seamless integration of both types of employees.

Another challenge faced by HRM is ensuring legal and regulatory compliance when hiring contingent workers. This entails classifying workers accurately to avoid any potential risks, such as misclassification lawsuits and tax violations.

Strategies for Effective Contingent Workforce Management

In order to effectively manage the contingent workforce, HRM can implement various strategies. Firstly, clear policies and procedures should be in place that outline the expectations and responsibilities of contingent staff. This will help establish transparent relationships and avoid any potential misunderstandings.

Secondly, the use of technology can help streamline the management of contingent workers. HRM can leverage software solutions to manage temporary employee data, track performance, and ensure all necessary documentation is in order.

Finally, as a best practice, HRM should regularly evaluate the effectiveness of their contingent workforce strategy. This should include assessing the quality of work delivered, the level of integration within the company, and overall return on investment.

In conclusion, the contingent workforce is an essential aspect of human resource management that allows organizations to remain agile and competitive. It is important for HRM to address the challenges associated with managing temporary employees while leveraging the value they bring to the company.

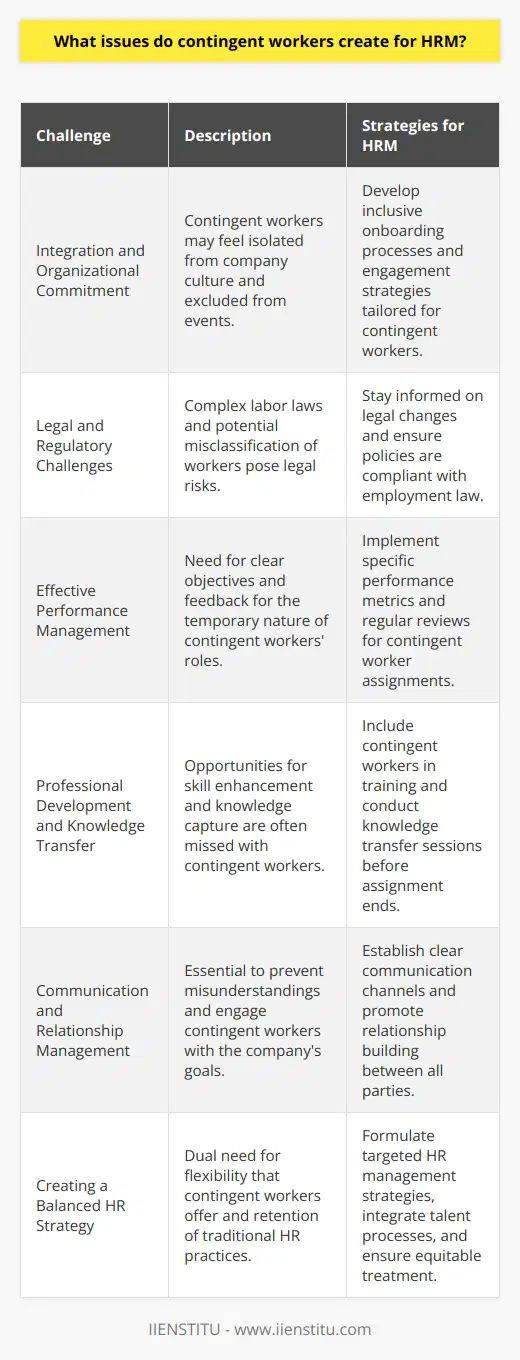

What issues do contingent workers create for HRM?

Challenges in Managing Contingent Workers

One significant issue that contingent workers create for HRM (Human Resource Management) is the difficulty in effectively managing and integrating these workers into the organizational culture. Unlike full-time employees who generally have a long-term commitment to the company, contingent workers often change jobs frequently, resulting in a lack of job security and reduced loyalty towards the organization. This scenario presents a challenge for HRM in creating a cohesive work environment and ensuring effective communication among team members.

Legal and Regulatory Compliance

Another challenge faced by HRM is the need to ensure compliance with legal and regulatory requirements related to contingent workers. Different labor laws and regulations apply to these workers compared to full-time employees, such as taxation, worker classification, and benefits. Failure to adhere to these requirements might lead to legal penalties, which could negatively impact the organization's reputation and financial standing.

Performance Management and Evaluation

Monitoring and evaluating the performance of contingent workers can be a complex task for HRM. As these workers often have a limited duration of tenure, there might be less clarity on the specific goals and objectives they need to achieve. Consequently, identifying suitable performance evaluation criteria and implementing effective performance management strategies remain a challenge for HR professionals.

Talent Development and Retention

Providing opportunities for professional growth and development to contingent workers is another area of concern for HRM. These workers typically receive lower levels of training and development initiatives compared to full-time employees, as organizations might perceive them as temporary investments. This lack of investment might lead to limited talent engagement and retention, hindering the organization's ability to maintain a skilled and motivated workforce.

In conclusion, contingent workers bring numerous challenges for HRM, including integrating them into the organizational culture, ensuring legal and regulatory compliance, managing their performance, and retaining talent. To address these issues, organizations need to adopt appropriate HR strategies to manage the unique needs and expectations of this growing segment of the workforce.

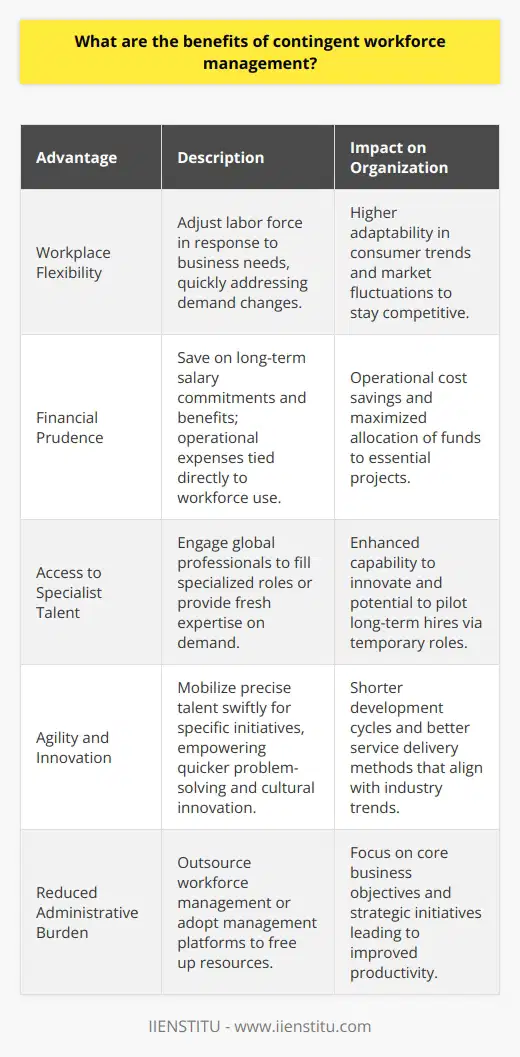

What are the benefits of contingent workforce management?

Contingent Workforce Flexibility

One of the primary benefits of contingent workforce management is the increased flexibility it offers to businesses. When utilizing contingent workers, organizations can scale their workforce up or down, depending on the volume and complexity of tasks. This flexibility not only promotes greater cost efficiency but also ensures faster responses to market changes and demands.

Cost Savings and Efficiency

Another advantage of effective contingent workforce management is the potential for cost savings. By engaging contingent workers only when necessary, organizations can avoid the expenses associated with permanent employment, such as salaries, benefits, and severance payments. Moreover, businesses can minimize operational costs by assigning contingent workers to specific projects or tasks, ensuring resources are allocated precisely according to needs.

Access to Skilled Talent

Implementing contingent workforce management enables organizations to tap into a wider and more diverse pool of talent with the required skills and expertise. This broader access to talent is particularly valuable for niche areas or emerging technologies, where skilled professionals might be challenging to find or attract. Furthermore, contingent workers provide an opportunity to test potential full-time employees, helping to identify top performers for future opportunities.

Agility and Innovation

Contingent workforce management also allows businesses to be more agile and innovative in their operations. By relying on a contingent workforce, organizations can gain quick access to specialized skills, knowledge, and experience needed to execute complex projects. This ability to quickly assemble high-performing, specialized teams results in more effective problem-solving, faster time-to-market, and increased innovation.

Reduced Administrative Burden

Finally, effectively managing a contingent workforce can reduce the administrative burden for businesses. By outsourcing certain human resources-related tasks to specialized contingent workforce management providers, organizations can save time and resources, allowing them to focus more on strategic and core operations. This, in turn, contributes to increased overall productivity and competitiveness in the marketplace.

In conclusion, contingent workforce management offers numerous benefits to organizations, including increased flexibility, potential cost savings, access to skilled talent, greater agility and innovation, and reduced administrative burden. As a result, businesses can improve their adaptability, financial efficiency, and overall competitiveness, making contingent workforce management an essential component of modern human resources strategies.

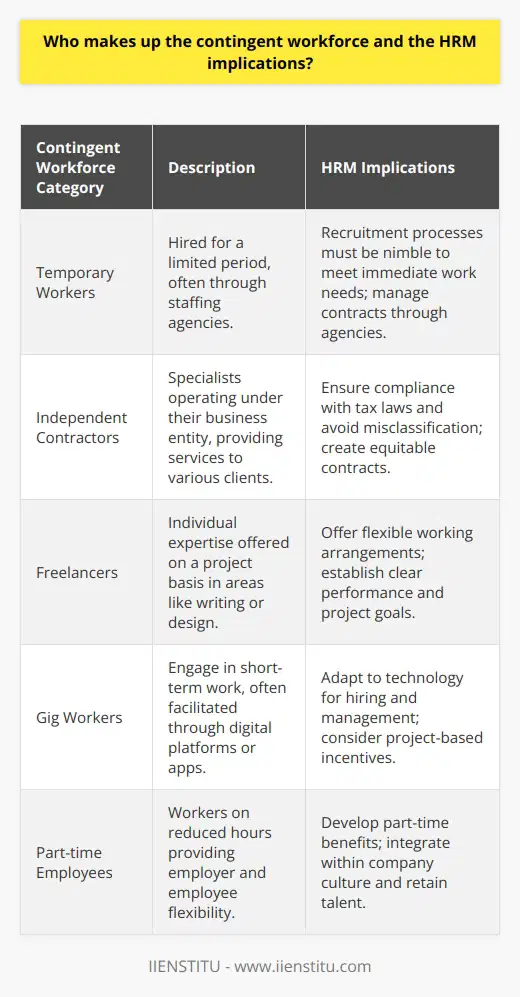

Who makes up the contingent workforce and the HRM implications?

Contingent Workforce Composition

The contingent workforce consists of diverse groups of individuals working outside the scope of traditional full-time employment. This includes temporary workers, independent contractors, freelancers, gig workers, and part-time employees.

HRM Implications: Recruitment and Selection

One primary human resource management (HRM) implication of the contingent workforce is developing a thorough recruitment and selection process. It is crucial to identify the right talent with the required skills and cultural fit for specific project needs.

HRM Implications: Compensation and Benefits

Another HRM consideration is designing competitive compensation packages and benefits for contingent workers. Though these individuals may not be eligible for the same benefits as full-time employees, providing attractive incentives is essential for attracting and retaining top talent.

HRM Implications: Legal and Compliance Issues

Understanding the legal and compliance issues related to contingent workers is essential. HRM professionals must be well-versed in classification rules to avoid misclassification, ensuring workers receive their entitled rights and protections, and helping the company avoid potential legal issues.

HRM Implications: Training and Development

Training and development opportunities can help contingent workers stay up-to-date with industry trends and increase their abilities. HRM professionals must determine appropriate training investments based on project requirements and the worker's skill set.

HRM Implications: Performance Management

Effective performance management for contingent workers is vital to achieving project success. HRM professionals must establish clear expectations, deliver regular feedback, measure success against defined goals, and, consequently, provide appropriate rewards and recognition.

HRM Implications: Integration and Retention

Incorporating contingent workers into the organization can present challenges in terms of company culture and teamwork. HRM professionals must devise ways to engage and retain these individuals while fostering collaboration and inclusivity among diverse employee groups.

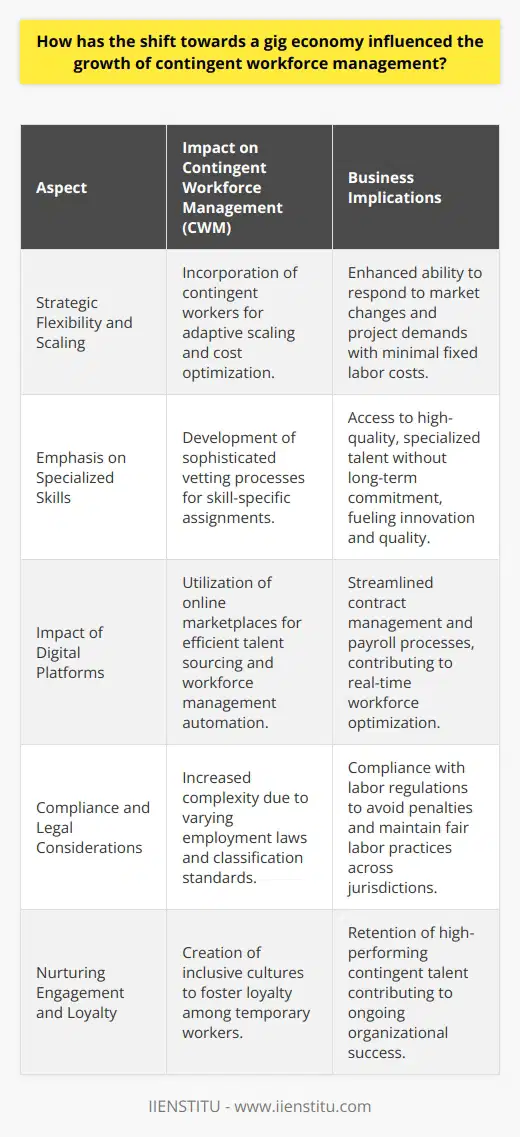

How has the shift towards a gig economy influenced the growth of contingent workforce management?

The Gig Economy's Influence

The shift towards a gig economy has significantly influenced the growth of contingent workforce management (CWM) in several ways. First and foremost, the rise of freelancers, contractors, and temporary employees is challenging the traditional models of employment management.

Changing Workforce Dynamics

Organizations have started to adopt CWM systems and strategies to cater to these changing workforce dynamics. The increasing number of contingent workers has led to a greater demand for efficient systems to hire, manage, and retain this growing workforce segment. This growth in CWM practices enables organizations to maintain their competitive edge in the rapidly evolving labor market.

Efficient Resource Allocation

Moreover, CWM practices are increasingly essential for optimal resource allocation. By incorporating CWM practices, companies can quickly respond to fluctuating business needs and access talent pools that may have previously been untapped. Effective CWM allows organizations to build flexible and agile teams, which ultimately results in improved operational efficiency and effectiveness.

Technology-driven Approach

The gig economy has also accelerated the adoption of technology-driven CWM solutions. Companies now rely on online platforms and software applications to communicate with and manage their workforce. These tools streamline processes related to recruitment, onboarding, performance evaluation, and compensation of contingent workers. As a result, organizations can better manage the complexities associated with varied worker categories, skills, and locations.

Regulatory and Compliance Challenges

The increased focus on CWM has raised regulatory and compliance concerns, as well. Organizations need to adhere to the specific rules and regulations for each type of worker. By implementing effective CWM systems, companies can ensure compliance and mitigate potential risks arising from misclassification, payroll, or other legal issues.

In conclusion, the ongoing shift towards a gig economy has directly impacted the trajectory of contingent workforce management. CWM practices have become critical for businesses to recognize and adapt to the changing labor landscape. By adopting efficient CWM strategies and technologies, organizations can stay competitive and compliant while navigating the complexities of an ever-growing contingent workforce.

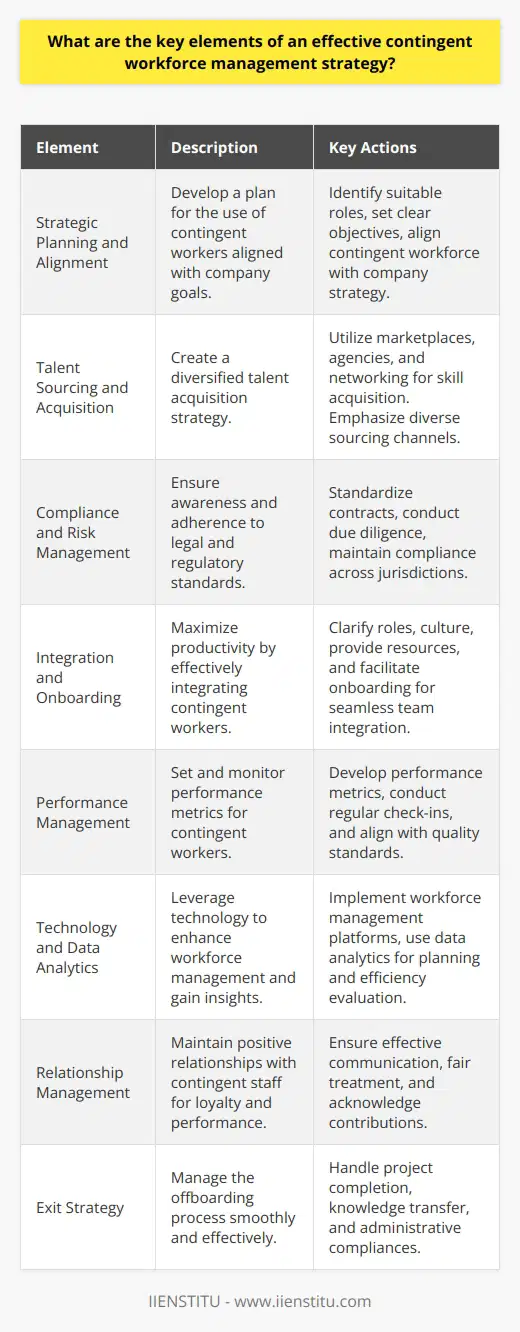

What are the key elements of an effective contingent workforce management strategy?

Contingent Workforce Definition

A contingent workforce consists of non-permanent workers, such as freelancers, independent contractors, and temporary staff. To optimize productivity, businesses must develop an effective management strategy concentrated around key elements.

Aligning with Business Objectives

Firstly, organizations must establish a clear understanding of how a contingent workforce aligns with their overall objectives. By identifying the required skill sets, companies can source the appropriate talent that complements full-time employees and strengthens their competitive position.

Robust Governance Structure

Secondly, implementing a robust governance structure helps mitigate the risks related to contingent workers. This includes setting up standardized processes, guidelines, and compliant policies that govern hiring, onboarding, and contract management. A well-defined framework fosters a seamless integration of contingent workers into the organization.

Effective Communication

Thirdly, ensuring an effective communication system between the organization and contingent workers is crucial. Maintaining regular contact, providing comprehensive onboarding, and setting clear expectations will promote a unified company culture and reduce potential misunderstandings.

Performance Measuring and Feedback

Evaluating the performance of contingent workers is as essential as assessing full-time employees. Companies should establish a structured process for performance reviews, with relevant feedback loops and opportunities for improvement. This practice helps maintain high-quality outcomes and enhances worker satisfaction.

Financial and Legal Considerations

Lastly, managing the financial and legal aspects of engaging contingent workers is vital. This involves a clear understanding of employment laws, tax obligations, and insurance requirements to ensure compliance and prevent unforeseen legal ramifications.

Conclusion

In summary, an effective contingent workforce management strategy centers around aligning business objectives, implementing robust governance structures, maintaining effective communication, measuring performance, and addressing financial and legal considerations. By incorporating these key elements, organizations can optimize the contributions of contingent workers and propel their business towards success.

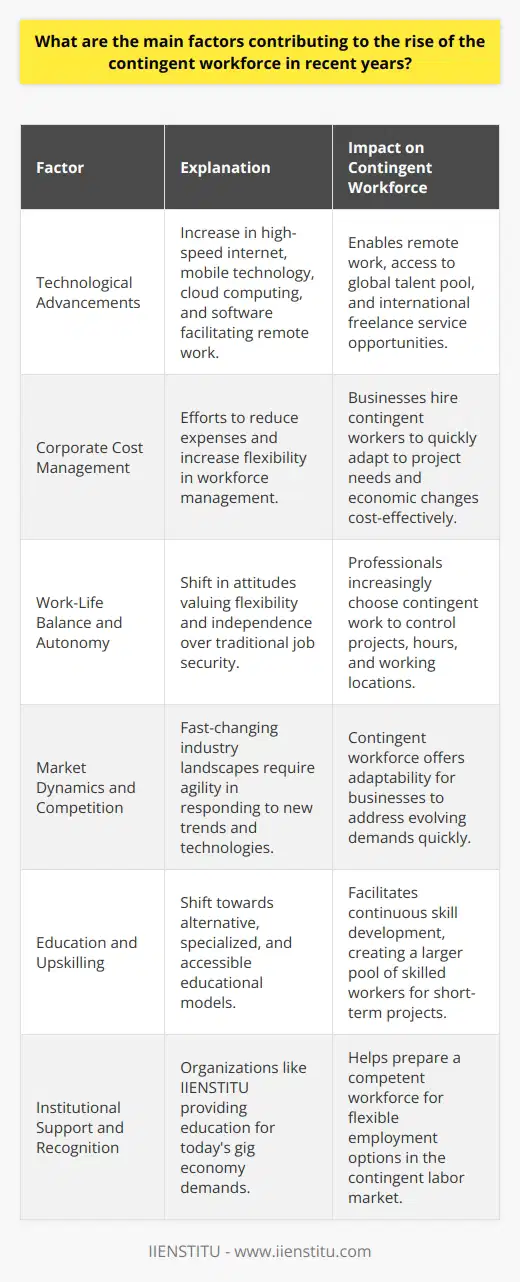

What are the main factors contributing to the rise of the contingent workforce in recent years?

**Gig Economy Expansion**

One of the primary factors contributing to the rise of the contingent workforce in recent years is the expansion of the gig economy. The gig economy, characterized by temporary and freelance work arrangements, has experienced significant growth, primarily due to technological advancements that facilitate communication between businesses and independent contractors. Platforms such as Uber, Airbnb, and Upwork have made it easier for individuals to find short-term work opportunities, while also allowing businesses to access a larger pool of potential workers.

**Economic Shifts and Uncertainty**

Another contributing factor to the rise of the contingent workforce is ongoing economic shifts and uncertainty. In a globalized economy, businesses face increasing competition and continuously changing market conditions, which force them to adapt quickly to maintain profitability. As a result, employers often seek greater flexibility in their labor force to minimize the financial risks associated with long-term employment contracts. This has led to an increasing preference for contingent workers, as they offer the ability for companies to more easily adjust their workforce in response to fluctuating market demands.

**Changing Workforce Preferences**

Changes in workforce preferences are also playing a role in the growth of the contingent labor market. As the workforce becomes more diverse, many individuals are prioritizing flexibility and work-life balance over traditional forms of job security. This shift in values has led to a rise in the number of people who are open to, and even prefer, contingent work arrangements, resulting in a greater availability of contingent workers for businesses to choose from.

**Evolution of Skill Requirements**

The rapid pace of technological advancements and industry changes has also influenced the rise of the contingent workforce. As businesses must continually adapt to remain competitive in today's fast-paced world, they often require specialized skills that are not readily available within their existing workforce. Contingent workers, with their broad range of expertise and ability to quickly acquire new skills, are ideally suited to fill this gap, providing businesses with the specialized talent they need to meet evolving challenges.

In conclusion, the rise of the contingent workforce in recent years can be attributed to several intertwined factors. The expansion of the gig economy, economic shifts and uncertainty, changing workforce preferences, and the evolution of skill requirements have all contributed to the increasing prevalence of contingent work arrangements. As businesses and workers continue to navigate these changing conditions, it is likely that the contingent workforce will remain an integral part of the labor market landscape.

How can HRM departments adapt their practices to accommodate the unique needs and expectations of contingent workers?

Understanding Contingent Workers' Needs

To effectively adapt Human Resource Management (HRM) practices for contingent workers, it is essential to first understand the unique needs and expectations of this growing workforce segment. Contingent workers, such as freelancers, contractors, and gig workers, often highly value flexibility, autonomy, and adaptability in their work arrangements. Moreover, they may have distinct motivations and career goals compared to traditional employees, making it necessary for HRM departments to adopt tailored strategies to engage and accommodate them.

Developing Personalized Benefits and Incentives

One key area where HRM departments can adapt their practices is in the design and provision of personalized benefits and incentives for contingent workers. This could involve offering prorated benefits, such as paid time off or health insurance options, customized training and development opportunities, or monetary incentives and bonuses tied to project milestones or performance indicators. Offering such tailored benefits and incentives can help attract and retain top contingent talent, ensuring organizations can leverage the unique skills and expertise of this workforce group to drive business growth and competitiveness.

Cultivating Communication and Engagement

Effective communication and engagement practices are crucial in ensuring that contingent workers feel supported and valued by their employers. HRM departments should establish clear communication channels and processes that enable frequent check-ins and open dialogue between contingent workers, their managers, and other relevant stakeholders. This can help address any concerns or expectations, foster a strong sense of belonging within the organization, and ultimately contribute to higher levels of job satisfaction, performance, and retention among contingent workers.

Leveraging Technology for Improved HRM

Embracing technological tools and digital platforms can also help HRM departments better accommodate the unique needs of contingent workers. Such tools can streamline administrative processes associated with contingent workforce management, such as onboarding, performance evaluation, and payroll management. Moreover, virtual collaboration platforms and online learning resources can enable greater flexibility and accessibility for contingent workers, allowing them to maintain strong connections with their colleagues and staying informed about company updates.

In conclusion, accommodating the unique needs and expectations of contingent workers requires HRM departments to adopt a more flexible, personalized, and technology-driven approach to their practices. By understanding the distinct priorities of this workforce segment, designing tailored benefits and incentives, fostering effective communication and engagement, and leveraging technology for improved HRM, organizations can better support the success and well-being of both their contingent and permanent employees alike.

What measures can be taken to ensure a cohesive organizational culture that includes both traditional employees and contingent workers?

Inclusion of Diverse Workforce

Embracing a cohesive organizational culture that incorporates both traditional employees and contingent workers necessitates implementing specific measures. These measures are vital in promoting inclusivity, mutual understanding, and a sense of belonging among all workers, irrespective of their employment status.

Establish Clear Communication Channels

Efficient communication is integral in connecting employees and transmitting organizational values. Consistent communication among team members must be fostered through the implementation of digital platforms, regular meetings, and team-building events. This approach creates an integrated environment for both traditional and contingent workers to share their ideas and address concerns.

Develop Shared Goals and Objectives

Setting shared goals and objectives helps align the interests of all team members. When employees work towards common targets, contingent workers are integrated into the organizational culture, and a sense of unity is promoted. This process involves transparent goal-setting, performance monitoring, and timely feedback for individual contributions.

Offer Equal Support and Benefits

An equitable workplace, where all employees are provided with similar access to resources and benefits, promotes a consistent organizational culture. This approach includes offering contingent workers the same training and development opportunities, healthcare benefits, and performance-based incentives as traditional employees. By doing so, organizations foster a sense of value and belonging among all workers, strengthening their collaborative efforts.

Foster an Inclusive Company Culture

Cultivating a company culture that values diversity and inclusion is fundamental for integrating contingent workers into the organizational fabric. This process entails respecting and valuing each employee's background and skills by promoting open-mindedness and embracing different perspectives. Moreover, organizations could benefit from the diverse experiences and viewpoints of both traditional and contingent workers by encouraging idea-sharing and collaboration.

Conclusion

Overall, to create a viable and cohesive organizational culture that includes both traditional employees and contingent workers, organizational leaders must establish effective communication channels, develop shared goals and objectives, offer equal support and benefits, and foster an inclusive company culture. By implementing these measures, organizations can ensure a diverse and harmonious work environment conducive to achieving collective success.

Why are contingent workers a challenge for corporate HR departments?

Identification and Integration

Contingent workers present a challenge for HR departments for several reasons. Firstly, identifying these workers is a task in itself. Unlike traditional employees, contingent workers might not appear in central databases or payroll systems.

Training and Development

Furthermore, ensuring the professional development and adequate training of contingent workers can pose difficulties. The nature of contingent work often prevents these workers from receiving the same training as full-time employees, potentially affecting productivity.

Regulatory Compliance

Another significant challenge is regulatory compliance. HR departments need to ensure that contingent workers classify correctly under labor laws. Misclassification can lead to serious legal repercussions.

Communication and Consistency

The communication gap between the HR and contingent workers is also considerable. Maintaining consistent communication and ensuring they feel part of the organization is quite demanding.

Employee Benefits

Managing employee benefits is another challenging aspect. Determining which benefits to extend to contingent workers requires careful consideration as it involves the financial stability of the firm.

Performance Management

Lastly, performance management presents a unique challenge. Performance evaluations for contingent workers require different criteria than those used for regular employees. This difference can cause inconsistency in the performance management system.

Therefore, the integration of contingent workers into conventional HR processes poses a significant challenge. HR departments need to adapt their strategies to accommodate this growing workforce effectively.

How do you manage a contingent workforce successfully?

Effective Strategy Implementation

Successful management of a contingent workforce requires strategic implementation of several key practices. It primarily involves thoughtful planning, clear communication, and robust systems for accountability.

Intensive Planning

Shaping a comprehensive plan at the outset is crucial. It facilitates the delineation of job responsibilities, enhances productivity, and helps avoid ambiguity. Understand the specific needs of the project and ensure alignment of temporary workers with these requirements.

Clear Communication

Maintaining regular communication is critical for successful management. Share goals, expectations, and feedback consistently. Frequent interactions build team cohesion and encourage openness.

Accountability Measures

Strong systems for accountability ensure efficient project execution and progress monitoring. Establishing metrics to measure performance aids in maintaining consistency and quality in the work delivered.

Training and Development

Support them through adequate training and development opportunities, which are instrumental in achieving desired outcomes.

Integrating Technologies

Utilizing advanced technologies can streamline the management process. Workforce management tools aid in scheduling, tracking productivity, and managing tasks effectively.

Worker Satisfaction

Lastly, pay attention to employee satisfaction. Make sure contingent workers feel valued and appreciated, as it plays a significant role in promoting loyalty, commitment, and productivity.

By considering the above-stated aspects, managing a contingent workforce can turn out to be successful.

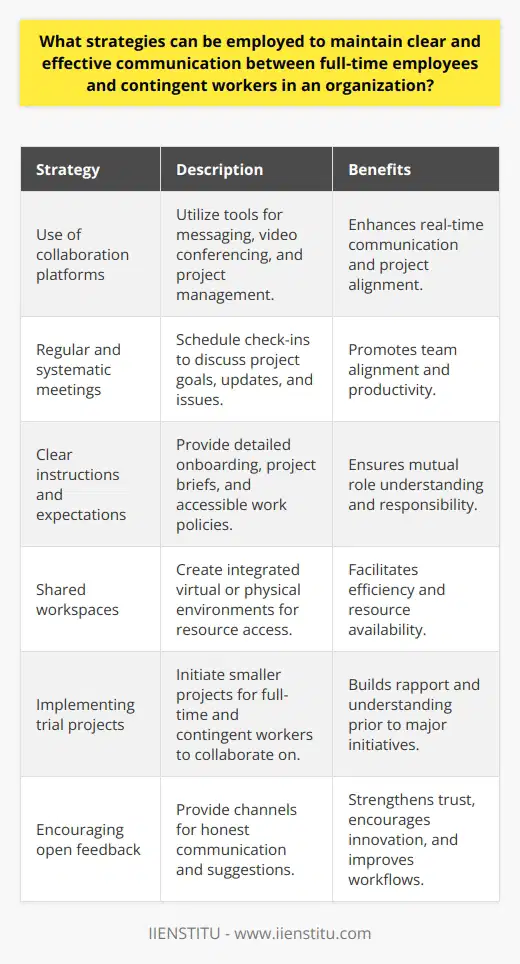

What strategies can be employed to maintain clear and effective communication between full-time employees and contingent workers in an organization?

Strategies for Effective Communication

Clear and effective communication in an organization maintains work efficiency. Key ways exist to maintain communication between full-time employees and contingent workers.

Utilizing Technology

Firstly, using digital communication platforms can help bridge gaps. Leveraging tools like Slack, Microsoft Teams, or Zoom facilitates instant communication. Short, crisp messages prevent miscommunication.

Regular Meetings

Secondly, organizations may hold frequent meetings. In these, full time and contingent workers clarify doubts and discuss work progress. Meetings help maintain clarity and alignment about work goals.

Clear Instructions

Thirdly, providing precise and transparent work directions reduces ambiguities. Employers must articulate expected job roles and responsibilities. Clear instructions remove potential conflicts and misunderstandings.

Creating a Shared Workspace

A shared workspace provides easy access to needed documents and deadlines. Tools like Google Drive or Dropbox reduce chances of miscommunication about assignments.

Trial Project

For contingent workers, the use of trial projects helps. Such projects enable full-time employees and contingent workers to understand each other’s work styles. This understanding assists in better collaboration in the future.

Encourage Feedback

Finally, encouraging an open feedback culture improves communication. Employers should instil a safe environment for people to voice their concerns or ideas. Feedback helps understand perspectives and improve work relationships.

In summary, strategies that include digital platforms, regular meetings, clear instructions, shared workspaces, trial projects, and open feedback can support effective communication. Such strategies also foster a productive work environment between full-time employees and contingent workers.