Embarking on a journey through the intricacies of strategic decision-making, one cannot overlook the pivotal role of cost-benefit analysis (CBA). This methodological approach not only facilitates a structured examination of the potential outcomes of various decisions but also quantifies their overall value. As someone who has frequently navigated the complex waters of business strategy, I can attest to the transformative power of CBA in making informed choices. Through personal experiences and professional applications, I have seen firsthand how CBA can illuminate the path forward, even in the murkiest of situations.

What is Cost-Benefit Analysis (CBA)?

Cost-benefit analysis is essentially a systematic approach to evaluating the financial, social, and economic ramifications of a decision or project. This method involves a thorough comparison of the total expected costs against the total expected benefits to identify the best course of action. Originally developed for business and economics, its application has since broadened to encompass various sectors. I remember the first time I used CBA in a project involving public policy. The clarity it brought to the decision-making process was remarkable, highlighting the principle of maximizing net benefits.

Purpose and Applications of CBA

The primary aim of CBA is to aid in informed decision-making by offering a comprehensive understanding of the implications of different actions. Its utility spans multiple industries—from environmental policy to healthcare. For instance, in healthcare, CBA helps prioritize medical interventions based on their efficacy and cost, ensuring that resources are allocated to the most beneficial treatments. I recall a project where we used CBA to evaluate the introduction of a new technology in a hospital. By meticulously comparing the costs of implementation with the expected improvement in patient outcomes, we were able to make a well-informed recommendation that ultimately led to better care and cost savings.

The Process of Conducting Cost-Benefit Analysis

Identifying Costs and Benefits

The initial step in CBA involves identifying and listing all relevant costs and benefits associated with the decision. Costs might include initial investments, ongoing expenses, and potential negative side effects, while benefits could range from direct revenue to intangible gains like improved customer satisfaction. I once worked on launching an online educational platform where we had to carefully consider the technological investments against the expected revenue and the intangible benefits of offering flexible learning options. This process required a deep dive into various cost elements, such as development costs and ongoing maintenance, juxtaposed with benefits like increased student enrollment and enhanced learning experiences.

Quantifying and Calculating Costs and Benefits

After identifying the costs and benefits, the next crucial phase is quantifying them. This often involves assigning monetary values to both tangible and intangible elements. One of the challenges I faced during a project on environmental sustainability was quantifying benefits like improved air quality and public health. To tackle this, we employed discount rates and sensitivity analysis, which allowed us to make more accurate and reliable evaluations. This process can be complex, requiring not only financial acumen but also a nuanced understanding of the broader impacts.

Compiling Data and Making Comparisons

With all components quantified, the data compilation and comparative analysis follow. This step typically involves creating a cost-benefit ratio or using a net present value calculation to evaluate the viability of different options. I remember a particularly challenging project comparing the costs and benefits of various renewable energy sources. By compiling and contrasting data, we could discern which option provided the greatest net benefit, ultimately guiding us toward the most sustainable and cost-effective energy solution.

Interpretation and Decision-Making

The final analysis should lead to a clear interpretation of the data, enabling informed decision-making. The outcome of a CBA should provide straightforward insights into which options will yield the most beneficial results. In a university project, for instance, we evaluated the potential benefits of hosting online certificate programs. The CBA revealed that the potential revenue and increased student engagement significantly outweighed the development costs, leading to a successful implementation of the program.

Advantages and Disadvantages of Cost-Benefit Analysis

Benefits of Using CBA

The advantages of employing CBA are numerous. It imposes a disciplined framework for assessing the feasibility and cost-effectiveness of projects, promoting transparency and accountability. Additionally, a robust CBA can serve as a persuasive tool when justifying decisions to stakeholders or seeking funding. I have often used CBA to build compelling cases for new initiatives, showcasing how the expected benefits justify the costs involved. This approach not only strengthens the decision-making process but also enhances stakeholder confidence.

Limitations of CBA

Despite its usefulness, CBA is not without limitations. One significant challenge is the difficulty in quantifying intangible costs and benefits, which can lead to an under-representation of the broader impacts. Additionally, the reliability of a CBA depends heavily on the quality and completeness of the data used. I have encountered situations where incomplete data or inaccurate predictions led to suboptimal decisions. Therefore, it's crucial to approach CBA with a critical eye and ensure that all relevant factors are thoroughly considered.

Practical Applications of Cost-Benefit Analysis

CBA in Environmental Policy

One of the most impactful applications of CBA is in environmental policy. By evaluating the costs and benefits of different environmental initiatives, policymakers can make informed decisions that balance economic growth with sustainability. For example, in a project assessing the feasibility of a new recycling program, we used CBA to compare the implementation costs with the expected environmental benefits and long-term savings. This analysis helped us advocate for policies that not only protected the environment but also offered economic advantages.

CBA in Healthcare

In healthcare, CBA is instrumental in prioritizing medical interventions. By comparing the costs of treatments with their expected outcomes, healthcare providers can allocate resources more effectively. I was involved in a project where we evaluated the introduction of a new diagnostic tool. The CBA revealed that, despite the high initial cost, the long-term benefits in terms of improved patient outcomes and reduced treatment costs justified the investment. This analysis was pivotal in securing funding and support for the project.

CBA in Business Strategy

Businesses frequently use CBA to evaluate new ventures and investments. By systematically comparing the costs and benefits, companies can make more informed decisions that enhance profitability and growth. I remember working with a startup that was considering expanding into a new market. Through a detailed CBA, we assessed the potential revenue against the costs of market entry, including marketing, distribution, and regulatory compliance. This analysis provided a clear picture of the risks and rewards, helping the startup make a strategic decision that aligned with its long-term goals.

Real-World Examples and Case Studies

Example 1: Infrastructure Development

In a project involving infrastructure development, we conducted a CBA to evaluate the feasibility of constructing a new highway. By comparing the construction and maintenance costs with the expected benefits of reduced travel time, improved safety, and economic growth, we were able to make a compelling case for the project. The analysis highlighted the long-term benefits, such as increased property values and enhanced regional connectivity, which outweighed the initial investment.

Example 2: Educational Initiatives

In the education sector, CBA can guide the allocation of resources to maximize student outcomes. I worked on a project evaluating the introduction of a new curriculum in a school district. The CBA compared the costs of curriculum development and teacher training with the expected benefits of improved student performance and higher graduation rates. The analysis demonstrated that the investment in the new curriculum would yield significant long-term benefits, leading to its successful implementation.

Conclusion

Cost-benefit analysis is an indispensable tool in strategic decision-making. By providing a structured means of evaluating the financial and broader impacts of potential actions, CBA guides stakeholders toward choices that yield the greatest net benefits. While it is essential to be mindful of its limitations, the practice of CBA can decisively enhance the quality of decision-making across various fields. From environmental policy to healthcare and business strategy, CBA offers a transformative approach to achieving strategic goals. For those willing to embrace the discipline of structured analysis and critical thinking, CBA can be a powerful element in navigating the complexities of modern decision-making.

References

Boardman, A. E., Greenberg, D. H., Vining, A. R., & Weimer, D. L. (2017). Cost-Benefit Analysis: Concepts and Practice. Cambridge University Press.

Hanley, N., & Barbier, E. B. (2009). Pricing Nature: Cost-Benefit Analysis and Environmental Policy. Edward Elgar Publishing.

Mishan, E. J., & Quah, E. (2007). Cost-Benefit Analysis. Routledge.

Frequently Asked Questions

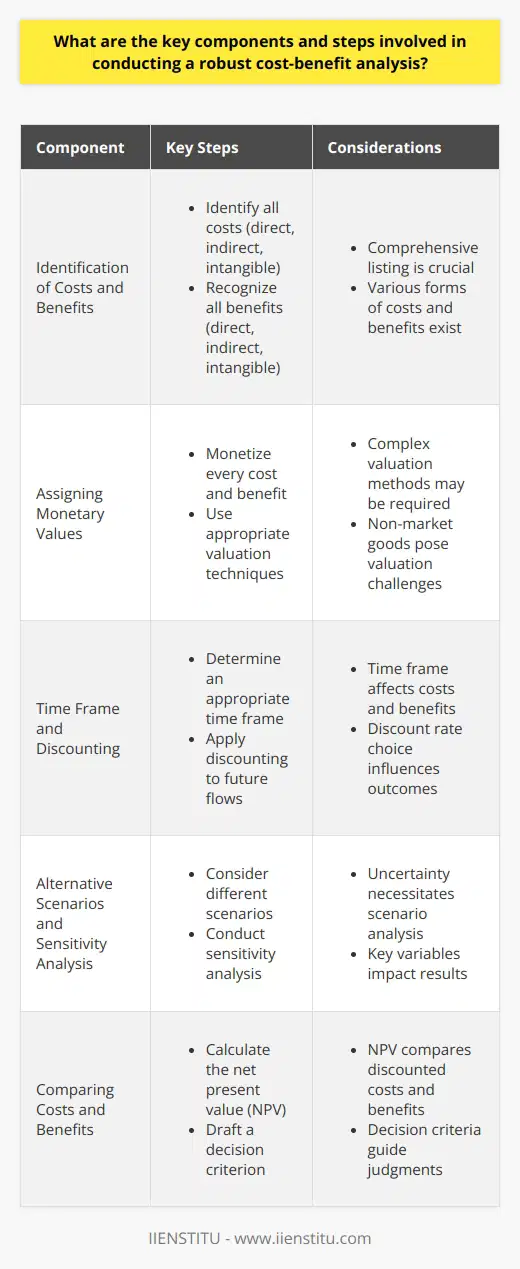

What are the key components and steps involved in conducting a robust cost-benefit analysis?

Understanding Cost-Benefit Analysis

Cost-benefit analysis (CBA) stands as a systematic process. This process evaluates the advantages and disadvantages of a project. Economists and planners often use it in decision-making. It compares the projected or estimated costs against the potential benefits. The comparison helps in determining the best course of action.

Identification of Costs and Benefits

Identify all costs. When conducting a CBA, listing all costs is imperative. Costs include direct, indirect, and intangible elements.

- Direct costs cover materials, labor, and expenses

- Indirect costs might entail overhead and administration

- Intangible costs can include environmental impacts

Recognize all benefits. Just as with costs, benefits come in various forms.

- Direct benefits yield revenue or reduce expenses

- Indirect benefits could improve productivity

- Intangible benefits may enhance goodwill

Assigning Monetary Values

Monetizing components is crucial. Every cost and benefit must have a monetary value. This step can involve complex valuation techniques.

- Market prices serve to value direct costs and benefits

- Surveys and models can help value indirect or intangible costs

- Time and resources often determine the value for non-market goods

Time Frame and Discounting

Determine an appropriate time frame. The time frame affects both costs and benefits.

- Infrastructure projects may span decades

- Policy changes could cause immediate impacts

Apply discounting to future flows. Discounting adjusts future costs and benefits. It reflects the time value of money.

- A discount rate converts future values to present values

- The chosen rate significantly influences the analysis outcome

Alternative Scenarios and Sensitivity Analysis

Consider different scenarios. Uncertainty necessitates scenario analysis. This assesses the robustness of project outcomes.

- Optimistic and pessimistic scenarios bracket potential results

- Probabilistic scenarios can incorporate risk and uncertainty

Conduct sensitivity analysis. Sensitivity analysis tests the impact of changes. This applies to key variables within the CBA.

- Varying the discount rate can alter the net present value (NPV)

- Changes in demand forecasts affect revenue and cost predictions

Comparing Costs and Benefits

Calculate the net present value (NPV). NPV shows the value today of future cash flows. It subtracts discounted costs from discounted benefits. A positive NPV suggests benefits outweigh costs.

Making a Decision

Draft a decision criterion. Decision-making criteria help guide judgments. They often hinge on cost-benefit comparisons.

- A positive NPV generally suggests a project is worthwhile

- Other criteria may include payback period or internal rate of return (IRR)

Report and Review

Create a comprehensive report. A detailed report communicates the findings. It includes methodologies and assumptions.

- Transparency is paramount in methodologies and calculations

- Assumptions must be clear and justifiable

Undergo a review process. Peer review adds credibility to the CBA. External experts can offer insights and critique.

- Review can verify calculations and conclusions

- Feedback may improve the analysis's robustness

Conclusion

An effective cost-benefit analysis involves careful planning and attention. It combines systematic identification, valuation, and comparison. Its application assists in making informed economic decisions. By considering all possible impacts and rigorously testing assumptions, decision-makers can use CBA to guide policy and investment choices. While the process is complex, the underlying goal is simple: to ensure that projects and policies deliver a net benefit to society.

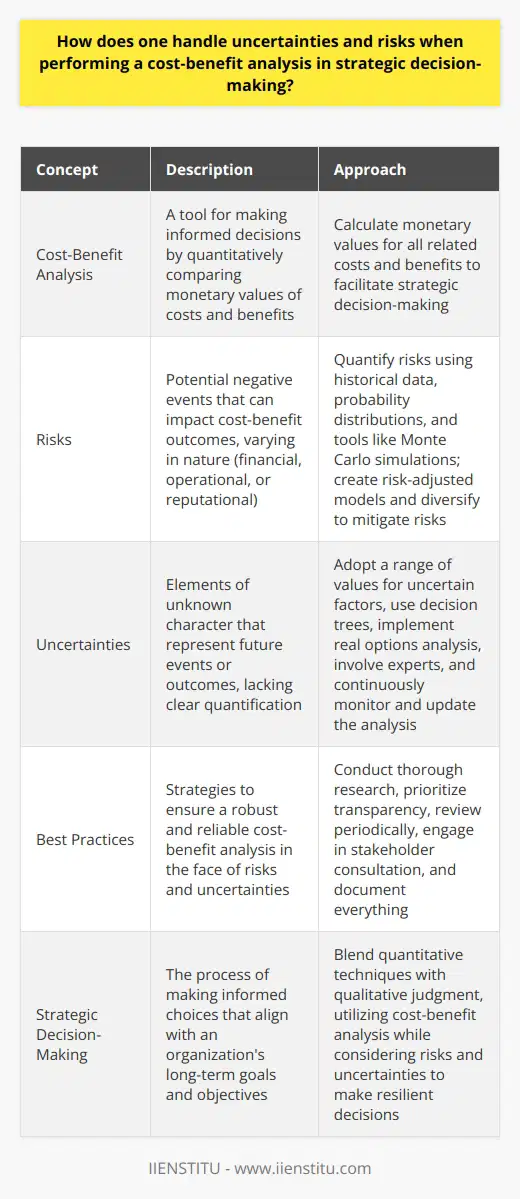

How does one handle uncertainties and risks when performing a cost-benefit analysis in strategic decision-making?

Understanding Cost-Benefit Analysis

Cost-benefit analysis stands as a pivotal tool. It makes quantitative comparisons for informed decisions. This analysis involves calculating monetary values for all related costs and benefits.

Identifying Risks and Uncertainties

In strategic decision-making, one must recognize risks and uncertainties. Risks are potential negative events. Uncertainties are elements of unknown character. Both affect cost-benefit outcomes.

Recognizing Risk Types

Risks vary in nature. Some are quantifiable. Others are less tangible. They can be financial, operational, or reputational. Each has a distinct impact on decision-making.

Facing Uncertainties

Uncertainties prove more elusive. They lack clear quantification. They represent unknown future events or outcomes.

Handling Risks in Analysis

Quantify risks where possible. Use historical data. Consider probability distributions. Employ tools like Monte Carlo simulations.

Create risk-adjusted models. Factor potential risks into financial models. Adjust for different risk levels.

Diversify to mitigate risks. Don't rely on a single outcome or assumption. Spread the risk across multiple scenarios.

Adopt sensitivity analysis. Change key parameters. Observe the outcome impacts. This reveals the model's sensitivity to change.

Consider scenario planning. Develop a range of possible futures. Evaluate each scenario independently. It prevents over-reliance on one outcome.

Addressing Uncertainties in Analysis

Adopt a range of values for uncertain factors. This approach widens the analysis scope. It accommodates various possible states.

Use decision trees. Map out decision paths and outcomes. Include probabilities for different branches.

Implement real options analysis. Treat investment as an option. Decide whether to proceed based on evolving information.

Involve experts. Draw on their experience. Their insight can illuminate uncertain aspects.

Continuous monitoring. Stay vigilant. Update the analysis as new information emerges.

Applying Best Practices Strategically

Conduct thorough research. Solid data forms the basis of trustworthy analysis. It reduces the extent of unknowns.

Prioritize transparency. Make assumptions, risks, and uncertainties clear. Stakeholders can then appreciate the analysis' depth.

Review periodically. Circumstances change. So should the strategic approach and underlying analysis.

Engage in stakeholder consultation. Different perspectives can reveal overlooked aspects. They contribute to a more robust analysis.

Document everything. Keep records of assumptions, data sources, and decisions. This practice aids future reviews and accountability.

Conclusion

Handling risks and uncertainties requires method and caution. One must blend quantitative techniques with qualitative judgment. The collective approaches empower more informed and resilient strategic decisions.

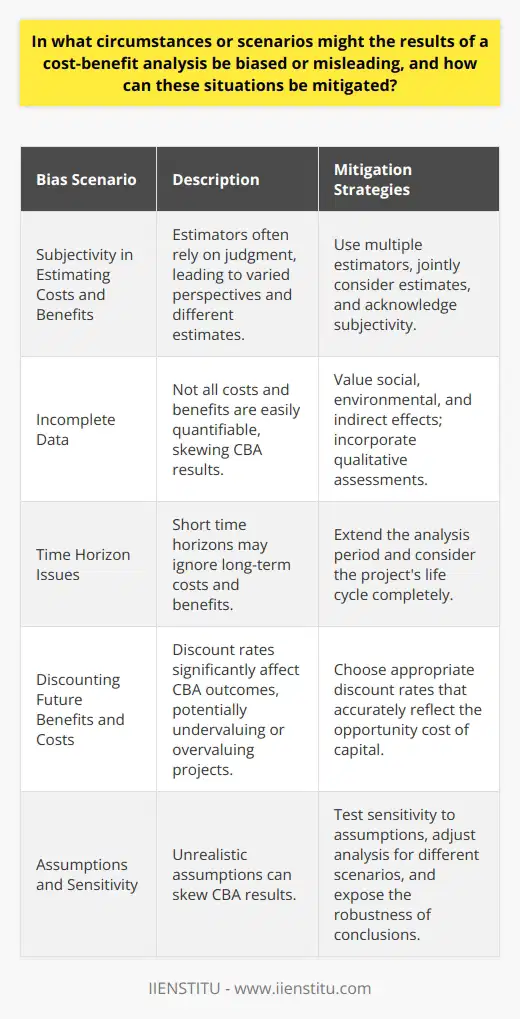

In what circumstances or scenarios might the results of a cost-benefit analysis be biased or misleading, and how can these situations be mitigated?

Introduction to Cost-Benefit Analysis Bias

Cost-benefit analysis (CBA) plays a crucial role in decision-making processes. It evaluates the costs and benefits of a project or decision to determine whether it is financially or strategically viable. However, biases can occur, leading to inaccurate or misleading results.

Identifying Bias Scenarios in CBA

Subjectivity in Estimating Costs and Benefits

Subjectivity can lead to bias. Estimators often rely on judgment. Varied perspectives result in different estimates. Acknowledging this subjectivity is the first step. Use multiple estimators to mitigate this bias. Jointly consider estimates for a balanced view.

Incomplete Data

Incomplete data skews CBA results. Not all costs and benefits are easily quantifiable. While financial figures are accessible, intangible elements often get overlooked. Value social, environmental, and indirect effects. Incorporate qualitative assessments to give a fuller picture.

Time Horizon Issues

Short time horizons can be misleading. They may ignore long-term costs and benefits. To avoid this, extend the analysis period. Consider the project's life cycle completely.

Discounting Future Benefits and Costs

Discount rates affect CBA outcomes significantly. A high rate undervalues future benefits, while a low rate could overvalue projects with deferred payoffs. Choose appropriate discount rates. Reflect the opportunity cost of capital accurately.

Assumptions and Sensitivity

Underlying assumptions shape CBA. Unrealistic assumptions skew results. Test sensitivity to assumptions. Adjust your analysis for different scenarios. This practice exposes the robustness of conclusions.

Mitigating Bias in Cost-Benefit Analysis

Diverse Perspectives

Incorporate diverse perspectives. Different stakeholders offer unique insights. Balance the interests of all involved parties. This can provide a more objective analysis.

Triangulation of Data

Triangulate your data sources. Use varying data points and methodologies. This can reduce reliance on a single source. It improves the reliability of the analysis.

Transparency and Peer Review

Embrace transparency. Document assumptions, data sources, and methodologies. Subject your analysis to peer review. Critics can spot potential biases. They can also suggest improvements to the approach.

Scenario Analysis

Employ scenario analysis. Consider best-case and worst-case situations. This will gauge the project's viability under different conditions. It also highlights risks that might not be evident in the baseline analysis.

Continuous Monitoring and Updating

Monitor and update CBA regularly. Projects and decisions evolve over time. New information can alter the cost-benefit equation. By continuously updating the CBA, maintain relevance and accuracy in your analysis.

Conclusion

While no analysis is entirely free from bias, recognizing these scenarios and actively employing strategies to mitigate them can lead to more informed and reliable cost-benefit analyses. The integrity of a CBA depends heavily on the objectivity and rigor of the process. Through careful planning, sound methodologies, and an openness to critique, analysts can minimize bias and strengthen the decision-making process.