In the bustling nine-to-five grind, there's a silent understanding among workers—we're here to get the job done, even if it spills over the clock. I remember when I first started working at a small-town hardware store during my college years. Friday evenings often stretched a bit longer, especially during the summer rush. Back then, I didn't give much thought to how those extra hours added up, and overtime pay was a term that floated around but didn't quite anchor in my mind. It wasn't until a colleague nudged me and said, "You know, we should be getting more for these late nights," that I embarked on a journey to unravel the complexities of overtime compensation.

Navigating the Maze of Overtime Pay

Understanding overtime pay isn't just for accountants or HR managers—it's essential for anyone punching a clock or managing those who do. Overtime pay laws for salaried employees, hourly workers, and even freelancers can differ, but the core idea remains: workers deserve fair compensation for their time. Let's dive deeper into this topic, exploring the legal frameworks, calculations, common misconceptions, and real-life stories that bring these concepts to life.

Legal Aspects and Policies of Overtime Pay

Federal Laws Governing Overtime Pay

At the heart of overtime regulations in the United States lies the Fair Labor Standards Act (FLSA), a piece of legislation passed back in 1938. The FLSA sets the groundwork by stipulating that non-exempt employees must receive one and a half times their regular rate of pay for any hours worked over 40 in a workweek. But who exactly is "non-exempt"?

The term "non-exempt" refers to employees who are not exempt from overtime pay requirements. This classification hinges on several factors, including job duties, salary basis, and salary level. For instance:

Salary Threshold: Employees earning less than $684 per week ($35,568 per year) are generally considered non-exempt.

Job Duties Test: Employees performing certain types of jobs, like executive, administrative, or professional roles, might be exempt if they meet specific criteria.

HR Auditing: Comprehensive Insight into Organizational Assessment

HR Literature: Evaluating its Influence on Organizational Success

Variable Pay: An In-depth Look at Modern Compensation Strategies

It's a bit of a complicated dance, isn't it? The overtime pay for exempt and non-exempt employees can vary significantly, so understanding where one falls is crucial.

State-Specific Laws Regarding Overtime Pay

While the FLSA provides a federal baseline, individual states have the authority to enact their own overtime laws—sometimes offering greater protections. For example:

California: Employees receive overtime for any work over 8 hours in a day and double time for over 12 hours in a day.

Alaska: Overtime applies after 8 hours in a day or 40 hours in a week.

Given this patchwork of regulations, it's important for both employers and employees to be aware of their state's specific laws. I recall a friend moving from Texas to California who was pleasantly surprised to learn about the daily overtime rules—something he'd never considered before.

Policies and Protections for Workers

Beyond just the pay rates, the FLSA and state laws include provisions to protect workers from exploitation:

1- Record-Keeping Requirements: Employers must maintain accurate records of hours worked and wages paid.

2- Posting Requirements: Workplaces are required to display posters outlining employee rights under labor laws.

3- Anti-Retaliation Protections: Employees are protected from being fired or discriminated against for asserting their rights.

These measures ensure transparency and provide recourse if disputes arise. Employee rights regarding overtime pay are not just legal niceties—they're essential protections for the workforce.

Calculating Overtime Pay Rates

Understanding the Basic Wage

Before tackling overtime calculations, it's important to grasp what constitutes the "regular rate of pay". This isn't always just your hourly wage. It can include:

Hourly Earnings

Nondiscretionary Bonuses: For example, a bonus based on productivity.

Shift Differentials: Extra pay for working less desirable shifts, like nights or weekends.

By including these elements, you ensure that overtime is calculated on the full scope of your earnings, not just base pay.

How to Determine Overtime Rate

Calculating overtime pay can seem daunting, but it doesn't have to be. Here's a simple step-by-step guide:

1- Calculate the Regular Rate: Add up total compensation for the week (including bonuses and differentials), then divide by total hours worked.

2- Determine Overtime Rate: Multiply the regular rate by 1.5.

3- Compute Overtime Pay: Multiply the overtime rate by the number of overtime hours worked.

For example:

Total weekly compensation: $600

Total hours worked: 45

Regular rate: $600 / 45 = $13.33 per hour

Overtime rate: $13.33 x 1.5 = $20.00 per hour

Overtime pay: $20.00 x 5 hours = $100

Tools and Aids in Calculating Overtime Pay

In today's digital world, there are numerous tools to help with these calculations:

Payroll Software: Programs like QuickBooks or ADP automate calculations and ensure compliance.

Online Calculators: Websites offer free calculators where you can input your data.

Mobile Apps: Apps like HoursTracker help employees track their hours meticulously.

Using these tools reduces errors and helps both employers and employees stay on the same page.

Common Misconceptions About Overtime Pay

Debunking Myths About Overtime Pay

There's a lot of misinformation floating around about overtime pay. Let's clear up some common myths:

Myth 1: Salaried employees aren't eligible for overtime.

Truth: Salary level and job duties determine exemption status, not the mere fact of being salaried.

Myth 2: Overtime is only calculated weekly, not daily.

Truth: Some states require daily overtime pay.

Myth 3: Employers can offer "comp time" instead of overtime pay.

Truth: In the private sector, compensatory time off in lieu of overtime pay is generally not permitted under the FLSA.

Understanding the 'Off-the-Clock' Work

"Off-the-clock" work refers to tasks an employee performs that aren't officially recorded as work time. This can include:

Answering emails from home

Preparing for the workday before clocking in

Cleaning up after clocking out

Legally, if an employer is aware (or should be aware) that an employee is performing these tasks, they must be compensated. Ignoring this can lead to significant legal trouble.

Distinguishing Between Volunteer Time and Compensable Time

Sometimes, employees might volunteer for extra tasks. However, under the FLSA:

An employee cannot volunteer to do the same type of work they are paid for, for the same employer, without compensation.

Volunteering is typically only permissible in public sector or nonprofit settings and must be truly voluntary.

Understanding this distinction helps prevent unintentional violations and ensures workers aren't taken advantage of.

Real-World Cases and Examples

Significant Court Cases Involving Overtime Pay

Case Study 1: Flores v. City of San Gabriel

In this case, police officers sued the city because their cash-in-lieu of benefits payments were not included in their regular rate of pay for overtime calculations. The court ruled in favor of the officers, leading to significant back-pay awards.

Case Study 2: Tyson Foods, Inc. v. Bouaphakeo

Employees claimed they were not paid for time spent donning and doffing protective gear. The Supreme Court upheld a class-action lawsuit, emphasizing the importance of compensating all work-related activities.

Success Stories of Workers Claiming Their Rightful Overtime Pay

I recall meeting Sarah, a nurse who worked endless double shifts during the pandemic. Her employer classified her as exempt, but her duties didn't meet the criteria. After consulting with a labor attorney, she filed a claim and received substantial back pay.

Consequences for Companies Not Complying

Companies that ignore overtime laws can face:

Penalty Fines

Back Pay Awards

Damage to Reputation

Walmart, for instance, has faced numerous lawsuits resulting in millions paid for overtime violations.

Conclusion

Navigating the world of overtime pay can feel like walking through a labyrinth. From federal laws to state specifics, from calculating rates to debunking myths, there's a lot on the table. But remember, knowledge is power. By understanding your rights and obligations, you can ensure fairness in the workplace.

If you ever find yourself in a situation where you're unsure about your overtime pay—or if you're drafting a reassignment request letter tips and information could come in handy—don't hesitate to seek guidance. Whether it's reaching out to HR, consulting with a labor attorney, or simply educating yourself further, taking action is key.

Resources and Additional Readings

Suggested Books and Articles

"The Fair Labor Standards Act" by Ellen C. Kearns.

A comprehensive guide to the FLSA and its applications.

"Wage and Hour Law: Guide to Fair Labor Standards Act" by Richard J. Simmons.

Detailed explanations and case studies on wage laws.

Contact Information for Assistance

U.S. Department of Labor Wage and Hour Division

Phone: 1-866-4USWAGE (1-866-487-9243)

Local State Labor Offices

Check your state's Department of Labor website.

In the end, ensuring you're paid fairly isn't just about the money—it's about respect and recognition for your time and effort. Just like I learned back at that hardware store years ago, sometimes it takes a bit of digging and a few conversations to uncover what's rightfully yours. And that's something worth working overtime for.

Frequently Asked Questions

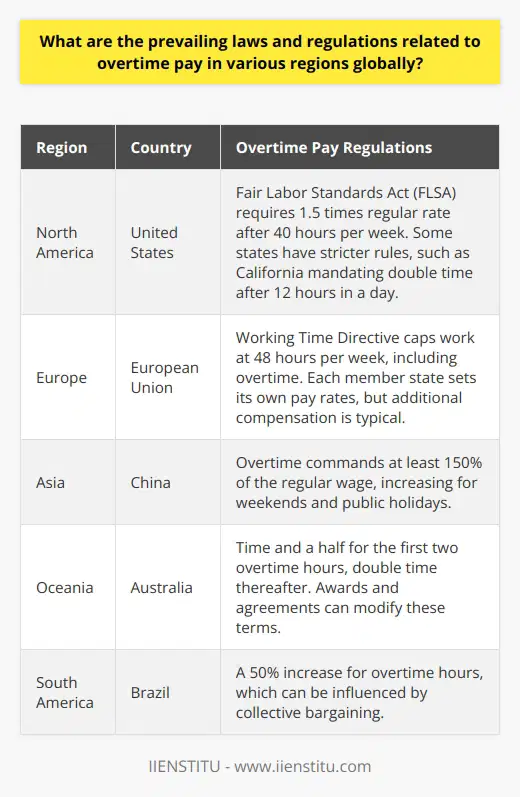

What are the prevailing laws and regulations related to overtime pay in various regions globally?

Global Overtime Pay Laws

North America

United States

In the US, the Fair Labor Standards Act (FLSA) sets overtime pay requirements. Workers earn one and a half times their regular rate after 40 work hours weekly. Certain states impose stricter rules. California mandates double time after 12 hours in a day.

Canada

Canada's regulation varies by province. Generally, employees receive one and a half times their standard rate after 44 hours weekly. However, some sectors have unique rules.

Europe

European Union

The Working Time Directive governs overtime in the EU. It caps work at 48 hours weekly, including overtime. Each member sets its own pay rates, but additional compensation is typical.

United Kingdom

Now outside the EU, the UK's laws resemble the Working Time Directive. Overtime pay is not mandatory unless stipulated in the employment contract.

Asia

China

Chinese labor law states that overtime commands at least 150% of the regular wage. This rate increases for weekends and public holidays.

Japan

In Japan, overtime pay rates must exceed the regular pay by at least 25%. Recent reforms aim to curb excessive working hours.

Oceania

Australia

Australia requires time and a half for the first two overtime hours. Double time applies thereafter. Awards and agreements can modify these terms.

New Zealand

New Zealand does not enforce a standard overtime rate. Contractors negotiate overtime as part of individual employment agreements.

South America

Brazil

Brazilian law prescribes a 50% increase for overtime hours. Collective bargaining can influence these rates.

Argentina

In Argentina, overtime work earns a 50% premium on weekdays and 100% on Sundays.

Africa

South Africa

In South Africa, overtime compensation is one and a half times the normal wage rate. Such pay applies to hours beyond 45 per week.

Nigeria

Nigerian workers receive at least time and a half for overtime. Some industries set higher rates through collective bargaining.

Middle East

United Arab Emirates

The UAE mandates a 25% increase for day overtime. Night overtime reaches a 50% increase.

Saudi Arabia

Saudi Arabia requires payment of one and a half times the regular rate for overtime.

Factors Influencing Overtime Laws

- Local labor laws

- Collective bargaining agreements

- Sector-specific regulations

- Public holidays and weekends

Conclusion

Each region upholds distinct laws for overtime pay. Workers must know their rights. Employers should comply with these laws to foster fairness and avoid legal issues. Consideration of international laws is key for global businesses.

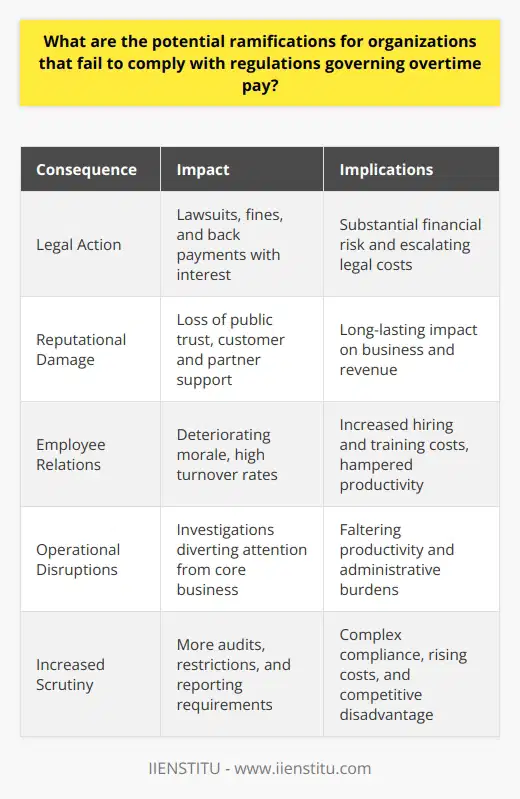

What are the potential ramifications for organizations that fail to comply with regulations governing overtime pay?

The Risks of Ignoring Overtime Pay Regulations

Organizations operate within a tight regulatory framework. Compliance with these regulations, including those governing overtime pay, bears crucial importance. Ignoring these laws can unleash significant negative outcomes for any organization.

Legal Consequences

Non-compliance triggers legal action. Firms may face lawsuits from employees. These legal battles often result in hefty fines. Additionally, the organization might incur back payments with interest. Legal costs can escalate quickly. They pose a substantial financial risk.

Reputational Damage

Public trust is fragile. Reports of regulatory breaches harm reputations. Such news travels fast and far. Customers and partners may withdraw their support. This can result in a loss of business. Reputation damage has a long-lasting impact.

Employee Relations

Morale deteriorates with compliance failures. Staff may feel exploited. This discontent can lead to high turnover rates. Hiring and training new staff costs time and money. Moreover, workplace culture suffers. A damaged culture hampers productivity.

Operational Disruptions

Overtime violations often lead to investigations. These can disrupt operations. Management must then focus on compliance issues. This diverts attention from core business activities. Consequently, productivity falters.

Increased Scrutiny

Regulatory bodies may increase their oversight. This means more audits and restrictions. These agencies may impose stringent future reporting requirements. Compliance becomes more complex. Administrative burdens rise. Thus, costs soar.

Competitive Disadvantage

Companies that ignore regulations gain an unfair advantage. They may offer lower prices due to lower operational costs. This disrupts the market. It puts law-abiding competitors at a disadvantage. Over time, this affects the entire industry.

In summation:

- Legal action threatens financial stability.

- Reputation suffers in public view.

- Employee trust and morale decline.

- Day-to-day business faces interruptions.

- Regulatory scrutiny tightens.

- Unfair market conditions emerge.

Companies must heed overtime regulations. Compliance safeguards against these severe repercussions. It ensures fair play and promotes a sustainable business environment.