It feels like just yesterday when I was standing in our cramped family store, staring at shelves overflowing with unsold goods. My father, a seasoned businessman, would shake his head and say, "Son, a penny saved in inventory costs is earned in supply chain management." At the time, I didn't fully grasp the weight of his words. But as I ventured deeper into the world of business, the reality of inventory costs became all too clear.

Introduction

Inventory Costs

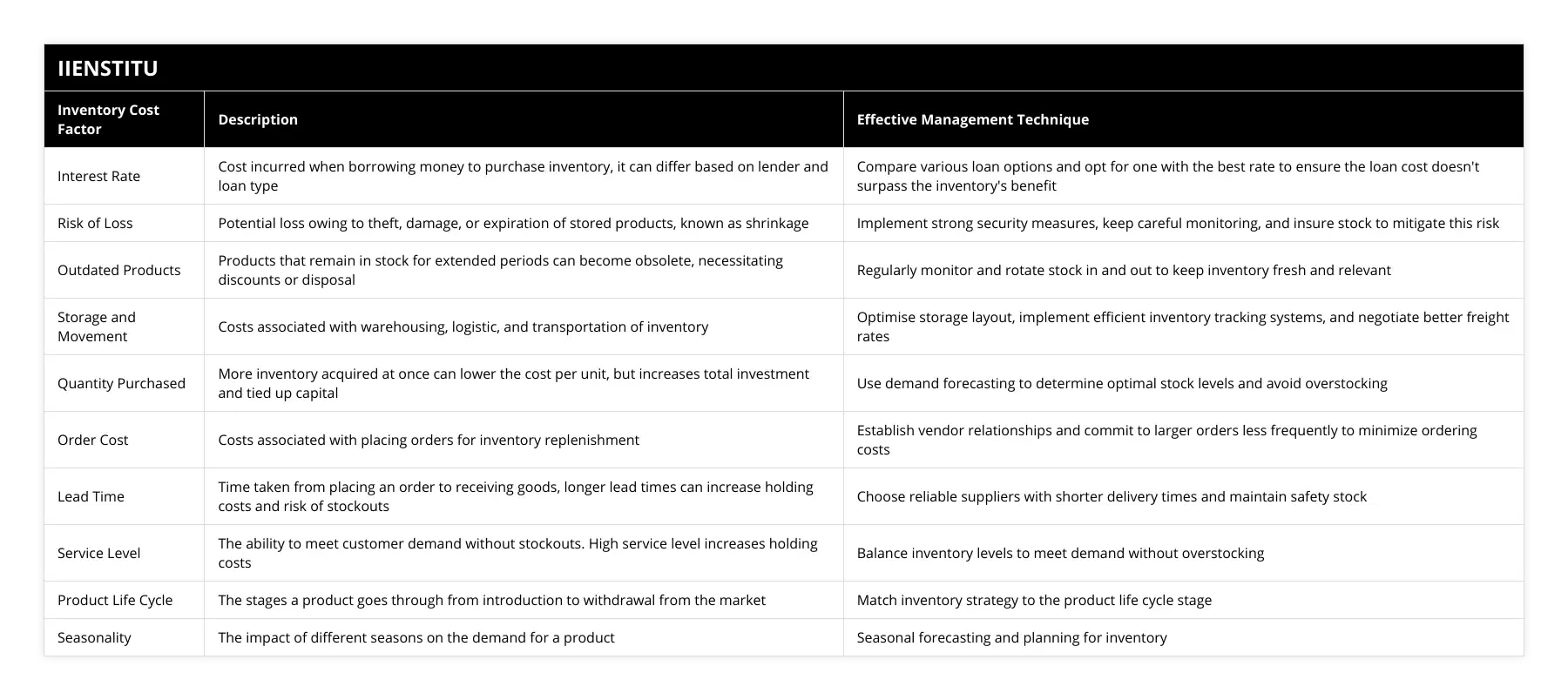

Interest Rate

Risk of Loss

Outdated Products

Understanding the Real Cost of Inventory

Inventory isn't just about stacking products on shelves and hoping they sell. There's a whole iceberg beneath the surface that many budding entrepreneurs might not see at first glance. This includes the cost of borrowing money, the ever-present risk of loss, and the nagging problem of outdated products. Managing these factors is crucial to keep overall inventory costs to a minimum.

The Hidden Expenses

1- Capital Costs: Borrowing money to purchase inventory often comes with interest rates that can eat into profits.

2- Storage and Handling: Renting space, utilities, and paying staff to manage inventory aren't free.

3- Shrinkage: Losses due to theft, damage, or errors can add up quicker than you'd expect.

The Interest Rate Trap

Back in college, a friend of mine started an online gadget store. He was all in – borrowed a hefty sum to bulk purchase the latest tech toys, thinking he'd make a killing during the holiday season. But here's the kicker: he didn't account for the high interest rates on his loan. The sales didn't match his expectations, and the interest piled up. Before he knew it, he was under water.

Lesson learned? Always:

Shop around for the best loan rates.

Consider alternative financing options.

Factor interest costs into your pricing strategy.

According to Dr. Elaine Thompson's book, Financing Business Growth, "High interest rates can turn a profitable venture into a loss-making enterprise if not carefully managed."[^1]

The Ever-Present Risk of Loss

Let's face it, not every product makes it safely from supplier to customer. There's a myriad of things that can go wrong:

Theft: Both external and internal theft can deplete your inventory.

Damage: Accidents happen. Products get dropped, mishandled, or damaged during transportation.

Errors: Miscounts, mislabeling, and administrative mistakes can all lead to losses.

I remember visiting a local warehouse where they installed cameras and strict check-in/check-out procedures. The manager told me, "We reduced our shrinkage by 30% just by tightening security. It was a game-changer."

A penny saved in inventory costs is earned in supply chain management.

Steps to Mitigate Risks

Here are some tips to help you optimize supply chain management process tips:

1- Implement Security Measures: CCTV, access controls, and regular audits.

2- Train Staff: Educated employees make fewer mistakes.

3- Invest in Quality Control: Regular inspections can catch issues early.

4- Insurance: It might seem like an extra cost, but insurance can be a lifesaver when things go south.

Outdated Products – The Silent Profit Killer

In today's fast-paced world, products can become obsolete overnight. Trust me, holding onto outdated stock is like holding onto a sinking ship. Not only does it take up valuable space, but it also ties up capital that could be used elsewhere.

A few years back, I stocked up on what I thought would be the next big thing in fashion – neon-colored accessories. For a while, they sold like hotcakes. But as trends shifted, they sat collecting dust. Eventually, I had to sell them at a steep discount. Ouch.

Keeping Inventory Fresh

Market Research: Stay ahead of trends by keeping an ear to the ground.

Just-in-Time Inventory: Reduce stock levels and order products as needed.

Promotions: Offer deals to move stock before it becomes outdated.

Diversification: Don't put all your eggs in one basket.

As Professor Martin Lee mentions in The Dynamics of Retail Trends, "Adaptability is key. Retailers must be agile in adjusting their inventory to current market demands."[^2]

Strategies to Master Inventory Management

Now, let's dive into some practical strategies that have helped me and countless others:

1. Embrace Technology

In this digital age, there's no excuse not to use inventory management software. Tools like barcode systems and RFID tags can:

Track inventory in real-time.

Reduce human error.

Provide valuable data on sales patterns.

2. Build Strong Supplier Relationships

Having a good rapport with your suppliers can lead to:

Better payment terms.

Faster turnaround times.

Access to exclusive products.

I once negotiated a consignment deal with a supplier, which meant I only paid for products after they sold. This significantly reduced my upfront costs.

3. Regular Audits and Assessments

Don't wait for problems to arise. Regular checks can help you:

Identify slow-moving stock.

Adjust ordering patterns.

Prevent overstocking.

4. Optimize Your Supply Chain

Remember those optimize supply chain management process tips we touched on? Here they are in action:

Streamline Processes: Remove unnecessary steps in your supply chain to improve efficiency.

Collaborate with Partners: Work closely with suppliers and distributors for better coordination.

Leverage Data Analytics: Use data to forecast demand and adjust accordingly.

As the old saying goes, "Time is money." By optimizing your supply chain, you save both.

Personal Reflections on Inventory Challenges

There's a certain nostalgia when I think back to the early days of managing inventory. The sleepless nights wondering if I'd overstocked, the anxious calculations of holding costs, and the sheer joy when a strategy paid off.

One time, I decided to take a risk on a bulk purchase of eco-friendly products. It was a niche market, and many advised against it. But I had a hunch, backed by research showing a growing trend towards sustainable living. Sure enough, sales soared, and it became one of the most profitable ventures that year.

Key takeaway: Sometimes, calculated risks based on solid research can yield significant rewards.

Conclusion

Managing inventory costs isn't just about crunching numbers. It's about understanding the intricate balance between supply and demand, anticipating market trends, and making informed decisions. By being proactive and strategic, businesses can minimize costs, reduce risks, and maximize profits.

So, whether you're a seasoned retailer or just starting out, remember: effective inventory management is the backbone of a successful business. Stay informed, stay flexible, and don't be afraid to adapt.

References

[^1]: Thompson, E. (2015). Financing Business Growth. New York: Harper Business Publications.

[^2]: Lee, M. (2018). The Dynamics of Retail Trends. London: Global Retail Insights.

In the grand scheme of things, understanding and managing inventory costs can be the difference between a thriving business and one that struggles to stay afloat. And as my father wisely said, "A penny saved in inventory costs is earned in supply chain management."

Did you find these insights helpful? Feel free to share your own experiences or ask questions below!

Frequently Asked Questions

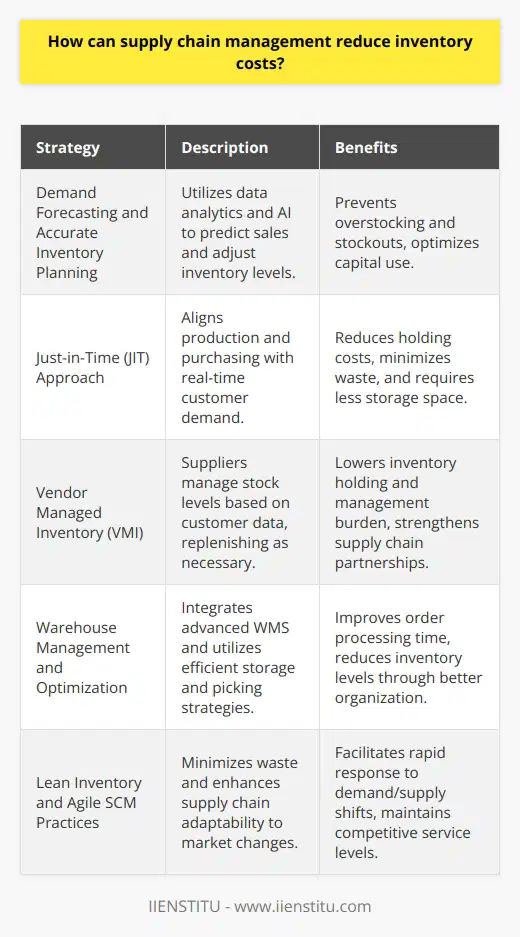

How can supply chain management reduce inventory costs?

Effective Inventory Control

Supply chain management (SCM) plays a crucial role in reducing inventory costs by implementing effective inventory control strategies. Through proper forecasting of demand, accurate tracking of inventory levels, and efficient product flow coordination, SCM ensures that the organization maintains optimal inventory levels to meet customer demands while minimizing holding and obsolescence costs.

Demand Forecasting and Inventory Planning

An essential aspect of reducing inventory costs is predicting future product demands accurately. SCM uses statistical tools, historical data, and market trends to create demand forecasts, which help organizations plan inventory levels better. This prevents overstocking, which results in high storage and holding costs or understocking, leading to stockouts, lost sales, and unsatisfied customers.

Just-in-Time Inventory Management

The Just-in-Time (JIT) inventory management technique is important for reducing inventory costs. By aligning production schedules with actual customer demands, JIT reduces the need to maintain high levels of inventory. Organizations using this method produce or order goods only when needed, minimizing holding costs and reducing the risk of stock becoming obsolete.

Vendor Managed Inventory

Vendor Managed Inventory (VMI) is another approach to reducing inventory costs. In this model, suppliers take responsibility for managing and replenishing inventory at the buyer's location. This collaborative effort improves inventory visibility, ensures product availability, and enables better coordination between supply chain partners, ultimately reducing inventory levels and costs.

Warehouse Optimization

Efficient warehouse management can help organizations further reduce inventory costs. By implementing best practices, such as optimal space utilization, warehouse layouts, and inventory tracking systems, organizations can minimize the costs associated with storing and handling items. Additionally, warehouse optimization can help coordinate inbound and outbound logistics more effectively, ensuring timely product deliveries and reducing the need for high inventory levels.

In conclusion, supply chain management significantly contributes to reducing inventory costs by employing effective inventory control techniques, demand forecasting, and better coordination with supply chain partners. By optimizing inventory levels and warehouse operations, organizations can minimize holding costs, avoid stock obsolescence, and improve overall customer service.

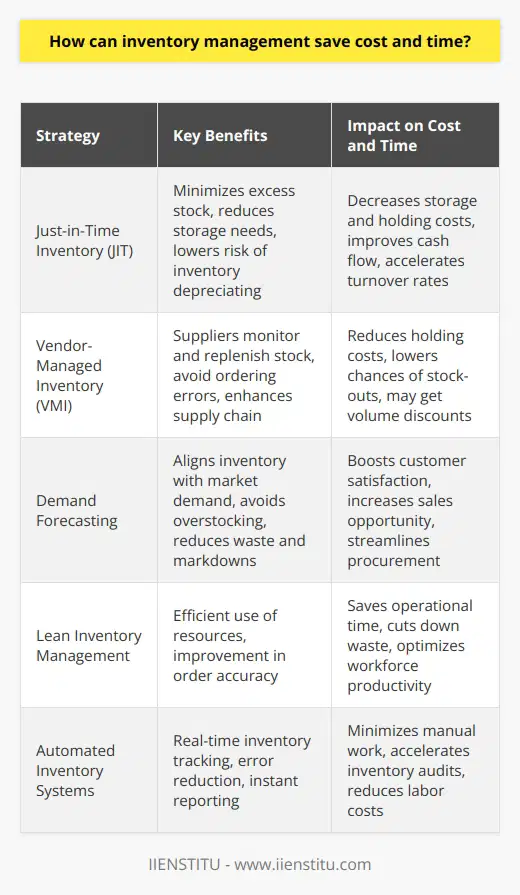

How can inventory management save cost and time?

Efficient Inventory Management Techniques

Inventory management plays a crucial role in cost and time savings for businesses by ensuring the optimal amount of stock required to fulfill customer demands while minimizing storage costs. Implementing efficient inventory management techniques, such as just-in-time inventory (JIT), vendor-managed inventory (VMI), and demand forecasting, can lead to substantial benefits.

Just-in-Time Inventory

The JIT technique involves ordering the required stock just before it is needed, thus reducing carrying costs and stock obsolescence. This approach allows businesses to free up resources and reduce expenditures on storage facilities, insurance, and personnel. The reduced warehouse space could also minimize the overall handling time and labor costs, leading to operational efficiency.

Vendor-Managed Inventory

VMI involves suppliers managing their customers' inventory. This arrangement permits suppliers to monitor stock levels and replenish accordingly, which prevents stockouts and excessive quantities. With VMI, businesses can shift the responsibility of inventory management to suppliers, leading to a decrease in lead times and administrative costs. Moreover, collaboration between suppliers and businesses can enhance supply chain visibility, fostering better decision-making and demand planning.

Demand Forecasting

Accurate demand forecasting is essential to balance inventory levels and customer satisfaction. Through historical sales data analysis, market trends, and seasonality, businesses can predict customer demand and align their inventory management policies accordingly. By effectively anticipating future needs, businesses can reduce stock discrepancies, minimize excess inventory, and ensure the availability of products when needed. Furthermore, reduced stock discrepancies can decrease the time spent on managing stock discrepancies, leading to increased productivity.

In conclusion, inventory management techniques like JIT, VMI, and demand forecasting can significantly contribute to cost and time savings for businesses. By maintaining optimal inventory levels and fostering collaboration with suppliers, organizations can enhance their operational efficiency, reduce carrying costs, and improve customer satisfaction.

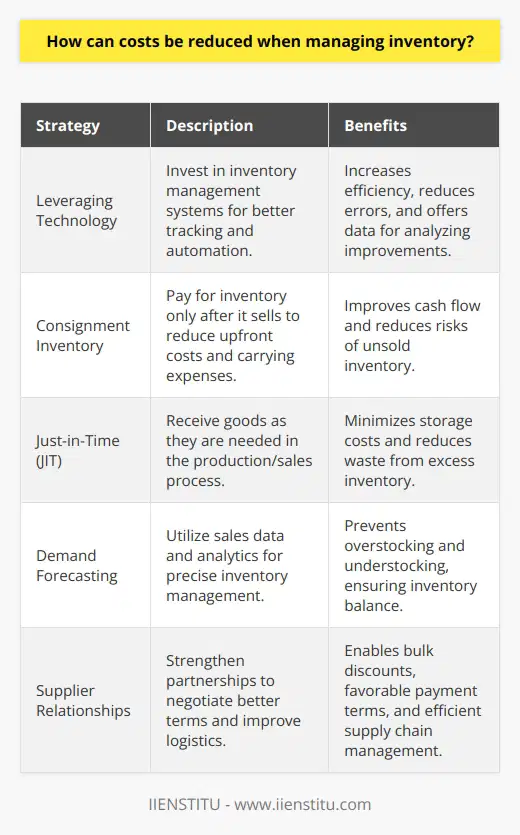

How can costs be reduced when managing inventory?

Utilizing Effective Inventory Management Strategies

To reduce costs when managing inventory, businesses should employ effective inventory management strategies. Some ideas include implementing technology, using consignment inventory, and adopting a just-in-time approach.

Leveraging Technology

Integrating technology in inventory management can optimize operations to reduce overhead expenses. Computerized inventory software tracks sales, manages inventory levels, and provides detailed reports to highlight inefficiencies. Additionally, automation reduces manual labor costs and lowers the risk of human errors. Businesses should continuously assess and adopt the latest technological advancements to streamline the inventory management process.

Employing Consignment Inventory

A consignment inventory model allows businesses to store inventory at their premises but only pay for products upon their sale. Suppliers retain ownership of the stock until it is sold. This arrangement reduces the need for initial capital investment and inventory holding costs. However, it is crucial to maintain a strong relationship with suppliers to ensure trust and smooth operations.

Embracing Just-in-Time Methodology

The just-in-time (JIT) approach entails ordering and receiving inventory when needed, thus reducing storage costs and potential inventory waste. Accurate demand forecasting and timely communication with suppliers are necessary for JIT implementation. This strategy minimizes the risk of overstocking and stock obsolescence, ultimately reducing inventory costs.

Practicing Proper Demand Forecasting

An essential aspect of reducing inventory costs is accurately predicting demand to align inventory levels accordingly. Reliable demand forecasting minimizes safety stock requirements and prevents stockouts or overstock situations. Businesses should analyze historical sales data, industry trends, and other external factors to create accurate demand forecasts.

Improving Supplier Relationships

Building strong partnerships with suppliers can help negotiate better prices, payment terms, and product delivery. An open line of communication facilitates timely order placement, reducing lead time and lowering the risk of stockouts. Collaborating closely with suppliers improves the overall efficiency of inventory management, ultimately reducing costs.

Through the implementation of these efficient inventory management strategies, businesses can effectively minimize costs and enhance profitability while ensuring an optimized level of stock at all times.

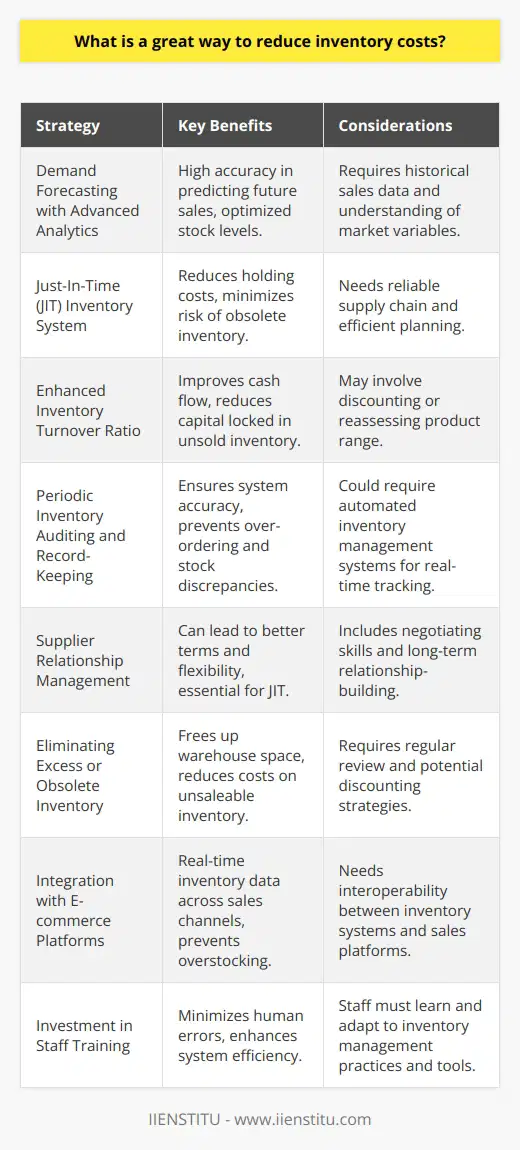

What is a great way to reduce inventory costs?

Optimizing Inventory Management

A great way to reduce inventory costs is through optimizing inventory management, which involves efficiently controlling the quantity and type of products stored in a warehouse or retail store. Such optimization ensures that businesses maintain the right amount of stock to meet customer demands and avoid wastage due to expired or obsolete products.

Demand Forecasting

One effective method to achieve optimized inventory management is by implementing demand forecasting, which involves analyzing historical sales data to develop an accurate projection of future demands. By understanding their customers' needs and buying patterns, businesses can adjust their inventory levels accordingly, reducing holding costs, minimizing stockouts, and preventing excess stock.

Just-In-Time Inventory Management

Another strategy to reduce inventory costs is the Just-In-Time (JIT) inventory management system. This approach involves ordering inventory only when it is required, effectively reducing carrying costs and minimizing storage space. By closely monitoring stock levels and partnering with reliable suppliers, businesses can maintain an optimal inventory level and promptly respond to changes in demand, thus increasing overall efficiency.

Inventory Turnover Ratio

Calculating and monitoring the inventory turnover ratio can also contribute to reducing inventory costs. This metric reflects the number of times a business sells and replaces its inventory within a specific period. A high inventory turnover ratio indicates that inventory is being sold quickly and efficiently, reducing the probability of stock becoming obsolete. By focusing on improving this ratio, businesses can optimize their inventory management and maintain cost-effective stock levels.

Periodic Inventory Audits

Finally, conducting periodic inventory audits can assist in identifying discrepancies between physical stock and inventory records, helping businesses to uncover and address potential issues related to theft, damage, and mismanagement. Through regular audits, businesses can maintain accurate inventory data, which facilitates precise decision-making regarding ordering, replenishment, and discontinuation of products. This ultimately results in a more effective inventory management strategy.

In conclusion, optimizing inventory management through methods such as demand forecasting, Just-In-Time inventory management, monitoring inventory turnover ratios, and conducting periodic inventory audits can greatly contribute to reducing inventory costs. By implementing these strategies, businesses can efficiently manage their stock levels, decrease holding costs, and improve overall operational efficiency.

How do you manage inventory in supply chain management?

Efficient Inventory Management Techniques

In supply chain management, efficient inventory management is crucial to ensure optimal levels of stock, reduce holding costs, and maintain customer satisfaction. One effective method in managing inventory is implementing a robust Enterprise Resource Planning (ERP) system. This software integrates various business processes, such as procurement, production, and sales, enabling a holistic view of inventory needs and facilitating communication among departments.

Just-in-Time (JIT) Approach

Another inventory management technique is adopting the Just-in-Time (JIT) approach. This method involves ordering and receiving inventory only when required, thus minimizing warehousing costs and reducing the risk of stock obsolescence. JIT relies on accurate demand forecasting and strong supplier relationships to ensure timely delivery of the required inventory, thereby preventing stockouts.

Demand Forecasting

To effectively manage inventory, supply chain managers must accurately forecast demand. By using historical sales data, market trends, and economic indicators, firms can predict sales and determine appropriate inventory levels. Accurate forecasting helps in avoiding stockouts, reducing holding costs, and ensuring that products are available to meet customer needs. Moreover, it allows for efficient production planning and resource allocation, which can further optimize the supply chain.

Safety Stock and Reorder Points

Establishing safety stock levels and reorder points is vital in managing inventory in supply chain management. Safety stock represents the minimum inventory level that should be maintained to account for variability in demand and lead time. The reorder point is the inventory level at which an order should be placed to replenish stock before it reaches the safety stock level. By setting appropriate safety stock and reorder points, supply chain managers can minimize stockouts, reduce excess inventory, and ensure a continuous flow of goods.

Periodic Inventory Review

Performing periodic inventory reviews can help supply chain managers monitor stock levels, identify trends, and make informed decisions about inventory management. Regular reviews enable companies to evaluate the effectiveness of their inventory management practices and make adjustments as needed. This can lead to reduced carrying costs, improved product availability, and enhanced operational efficiency.

To summarize, effective inventory management in supply chain management involves implementing ERP systems, adopting the JIT approach, accurately forecasting demand, establishing safety stock and reorder points, and conducting periodic inventory reviews. By employing these techniques, supply chain managers can optimize inventory levels, reduce costs, and ultimately enhance customer satisfaction.

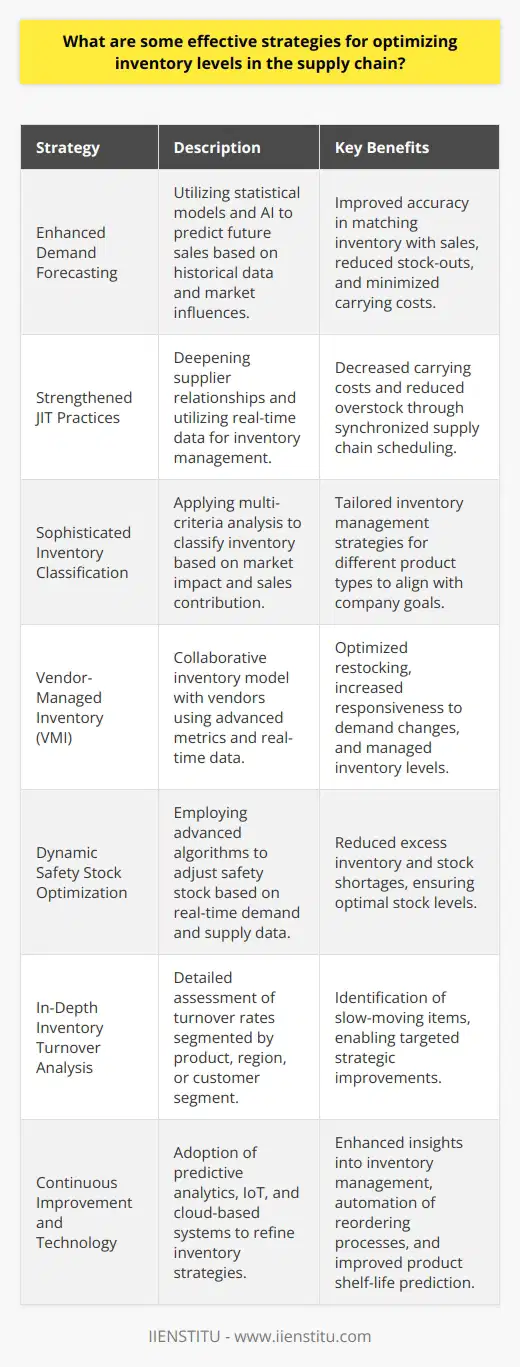

What are some effective strategies for optimizing inventory levels in the supply chain?

Effective Strategies for Optimizing Inventory Levels

Demand Forecasting:

Accurate demand forecasting enables businesses to anticipate inventory requirements and make informed decisions about stock levels. It involves analyzing historical data, market trends, and external factors to predict future demand, thereby minimizing stockouts and overstocks.

Just-In-Time (JIT) Inventory Management:

JIT inventory management focuses on obtaining products at the exact moment they are needed, reducing storage costs and minimizing the risk of obsolescence. This strategy requires strong supplier relationships and efficient communication channels to ensure timely deliveries and eliminate excess inventory.

Inventory Classification Systems:

Categorizing inventory based on factors such as demand, cost, and lead time allows businesses to prioritize items and allocate resources accordingly. The ABC analysis, for example, classifies inventory into three groups: high-value (A), medium-value (B), and low-value (C) items, enabling a focused approach to inventory management.

Vendor-Managed Inventory (VMI):

VMI involves transferring the responsibility of inventory management to suppliers, who monitor stock levels and replenish products as needed. This strategy streamlines the supply chain, reduces the burden on the buyer, and fosters better collaboration between the two parties.

Safety Stock Management:

Maintaining a buffer of safety stock protects against demand variability and supply disruptions, ensuring a continuous supply of products. The optimal safety stock level balances the risk of stockouts against the cost of holding excess inventory and should be adjusted based on factors such as lead time variability and demand fluctuations.

Inventory Turnover Analysis:

Regularly measuring inventory turnover helps businesses assess the efficiency of their supply chain and identify areas for improvement. A high inventory turnover indicates a well-managed inventory, while a low turnover may signal overstocked items, slow-moving products, or obsolete stock.

Continuous Improvement:

Lastly, businesses should continuously review and optimize their inventory management processes, considering evolving market conditions and emerging technologies. Implementing advanced analytics, real-time inventory tracking systems, and other digital solutions can further enhance inventory optimization efforts.

How can efficient inventory forecasting contribute to cost reduction?

Efficient Inventory Forecasting Methods

Efficient inventory forecasting has significant implications for cost reduction in various industries, particularly in manufacturing and retail sectors. Predicting inventory requirements with high accuracy ensures that appropriate stock levels are maintained, minimizing costs associated with holding excessive or insufficient inventory. This academic paragraph will discuss the vital role of accurate inventory forecasting and the potential cost-saving benefits for organizations that adopt effective methods.

Reduced Holding Costs

Effective inventory forecasting techniques contribute to cost reduction by minimizing holding costs. Holding costs, also known as carrying costs, include expenses such as warehouse rent, utilities, insurance, and taxes. Accurate forecasting prevents overstocking, thereby reducing the costs associated with storing surplus inventory in warehouses. Lower warehouse utilization and operational costs translate into considerable savings for organizations.

Minimized Stockouts and Overstocks

Efficient inventory forecasting not only reduces holding costs but also mitigates the risks of stockouts and overstocks. Stockouts occur when demand exceeds the available inventory, resulting in lost sales, customer dissatisfaction, and potential damage to a company's reputation. Meanwhile, overstocks represent wasted resources and capital tied up in unsold inventory. Accurate demand prediction helps organizations strike a balance between maintaining adequate inventory levels and minimizing risks associated with stockouts and overstocks, ultimately contributing to cost reduction.

Improved Order Fulfillment Rate

Another factor positively impacted by efficient inventory forecasting is the order fulfillment rate. An optimized order fulfillment rate directly correlates with customer satisfaction and increased revenue generation. A well-calibrated inventory forecasting method results in shorter lead times, faster order processing, and overall efficiency. These improvements contribute to meeting customer demands in a timely manner, fostering strong customer relationships and encouraging repeat business.

Enhanced Decision-Making

Lastly, efficient inventory forecasting enables data-driven decision-making. Accurate inventory data is imperative for making informed strategic decisions concerning resource allocation, capital investment, workforce management, and production planning. These decisions, in turn, impact the overall financial health of an organization. Consequently, a robust inventory forecasting system equips organizations with the necessary tools to make cost-effective decisions, thereby reducing operational costs and improving overall profitability.

In conclusion, efficient inventory forecasting, when executed effectively, can lead to substantial cost reductions in various aspects of an organization's operations. By minimizing holding costs, mitigating stockouts and overstocks, enhancing order fulfillment rates, and improving decision-making capabilities, an organization can optimize its inventory management system, resulting in significant cost savings and increased profitability.

In what ways can supply chain visibility aid in minimizing inventory costs?

Supply Chain Visibility and Inventory Costs Reduction

Real-Time Tracking

Supply chain visibility allows businesses to track their inventory in real-time, enabling them to make informed decisions about when and how much to purchase. This helps in reducing overstocking and understocking, leading to decreased carrying and stockout costs.

Accurate Demand Forecasting

Visibility into customer demand patterns and upstream supply processes allows businesses to forecast demand more accurately, minimizing the need to hold excessive safety stock. This results in reduced inventory holding costs and improved resource utilization.

Lean Inventory Management

By providing real-time data on inventory levels, supply chain visibility enables companies to implement lean inventory management practices. Lean practices emphasize reducing waste, including excess inventory, thus lowering carrying costs and the risk of obsolescence.

Improved Supplier Collaboration

Supply chain visibility aids in improved supplier collaboration by streamlining communication and data sharing. This enables businesses to reduce lead times and align production schedules with demand, resulting in lower inventory levels and increased inventory turnover.

Optimized Production Scheduling

Visibility into the supply chain allows businesses to optimize their production schedules, reducing the time and cost required to produce goods. This helps in minimizing work-in-process inventory, reducing overall inventory costs, and improving cash flow.

To conclude, supply chain visibility plays a vital role in minimizing inventory costs by enabling real-time tracking, accurate demand forecasting, lean inventory management, improved supplier collaboration, and optimized production scheduling. Implementing these strategies ensures efficient inventory management and maximizes profitability for businesses.

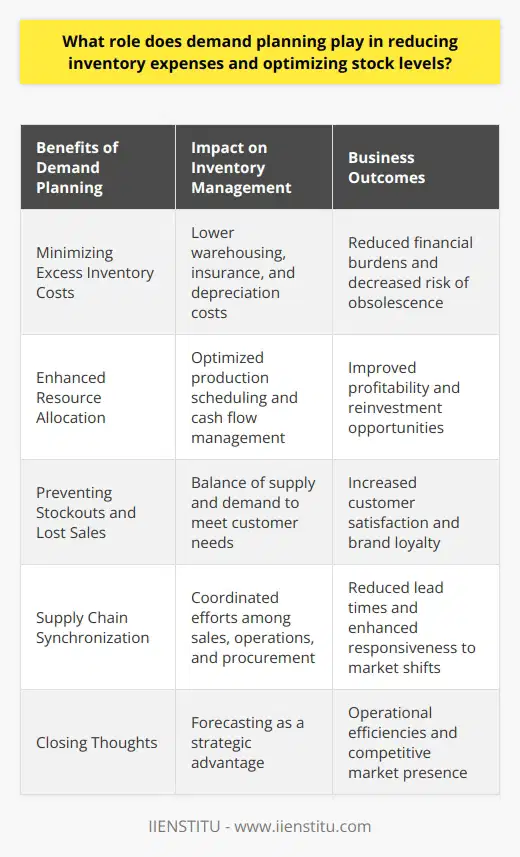

What role does demand planning play in reducing inventory expenses and optimizing stock levels?

Role of Demand Planning in Inventory Management

Effective demand planning significantly contributes to reducing inventory expenses and optimizing stock levels. As a predictive analysis tool, demand planning's central function is to anticipate customer demand and adjust the supply chain accordingly. This foresight helps organizations minimize excess inventory, better allocate resources, and improve overall efficiency.

Minimizing Excess Inventory

Reducing inventory costs is a primary objective of demand planning, as it ensures efficient inventory management by maintaining optimal levels. Through accurate forecasting, businesses can better understand the levels of stock needed to meet customer demand. This knowledge allows businesses to minimize incidences of overstocking, which would lead to additional holding costs and potential obsolescence.

Resource Allocation and Efficiency

By accurately predicting customer demand, demand planning enables businesses to allocate resources more effectively. Companies can avoid committing financial and operational resources to unneeded inventory. Instead, they can channel these resources to high-priority processes and enhance their overall efficiency. Moreover, such resource allocation supports a company's cost savings initiatives and enables better cash flow management.

Reducing Stockouts and Lost Sales

Demand planning also helps in addressing stockouts, a situation that occurs when a business runs out of a product due to insufficient inventory. Inventory stockouts lead to missed sales opportunities, customer dissatisfaction, and potential loss of market share. Accurate demand planning can effectively prevent stockouts, ensuring the availability of goods for purchase by customers, and ultimately maintaining customer satisfaction and loyalty.

Supply Chain Coordination

Optimizing stock levels is closely linked to effective supply chain coordination. Demand planning fosters better alignment between production, procurement, and sales teams. This alignment enhances the overall agility of the supply chain, which further reduces inventory expenses and optimizes stock levels. In addition, improved supply chain coordination can lead to reduced lead times, increased customer responsiveness, and stronger supplier relationships.

In conclusion, demand planning plays a critical role in reducing inventory expenses and optimizing stock levels. By offering insights into customer demand patterns and enabling the efficient allocation of resources and supply chain coordination, demand planning contributes significantly to an organization's financial and operational performance.

How can just-in-time inventory management lead to significant cost savings?

Efficiency in Inventory Management

Just-in-time (JIT) inventory management can lead to significant cost savings through efficiency. This method refers to acquiring materials for production only as needed. Therefore, it reduces the costs related to holding inventory.

Space and Storage Savings

Firstly, JIT management aids in saving on storage space and its related costs. Businesses do not need large warehouses to store their goods. Minimal inventories translate to fewer warehouse utilities and smaller storage facilities.

Reduction in Waste

Next, the method leads to a reduction in waste. Manufacturers produce products based on actual demand, preventing overproduction and subsequent disposal of unsold items.

Prevention of Obsolescence

Additionally, JIT inventory prevents obsolescence. As companies only produce goods when there is a demand, it dramatically decreases the chance of products becoming outdated. Consequently, it removes the need for businesses to incur costs tied to unsellable, obsolete goods.

Lower Investment in Stock

One other critical aspect is the lower investment in stock. Operating on lean inventory signifies that businesses tie up less of their funds in inventory. Instead, they can free up capital to invest in other areas of the business.

Improved Cash Flow

Furthermore, JIT inventory management can improve cash flow. By purchasing raw materials only when needed, businesses can optimize their cash conversion cycle. This approach can result in better liquidity, aiding the company's financial health.

Risk Minimization

Lastly, JIT reduces the risk associated with sudden changes in market demand. Since companies are producing to meet current demand, if a sudden drop occurs, they can immediately adjust production levels, reducing potential losses.

In conclusion, the JIT inventory management technique offers businesses a way to increase efficiency while reducing costs significantly. By minimizing storage costs, waste, obsolescence risk, and freeing up funds for investment, businesses can enjoy substantial cost savings and improved financial health.

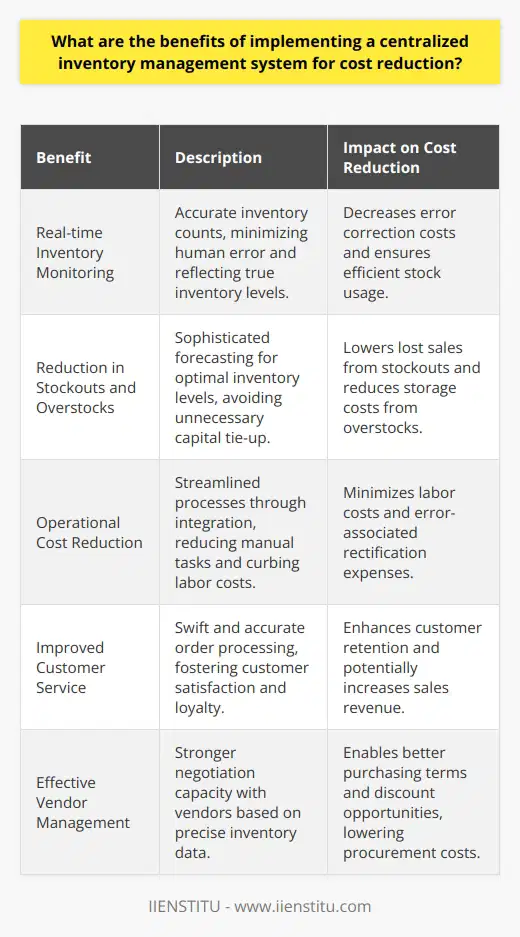

What are the benefits of implementing a centralized inventory management system for cost reduction?

Enhanced efficiency and accuracy

A centralized inventory management system provides significant benefits to companies striving to reduce costs. By streamlining processes, it enhances both efficiency and accuracy. Companies can track inventory levels in real time, which minimizes errors and inconsistencies.

Reduction in stockouts and overstocks

Crucially, such a system can minimize instances of stockouts and overstocks. These occurrences can lead to lost sales and excess storage costs respectively. Accurate forecasting becomes possible with a centralized inventory management system.

Reduction in operational costs

This system can also lead to a significant reduction in operational costs. Automation enables a shift from manual processes, reducing labour costs and increasing productivity.

Improved customer service

With an increased ability to meet customers' needs in a timely manner, customer service improves. This leads to customer loyalty, repeat purchases and overall, increased revenue for the business.

Avoiding lost sales

The immediate availability of inventory information helps to avoid lost sales. Quick, informed decisions regarding stock replenishment become achievable.

Effective vendor management

Finally, with a centralized system, more effective vendor management becomes possible. The visibility of inventory enables smart negotiations with vendors, further contributing to cost reduction.

In summary, the implementation of a centralized inventory management system offers immense benefits to businesses. From reducing operational costs to enhancing customer service, the system can significantly contribute to overall cost reduction and efficiency. By providing real-time inventory visibility, enabling more accurate forecasts, avoiding overstocks and stockouts, and enhancing vendor negotiations, a centralized inventory management system becomes a critical tool for cost-conscious businesses.

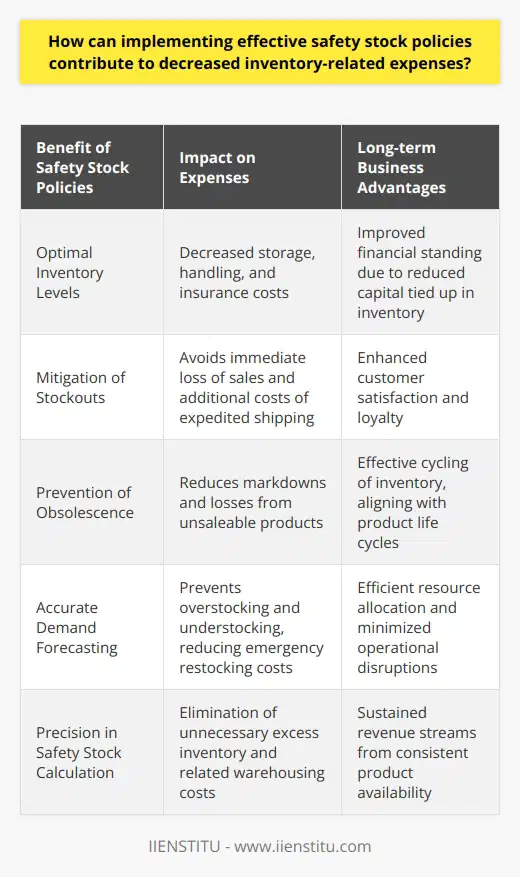

How can implementing effective safety stock policies contribute to decreased inventory-related expenses?

Reducing Costs with Safety Stock Policies

Effective safety stock policies can substantially cut inventory-related expenses. Properly calculated safety stock balances two primary costs. The cost of carrying excess inventory is offset against the risk and expense of stockouts. When this balance is right, it decreases unnecessary inventory costs.

Calculation Accuracy Aids Cost Management

Safety stock calculation directly affects a company's cost management. Precise calculations prevent overstocking and reduce warehousing costs. Reduced inventory levels mean lower storage, handling, and insurance costs. Accuracy eliminates unnecessary expenditure and improves the company's financial health.

Mitigating Stockouts Reduces Lost Sales

Mitigating the risk of stockouts can reduce the costs associated with lost sales. Stockouts can lead to lost revenue and damage customer relationships. Safety stock ensures product availability, supports continued revenue streams, and safeguard customer satisfaction.

Minimizing Obsolescence Lowers Expenses

Effective safety stock policies also minimize product obsolescence. Overstocked items can become obsolete, resulting in significant write-downs and write-offs. By ensuring optimal stock levels, the company can prevent such losses and lower its overall expenses.

Increased Efficiency through Demand Forecasting

Safety stock policies enhance efficiency through better demand forecasting. Accurate demand forecasts mean infrequent urgent reordering, thus saving on expensive expedited shipping fees. It also eliminates unproductive idle time caused by waiting for stock replenishment.

In effect, thoughtful implementation of safety stock policies can substantially decrease inventory costs. The direct and indirect cost savings contribute to enhancing a company's bottom line. Companies must perceive safety stock not merely as a preventive strategy but as an opportunity for ongoing cost optimization.