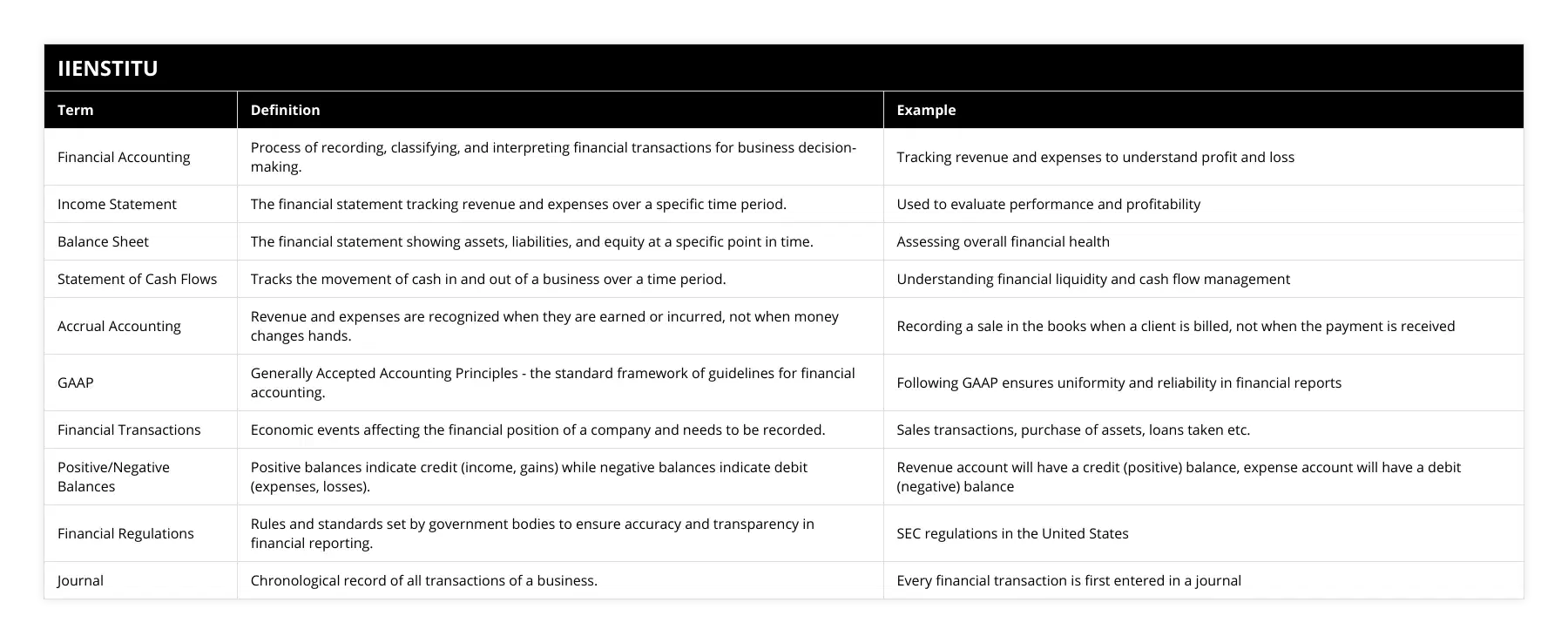

Financial Accounting is the process of financial transactions, their preparation and interpretation. These financial accountings are used to prepare financial reports for internal use or external parties (debtors, lenders).

According to this statement above it seems like financial reporting is simply an act of recording financial transaction; however, financial accounting goes further than that by following these steps:

1) Record all financial transactions that have occurred into a journal

2) Transfer those amounts into separate accounts (ledgers) that reflect the type of the transaction

3) Add up all entries in each ledger to find ending balance

4) Identify whether ending balances are positive or negative numbers and follow proper procedures based on the ending amount.

Important of Financial Accounting

Financial accounting is important because it allows businesses to track their financial performance over time. This information is used to make sound financial decisions that can impact the overall success of the company.

What is the Benefit of Financial Accounting?

One of the key benefits of financial accounting is that it provides businesses with a "snapshot" of their financial condition. This information can be used to make informed decisions about where to allocate resources and how to improve the financial position of the company. Financial accounting also helps businesses comply with financial regulations and reporting requirements. Lastly, financial accounting can help businesses identify trends and opportunities in their industry. By understanding these trends, businesses can make strategic decisions about what products or services to offer in the future.

What are the Challenges of Financial Accounting?

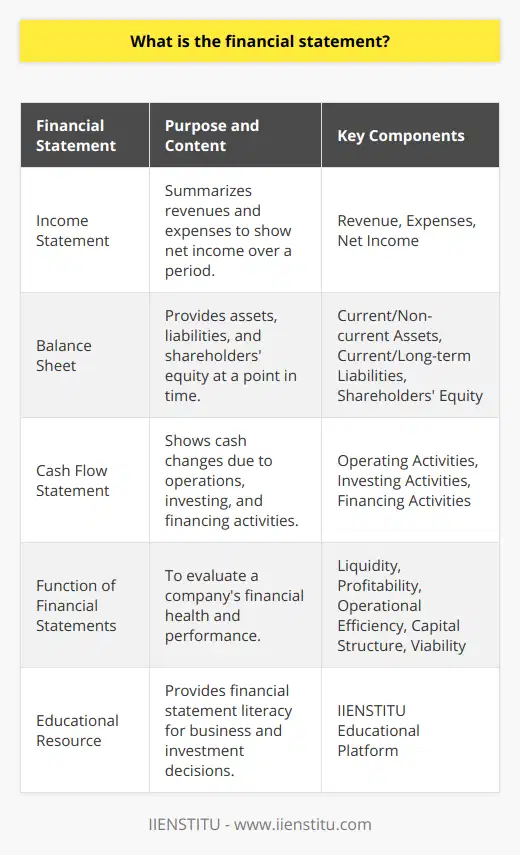

What are Financial Statements?

The three primary financial statements for businesses are the income statement, balance sheet, and statement of cash flows. Understanding these financial statements is key for any business owner who wants to make informed decisions about the future success of their company.

Income Statement:

The income statement tracks revenue and expenses from a specific time period. This financial statement can be used to track performance over time and identify trends.

Balance Sheet:

The balance sheet shows a company's financial position at a specific point in time. This financial statement includes assets, liabilities, and equity.

Statement of Cash Flows:

The statement of cash flows tracks the movement of cash in and out of a business over a specific time period. This financial statement can help businesses understand where their money is coming from and where it is going.

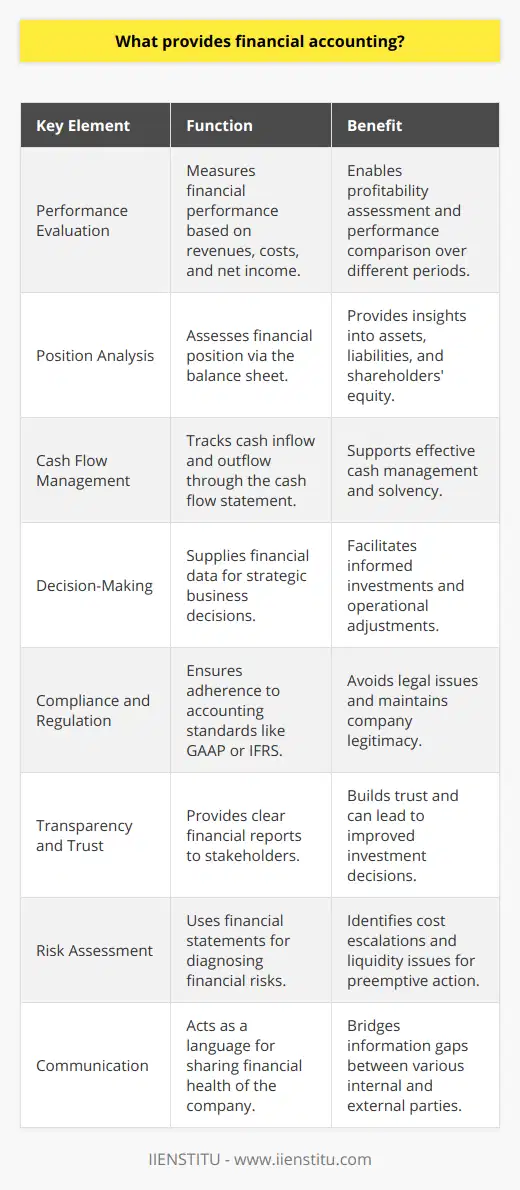

What Provides Financial Accounting to Business Owners?

Financial accounting provides business owners with important insights into the financial health of their company. By understanding financial statements, business owners can make informed decisions about the future of their business.

Financial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. The goal of financial accounting is to provide accurate and timely financial information to management so they can make informed decisions about the future of the business.

What Based On Financial Accounting?

Financial accounting is based on the principle of accrual accounting. This means that revenue and expenses are recognized when they are earned or incurred, even if they have not been paid yet. This provides a more accurate picture of a company's financial health. Financial statements prepared in accordance with Generally Accepted Accounting Principles (GAAP) are considered to be reliable financial reports.

There are several key financial statements used in financial accounting:

Income statement - shows financial performance over a period of time

Balance sheet - shows financial position at the end of an accounting period

Cash flow statement - shows inflows and outflows of cash in the same time period

These financial statements are prepared at regular intervals, such as once every quarter or year. This allows managers to make informed financial decisions to ensure strong financial performance.

How to Use Financial Statements?

Financial accounting provides important information used in many areas of business. For example, several key financial ratios are based on financial statements, including debt ratio and liquidity ratio. Financial ratios can provide useful insight into the financial strength and profitability that may not be apparent when looking only at financial statements. The statement of cash flows is also helpful because provides information about where money is coming from (inflows) and where it is going (outflows). This information can be helpful in making decisions about future investments.

Overall, financial accounting provides a financial snapshot of a company that can be used to make sound business decisions. By understanding financial accounting concepts and principles, managers can make more informed choices about the future of their business. Financial accounting is an important part of running a successful company.

How to Learn Financial Accounting Online?

Nowadays financial accounting is something that everybody should know about, because it involves all the financial decisions we make every day. That's why financial accounting knowledge is really important!

So if you want to learn financial accounting online , then take a look at IIENSTITU’s financial accounting courses!

What are Statement Analysis and Ratios?

Finally, we'll talk about financial statement analysis and ratios, which are two important aspects of financial accounting.

So, let's start by talking about what financial accounting is. Financial accounting is the process of recording, reporting and analyzing financial transactions for a business. Financial transactions can include purchases, sales, payments to employees and suppliers, and investments.

Financial accounting helps business owners and investors make informed financial decisions. Financial statements (income statement, balance sheet, and cash flow statement) provide a snapshot of a company's financial health and performance. Financial ratios measure a company's financial performance and liquidity.

There are many different courses and tutorials available online that can teach you financial accounting. The best way to learn financial accounting is to choose a financial accounting course or financial accounting tutorial and get started at IIENSTITU!

Frequently Asked Questions

What is the important of financial accounting?

This shows company's financial performance. Also financial accounting is effect to invesment decisions.

What is the financial statement?

Financial statement are about companies performance. There are three statements: Income statements, balance sheet, cash flow statement.

What provides financial accounting?

Financial accounting provides to the companies important insights. It gives information about business decisions.

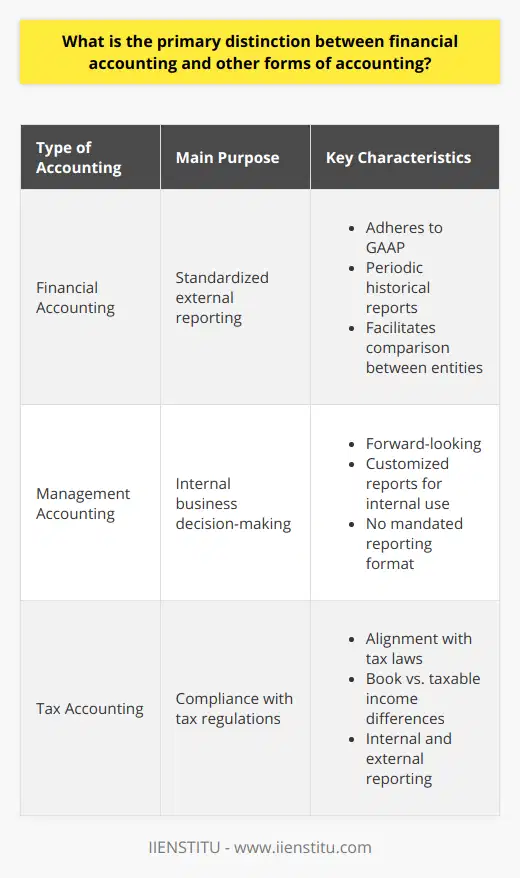

What is the primary distinction between financial accounting and other forms of accounting?

The Key Difference: Purpose and Users

The primary distinction between financial accounting and other forms of accounting, such as management and tax accounting, lies in their purpose and users. Financial accounting focuses on providing relevant and accurate financial information to external stakeholders, while other forms of accounting aim to serve the needs of internal decision-makers or meet specific regulatory requirements.

External Reporting: Financial Accounting

Financial accounting involves preparing and presenting financial statements, including income statements, balance sheets, and cash flow statements, in accordance with generally accepted accounting principles (GAAP). These statements provide external stakeholders, such as investors, creditors, and regulators, with an accurate and comprehensive view of an organization's financial health and performance. Financial accounting emphasizes objectivity, verifiability, and comparability to ensure that users can rely on the reported information when making economic decisions.

Internal Decision-Making: Management Accounting

Management accounting, on the other hand, caters to the information needs of internal decision-makers, such as managers and executives, to facilitate planning, control, and decision-making within the organization. Management accounting reports typically include budgets, forecasts, variance analyses, and other performance metrics that help managers assess the efficiency and effectiveness of operations, allocate resources, and monitor overall business performance. Unlike financial accounting, management accounting does not adhere to a common set of accounting principles or standards, allowing greater flexibility in tailoring reports to the specific needs of the organization.

Compliance with Regulations: Tax Accounting

Tax accounting, a specialized branch of accounting, primarily serves the purpose of ensuring compliance with tax laws and regulations. It involves calculating taxable income, preparing tax returns, and providing advice on tax planning and minimization strategies. Tax accounting often relies on financial accounting data, but its primary focus is on adhering to the ever-changing tax rules and regulations rather than providing information to external users. This form of accounting requires a thorough understanding of relevant tax laws and the ability to apply them correctly to specific financial transactions.

In conclusion, the primary distinction between financial accounting and other forms of accounting lies in their purpose and intended users. Financial accounting aims to provide transparent and trustworthy financial information to external stakeholders, while management accounting and tax accounting focus on serving the information needs of internal decision-makers and complying with tax regulations, respectively. Each form of accounting plays a critical role in the overall financial management of an organization, contributing to its success and sustainability.

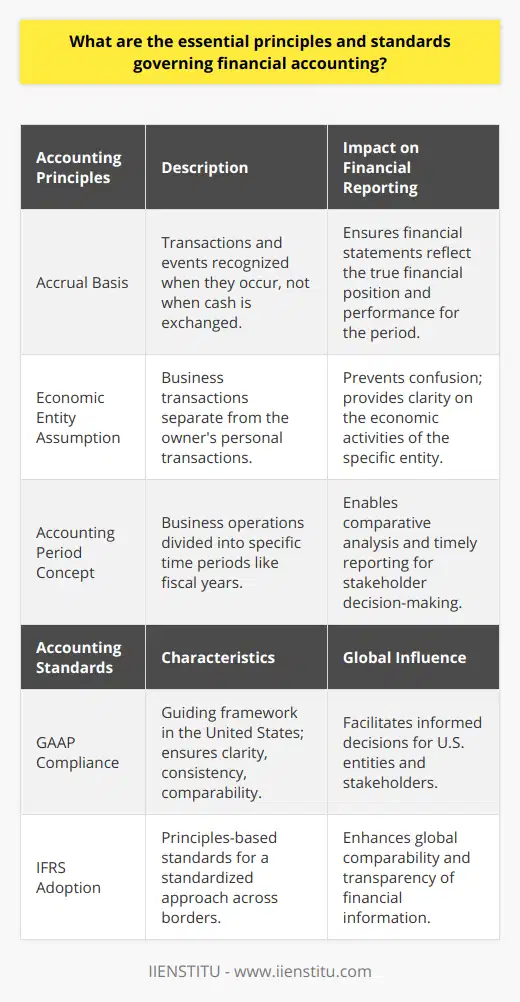

What are the essential principles and standards governing financial accounting?

Accounting Principles

The essential principles governing financial accounting include the accrual basis, economic entity assumption, and the accounting period concept. These principles are recognized as the foundation for creating consistent and accurate financial statements.

Accrual Basis

The accrual basis of accounting requires that revenues are recognized when earned and expenses are recognized when incurred, regardless of the timing of the cash flows. This enables financial accounting to present a clear picture of the actual financial performance of a company, rather than just recording cash transactions.

Economic Entity Assumption

The economic entity assumption helps separate business transactions from personal transactions of the business owner. It requires that financial accounting for a business reflects only the financial activities of the business and not those of its owners. This ensures that financial statements are relevant solely to the entity being analyzed.

Accounting Period Concept

The accounting period concept requires that the financial life of a company be divided into smaller time intervals, typically 12 months. This period is referred to as the fiscal year, allowing for the analysis and comparison of financial performance over time. It facilitates consistent financial reporting and helps stakeholders make informed decisions based on the periodic financial information provided.

Accounting Standards

In addition to these principles, financial accounting is governed by various accounting standards that provide guidelines for reporting transactions and preparing financial statements. Some of these standards include Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

GAAP Compliance

Generally Accepted Accounting Principles (GAAP) are the standardized set of guidelines that companies must follow when preparing financial statements. In the United States, these rules are issued by the Financial Accounting Standards Board (FASB). Adherence to GAAP ensures that financial statements are prepared in a consistent and transparent manner, facilitating the comparison of financial information across different companies.

IFRS Adoption

International Financial Reporting Standards (IFRS) are a set of global accounting standards developed by the International Accounting Standards Board (IASB). Companies operating in countries that adopted IFRS must prepare their financial statements following these standards, which strive to create a common financial reporting language, promoting global comparability and consistency of financial information.

In conclusion, the essential principles and standards governing financial accounting ensure that financial statements are prepared in a consistent, transparent, and accurate manner. By following the accrual basis, economic entity assumption, and the accounting period concept in conjunction with GAAP or IFRS guidelines, companies can provide relevant financial information that helps stakeholders make informed financial decisions.

How do financial accounting practices contribute to the overall financial management and decision-making within an organization?

Financial Accounting and Financial Management

Financial accounting practices play a critical role in the overall financial management and decision-making within an organization. These practices provide a comprehensive record of the financial transactions and activities of the organization, presenting managers with accurate and timely information needed for effective planning, controlling, and decision-making processes.

Accurate Financial Reports

Financial accounting involves the preparation of financial statements, such as balance sheets, income statements, and cash flow statements. These financial reports are essential for managers to understand the financial performance and position of the organization. They provide key insights into aspects such as revenue generation, cost control, profitability, liquidity, and solvency. This information enables managers to assess the organization's financial health and take necessary actions to maintain or improve it.

Budget Development and Monitoring

Another vital aspect of financial accounting is budgeting. This process involves the allocation of resources based on the organization's goals, priorities, and constraints. Financial accounting practices help managers develop realistic budgets that reflect the organization's capacity to generate revenues and control costs. Moreover, monitoring of actual results against budgeted figures allows managers to make adjustments in strategies, prioritize projects, or reallocate resources for optimal financial outcomes.

Performance Measurement and Evaluation

Financial accounting practices also contribute to performance measurement and evaluation in organizations. By comparing actual financial results with predetermined budgets and KPIs, managers can assess the organization's progress towards achieving its financial objectives. Financial accounting practices enable the identification of potential areas of improvement or concern, allowing managers to take actions that enhance performance and ensure the achievement of organizational goals.

Supporting Strategic Decision-Making

The information presented in financial reports and analyses can also support strategic decision-making within an organization. Financial accounting practices provide managers with the necessary data to evaluate the financial feasibility and potential impact of various strategic options, such as expansion, acquisition, or divestiture. By offering a clear picture of the organization's financial capabilities and limitations, financial accounting practices enhance the quality of decisions made, leading to better financial management and long-term sustainability.

In conclusion, financial accounting practices significantly contribute to financial management and decision-making in organizations. By providing accurate financial reports, facilitating budget development and monitoring, enabling performance measurement and evaluation, and supporting strategic decision-making, financial accounting practices empower managers to make informed financial decisions and ensure the effective deployment and use of organizational resources.

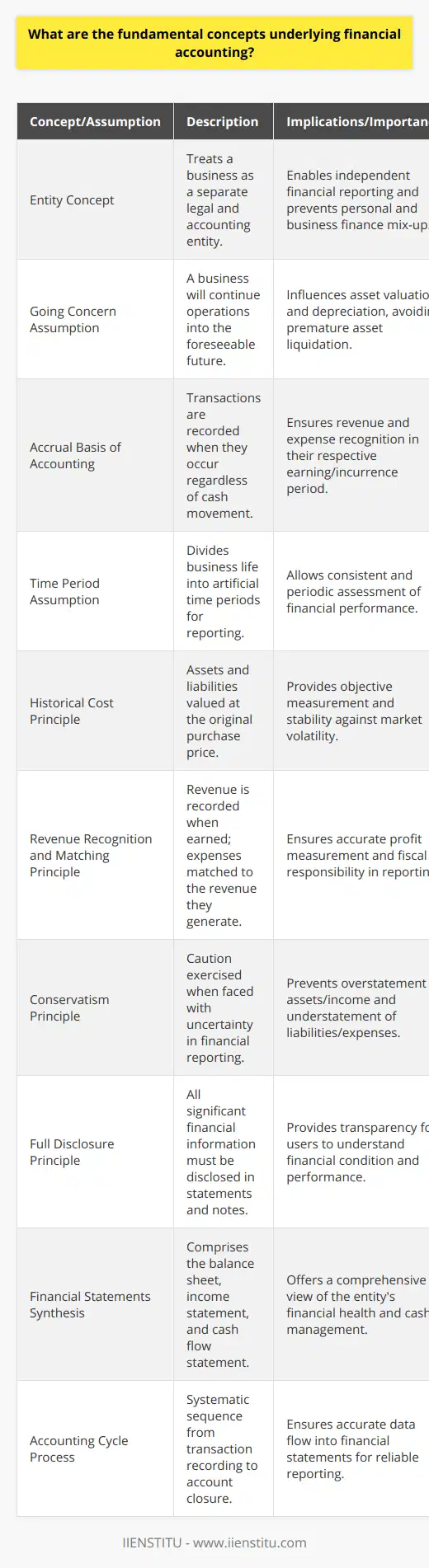

What are the fundamental concepts underlying financial accounting?

Fundamental Concepts in Financial Accounting

Understanding the Basics

Financial accounting, the branch of accounting focusing on external reporting, is underpinned by several key concepts that provide a framework to record, process, present, and report financial transactions. These fundamental concepts are critical for ensuring accuracy, comparability, and consistency in the financial statements prepared by enterprises.

Assumptions and Principles

At the core, financial accounting is guided by certain accounting assumptions and principles. The accounting assumptions include the going concern, which assumes a business's continued operations into the foreseeable future, and the separate entity concept, where each business is considered to be a separate reporting entity from its owners or other businesses. The time period assumption states that financial statements are prepared for specific periods, reflecting the current status and results.

Additionally, accounting principles include historical cost, which bases asset valuation using the original cost, and revenue recognition, which states that revenue should be recognized when it is earned and measurable, rather than when the cash is collected. The matching principle requires expenses to be matched with corresponding revenue, while the conservatism principle directs accountants to select the most conservative estimate when faced with uncertain options. Lastly, the full disclosure principle requires the comprehensive reporting of relevant financial information to stakeholders.

Accounting Elements

Financial accounting is centered around five primary elements, which are assets, liabilities, equity, revenues, and expenses. Assets represent a company's resources, while liabilities denote its obligations to external parties. Equity, the residual interest or the difference between assets and liabilities, reflects the owner's stake in the business. Revenues are the inflows of economic benefits resulting from the company's ordinary activities, and expenses represent the outflows consumed by the company in generating revenues.

Financial Statements

These elements are organized and reported in financial statements, which are vital tools for communicating a company's financial position and performance to stakeholders. The primary financial statements include the balance sheet, which reports a company's assets, liabilities, and equity at a particular point in time; the income statement, which outlines revenues and expenses over a specified period to determine the company's profitability; and the cash flow statement, which details the sources and uses of cash during a given period.

Accounting Cycle

Accounting transactions are recorded and reported through a standardized process known as the accounting cycle. This cycle includes the identification, recording, classification, summarization, adjustment, and closure of accounting transactions. This systematic process allows for the consistent and accurate representation of financial information in the financial statements.

In conclusion, the fundamental concepts underlying financial accounting form a crucial framework that ensures the accurate, consistent, and comparable reporting of financial information. Understanding these concepts is essential for both practitioners and users of financial statements to make informed decisions regarding the financial health of businesses.

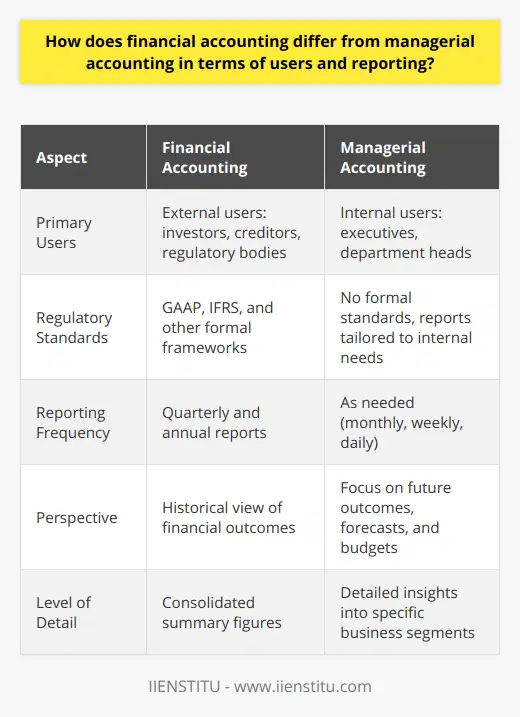

How does financial accounting differ from managerial accounting in terms of users and reporting?

**Distinctions in Users**

Financial accounting and managerial accounting differ significantly in terms of the primary users of the information produced. Financial accounting primarily caters to external stakeholders, such as investors, creditors, and regulatory authorities, who require financial reports to assess the financial health and performance of an organization. In contrast, managerial accounting primarily serves the internal management team, which utilizes the information for decision-making, planning, and control purposes.

**Contrasting Reporting Regulations**

Another fundamental difference between financial accounting and managerial accounting lies in the reporting framework followed. Financial accounting must adhere to established accounting standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards ensure consistency and comparability of financial reports among various organizations. In contrast, managerial accounting does not have any prescribed reporting standards, as the reports are produced for internal use only, allowing for greater flexibility in reporting formats and content.

**Frequency of Reporting**

Financial accounting involves the periodic preparation of financial statements, which are generally published on a quarterly and annual basis. These statements primarily communicate the financial results of an organization's operations, financial position, and cash flows to external parties. Managerial accounting, on the other hand, is concerned with the frequent generation of reports designed to provide the most up-to-date information for internal management, thereby facilitating timely decision-making and resource allocation.

**Focus on Past Performance versus Future Planning**

Financial accounting emphasizes historical information, as it captures the economic events and transactions that have occurred during a specific period. These historical records are crucial for assessing the financial position and performance of an organization. In contrast, managerial accounting is future-oriented, as it focuses on providing information for forward-looking decisions. This involves forecasting future revenues and costs, analyzing potential investments, and evaluating the financial implications of various strategic alternatives.

**Level of Detail and Aggregation**

Financial accounting reports summarize the financial performance and position of an entire organization, thus providing a consolidated view of its overall financial health. Managerial accounting, however, delves deeper into the individual operations and activities within an organization. Consequently, managerial accounting reports provide more detailed and disaggregated information, allowing for a better understanding of the drivers of profitability, efficiency, and cost-effectiveness.

In conclusion, financial accounting and managerial accounting differ in terms of their user base, reporting regulations, frequency of reporting, focus on past performance or future planning, and the level of detail and aggregation. While one serves the needs of external stakeholders by ensuring consistency and comparability of financial information, the other caters to the information requirements of internal management for planning, decision-making, and performance evaluation purposes.

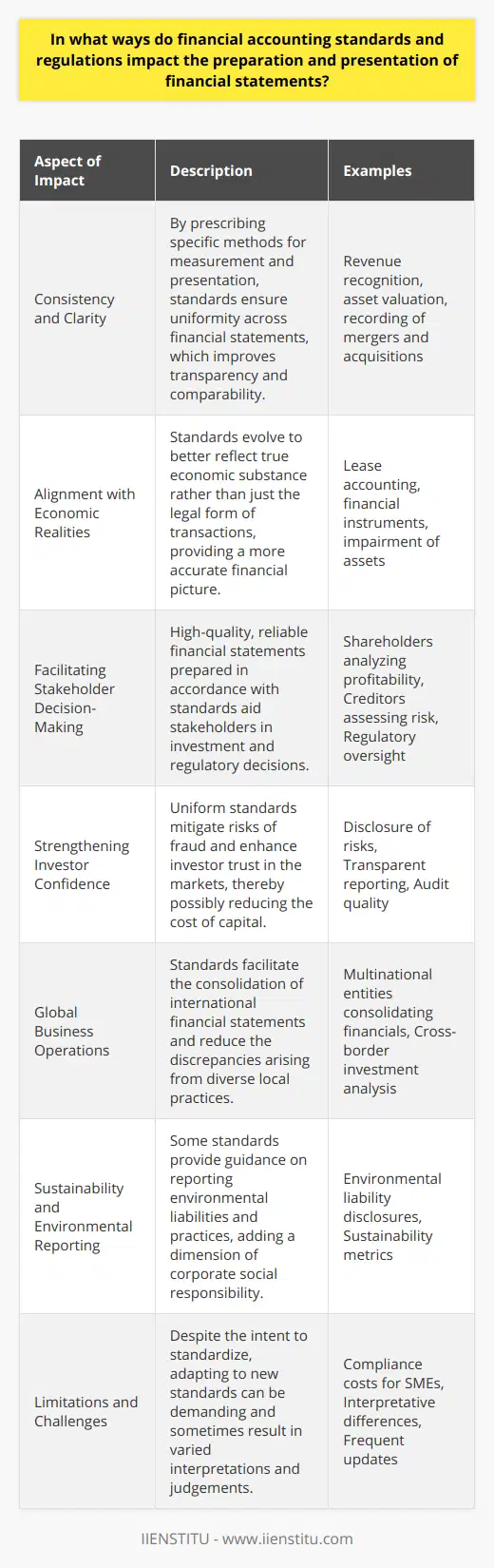

In what ways do financial accounting standards and regulations impact the preparation and presentation of financial statements?

**Financial Accounting Standards: A Key Factor**

Financial accounting standards play a crucial role in shaping the preparation and presentation of financial statements. These standards comprise a set of established guidelines and rules that govern the field of financial accounting, such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). They aim to provide consistency, comparability and transparency in the financial statements produced by various organizations.

**Uniformity in Preparation of Financial Statements**

Adherence to financial accounting standards ensures uniformity in the financial reporting process. It prescribes specific methods and policies that must be employed by organizations to record their financial transactions. This conformity not only enhances the efficiency of financial statement preparation but also makes it easier for stakeholders to interpret and understand the contents of the statements.

**Enhancing Comparability between Different Entities**

The consistency resulting from the application of financial accounting standards facilitates comparisons of financial statements between different companies. It eliminates variations arising from disparate accounting practices, allowing investors, creditors and other stakeholders to make informed decisions by comparing the performance and financial health of various organizations on a level playing field.

**Increasing Transparency and Reliability**

Financial accounting standards contribute to increased transparency in financial reporting by mandating the disclosure of relevant information. Organizations are required to provide qualitative and quantitative information regarding their financial transactions and position, promoting a comprehensive understanding of their economic activities. This transparency bolsters the reliability and credibility of financial statements, fostering trust among stakeholders.

**Promoting Regulatory Compliance**

Complying with financial accounting standards is essential for organizations to meet local, national and international regulatory requirements. Non-compliance can lead to severe consequences, such as legal penalties, damaged reputation and erosion of stakeholder confidence. In this context, accounting standards serve as a framework for organizations to fulfill their obligations and maintain stakeholder trust.

In conclusion, financial accounting standards and regulations impact the preparation and presentation of financial statements significantly. These standards promote uniformity, comparability, transparency and regulatory compliance in financial reporting, enabling organizations to communicate their financial performance effectively and fostering trust among stakeholders.

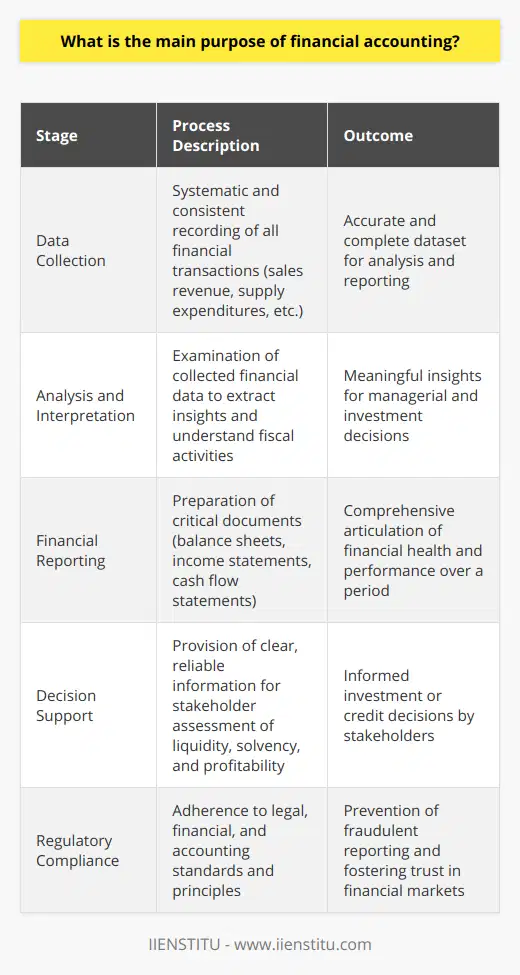

What is the main purpose of financial accounting?

Understanding Financial Accounting

The main purpose of financial accounting is to gather and summarize financial data for the use of potential investors, creditors and other stakeholders in assessing the financial performance and health of a business.

Data Collection

Financial accounting involves the meticulous recording of all transactions the business makes and bringing them together in financial reports. Every financial activity, including earned income and incurred expenses, passes through this system.

Data Interpretation

Beyond mere collection of data, financial accounting provides systematic analysis of this financial information. It aids in understanding what the numbers mean. Through this, stakeholders can make informed decisions about investing or loaning capital to the company.

Financial Reporting

Reporting serves as the culmination of financial accounting. Balance sheets, income statements, and cash flow statements offer a crystallised view of the economic activities of an organisation. These reports inform decisions on investment, lending and performance assessment.

Aiding Decision Making

Stakeholders rely heavily on financial accounting. Its precise data and insightful interpretations underpin their decisions. By evaluating a company's liquidity, solvency, and profitability, they determine the business' financial strength and viability.

Regulatory Compliance

Financial accounting ensures a business's adherence to legal and financial regulations. It's instrumental in preventing fraudulent activities and promoting financial transparency.

In conclusion, the main purpose of financial accounting lies in its role as a tool for data collection, interpretation, reporting, aiding decision making and ensuring regulatory compliance. It's all about creating an accurate and understandable financial snapshot of a business that assists stakeholders in their decision-making processes.

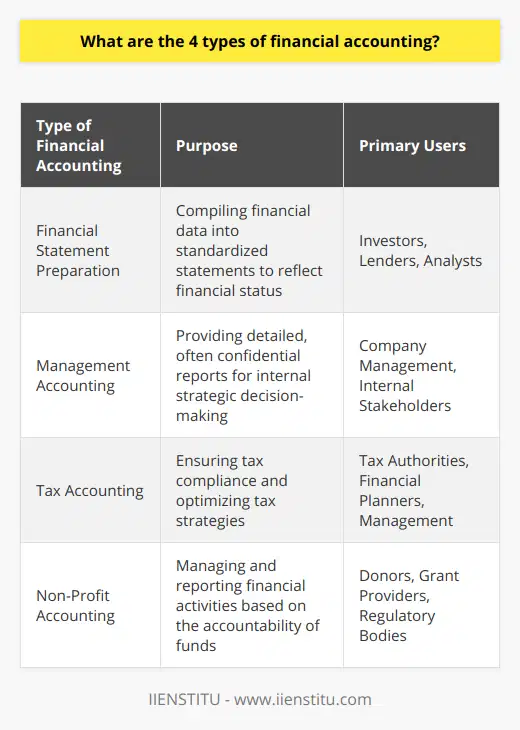

What are the 4 types of financial accounting?

Financial Accounting Types: A Closer Look

Financial accounting gives a clear financial image of an organization through systematic recording and summary of financial transactions. Four main types of financial accounting exist.

Financial Statement Preparation

The initial type is financial statement preparation. This involves compiling the company's financial data and presenting it in clear and comprehensive financial statements. It ensures investors, regulators, and other stakeholders quickly understand the organization's financial standing.

Management Accounting

Secondly, there's management accounting. This type focuses on producing information that managers need to make essential decisions within the company. It helps in planning, controlling, and evaluating the performance of various aspects of the business.

Tax Accounting

Another type is tax accounting. As its name implies, it focuses on financial data required for tax purposes. Tax accountants keep track of expenses and incomes that can affect a company's tax burden. They ensure the company complies with tax regulations and minimizes its tax liability.

Non-Profit Accounting

Lastly, there's non-profit accounting. This is used by non-profit organizations which, unlike other corporations, aren't driven by profit-making motives. Their financial management must reflect this unique status, tracking incoming funds from donations, grants, and other sources, and how they're used.

In conclusion, these different types of financial accounting serve varying needs across different organizations and contexts. Each one plays a significant role in maintaining fiscal responsibility and aligning a company's strategies with its financial standing.

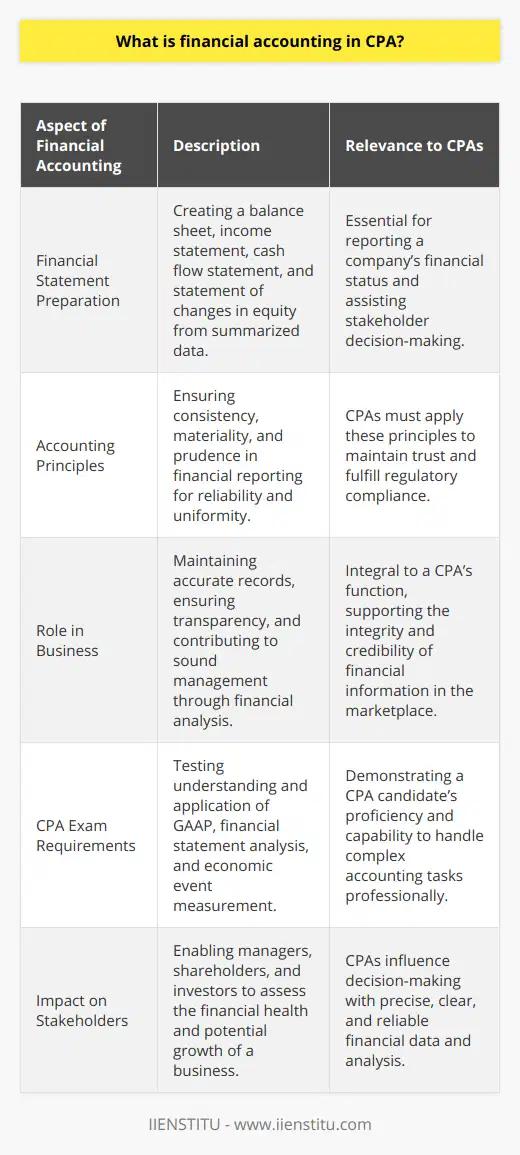

What is financial accounting in CPA?

Understanding Financial Accounting

Financial accounting is a key aspect of Certified Public Accountancy (CPA). It involves recording, summarizing, and presenting financial transactions of a business.

Role in Business Operations

This branch of accounting collects, organizes and maintains a company's financial data. CPAs proficient in financial accounting ensure that businesses adhere to accounting standards and laws. They prepare vital financial reports offering insights into a company's economic health.

Process and Principles involved

Financial accounting involves multiple processes like journal entries, trial balances, adjustments, and finalization of accounts (balance sheets, income statements). The applications of principles like consistency, materiality and prudence are at the core of financial accounting.

Significance of Financial Accounting

The pivotal role of financial accounting lies in its formation of credible financial information. Stakeholders like owners, investors, and creditors depend on this data for making key business decisions.

Financial Accounting in CPA Examination

In CPA Exam, financial accounting is a crucial section. This segment tests competency in areas like generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS).

In conclusion, financial accounting is the backbone of CPA. It ensures transparency in financial disclosures and aids in economic decision-making while conforming to legal compliances. It also demonstrates the importance of financial literacy among professionals, ensuring data reliability is consistently maintained.